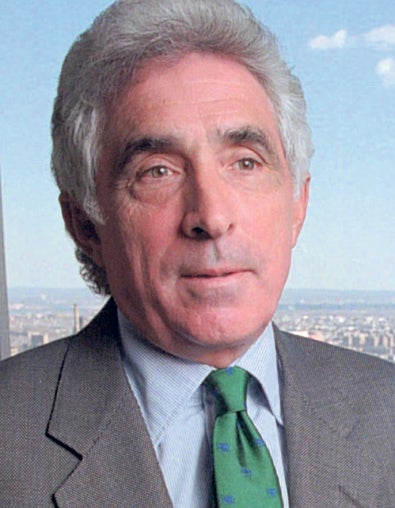

Teddy Forstmann: Pioneer of the leveraged buy-out

The former Wall Street financier, Theodore "Teddy" Forstmann, was a pioneer of the leveraged buy-out during the wave of corporate takeovers in the 1980s, playing a prominent role in one of the largest takeovers in history, that of RJR Nabisco, which he lost, though he became immortalised in the book, Barbarians at the Gate.

More recently, the celebrity bachelor and free-market proselytiser was the chairman and owner of the sports management firm IMG, and a philanth-ropist, giving away hundreds of millions of dollars, which he viewed as "a duty of the rich" and something "you did but didn't shout about". Much of his philanthropy centred on children.

Citing Nelson Mandela and Abraham Lincoln as his heroes, Forstmann was a co-founder and major contributor to the Children's Scholarship Fund, which helps low-income American families send their children to schools of their choice. To date, $483m in scholarships has helped over 123,000 children. Forstmann, the only non-African trustee of the Nelson Mandela Children's Fund, also served as a director of the International Rescue Committee, which helps war-injured children.

Earlier this year, he joined Bill Gates, Michael Bloomberg and Warren Buffett in "The Giving Pledge", committing himself to donate the majority of his estate to charity. As of September 2011, Forbes estimated Forstmann's net worth at $1.8 billion.

Teddy Forstmann, the second of six children, was born in Greenwich, Connecticut in 1940, an heir to one of the nation's biggest textile dynasties, built by his grandfather, a German-born émigré. Forstmann enjoyed an affluent upbringing, but became obsessed with "doing deals" from an early age after reading a book about Howard Hughes.

He graduated from Yale, where he played ice hockey. Following the collapse of the family's fortune in 1962 he attended Columbia University Law School, paying for his education by gambling at bridge. After working in a number of investment firms, with his brother Nicholas and close friend Brian Little he established Forstmann Little in 1978. It became one of Wall Street's most successful companies, and one of the first to engage in leveraged buy-outs (LBOs), in which investors use borrowed money to buy a business.

His business model was simple. Buy ailing companies, turn them around and sell them for a hefty profit, of which he took 20 per cent. He pooled money from investors and large pension funds to back the acquisitions, creating a business model that today is known as the private equity industry. During his tenure, Forstmann Little acquired or invested heavily in 31 companies, including Dr Pepper and Gulfstream Aerospace, over a 30-year period, returned more than $15billion to investors.

However, he became a critic of what he considered the reckless use of debt to finance purchases. He believed that with "ever-increasing levels of irresponsibility, many billions of dollars in American assets are being saddled with debt that has virtually no chance of being repaid." He likened the spate of buy-outs to "a herd of drunk drivers taking to the highways on New Year's Eve."

Forstmann tended to be cautious and conservative. In 1988, he famously withdrew from buying Nabisco when the price went too high. His instincts proved correct as the victor, Kohlberg Kravis Roberts, who paid $25bn, struggled for yearsto make profits. Forstmann correctly predicted the collapse of the junk bond market in the late 1980s and the credit crunch that hit in 2008.

Forstmann was not infallible and the firm suffered after making ill-timed investments in telecoms when the internet technology bubble burst in the early 2000s. Undeterred, in 2004, Forstmann, then 65, spent $750m on the sports marketing company IMG.

In 2010, Forstmann's image was tarnished when allegations emerged that he had been betting on sports, including matches involving IMG clients, such as the 2007 French Open final between Roger Federer and Rafael Nadal. While the bets were not illegal, many accused Forstmann of acting unethically. A lifelong gambler, he responded, "They were minor bets. They were to make boring Sunday afternoons more interesting."

Forstmann was romantically linked to Elizabeth Hurley and Princess Diana, although he later claimed that she was not "his kind of girl". Diagnosed with brain cancer in May, he said, "This is not how I want to end. It's a bend in the road for me," but the end came quickly.

Theodore Joseph Forstmann, financier and philanthropist: born Greenwich, Connecticut, US 13 February 1940; two adopted sons; died New York 20 November 2011.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks