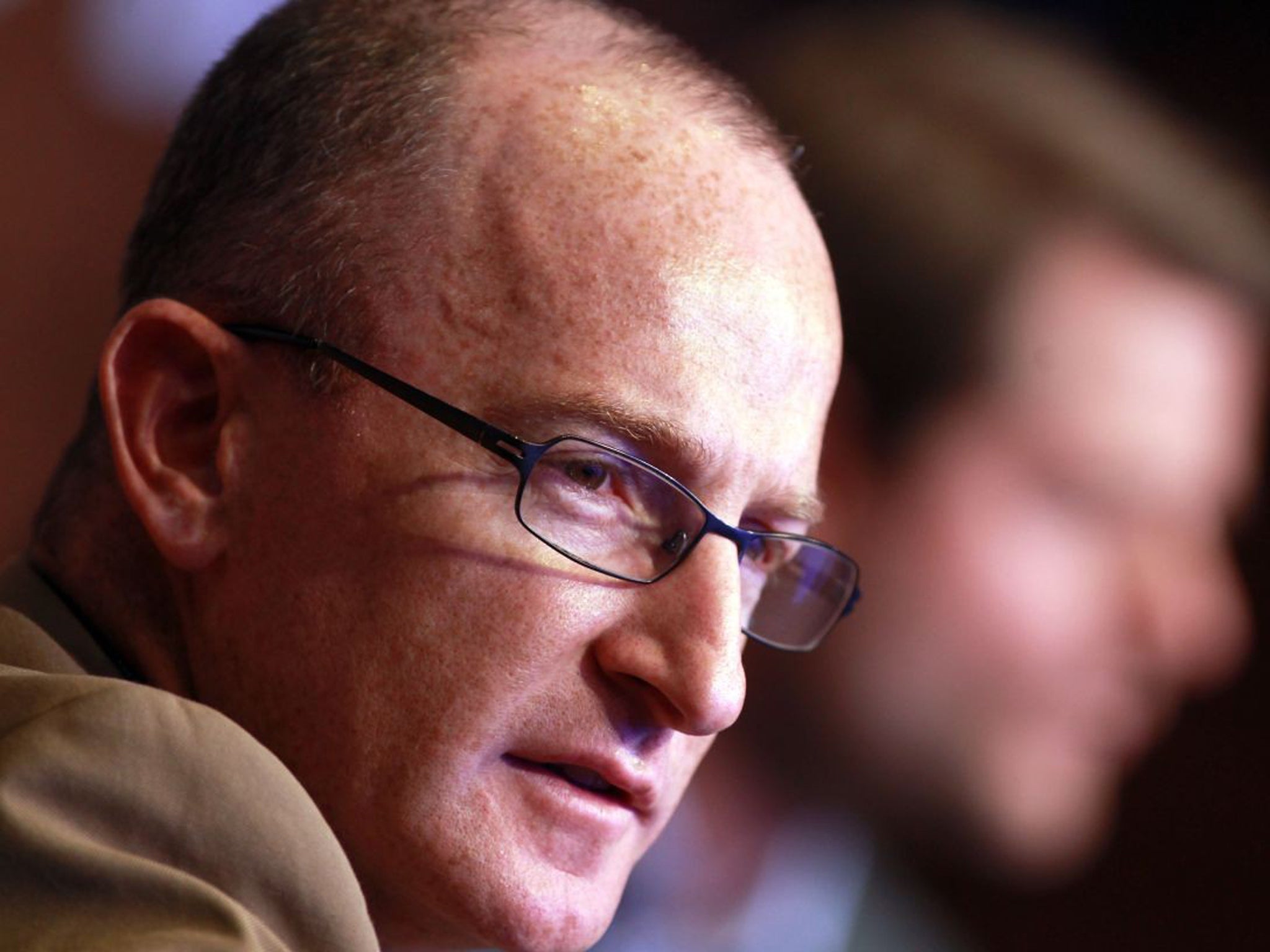

Wonga's Errol Damelin profile: Hey big (payday) lender

The Archbishop of Canterbury chose a formidable adversary when he took on Wonga and its maverick founder. By Jim Armitage

Errol Damelin “will be hating this”. So says a friend of the crop-haired founder of Wonga, currently sitting in the eye of the biggest God vs Mammon moral storm this country has seen since the financial crisis.

The wiry South African had always set out to shake up the financial industry, but never expected, much less wanted, the maelstrom in which he currently finds himself. For the focus of the media has moved on from blaming the multibillion-pound banking giants for our current economic malaise to home in on the “payday lenders”. And, although Mr Damelin may hate that phrase, the biggest, most sophisticated of them all by a very long chalk is Wonga, the company which provides small, short-term loans at unpalatably high interest rates. According to the friend: “The one thing about him is that he’s very keen to be taken seriously, as a serious businessman running a business that’s socially acceptable.”

That seriousness is something which crops up repeatedly from those who know him. Directors and staff repeatedly use phrases such as “very disciplined”, “really intense”, “totally focused on his business,” “extremely straight and dedicated” when asked about him. Someone who knows him well says: “When he hosts a box for clients at the cricket, he is rarely the centre of attention. Not like some of the big, brash, sporty South Africans you see in those places.” But then, to create a business from scratch and turn it into one with millions of customers within just seven years is not a job for the frivolous. You don’t get Silicon Valley’s top venture capital firms investing in your business by cracking jokes and spending the day in bed.

One colleague says: “You are talking about a guy who was born in South Africa, studied in the US, had his first business in Israel, and is now on his third serious company in the UK. He is not gentle, charming and avuncular. He is clearly a very driven man: competitive, focused and dedicated beyond belief.” But another colleague describes him as “charismatic” with a “wicked sense of humour” that others less close to him might not see. Even when he’s switching off, it’s still highly intensive stuff: marathon training or sea kayaking when not spending time with his wife and children.

The Damelin story begins in South Africa, where he was born in 1969. He still has a strong South African accent today. He studied at the University of Cape Town, heading to Israel after graduating in 1995 and working in investment banking, going on to take an MBA degree in Boston University. He set up two businesses before Wonga, the first being a steel wire maker and the second an online company helping businesses to improve their supply chains. Successful and lucrative, but low-profile stuff. All the while he was looking to find an industry which he could shake up with what he describes as a “disruptive” new business model.

Several ideas came to mind – which he says he will get around to one day – but he alighted on the idea of finance. “He saw the banks and existing financial companies as lazy institutions which take their customers for granted,” says one colleague. In other words, easy prey.

He realised that people, particularly the young, would respond well to an online business making quick, small loans with no jargon or hanging around. While being highly tech savvy (a fellow director tells of how “he’s gadget-obsessed, always seems to have dozens of iPads and other kit lying around the office and seems to get through Bluetooth headsets at a rate of one a week”), he knew he needed a good software developer as a partner. He didn’t have to look far – pairing up with Jonty Hurwitz, who’d been running a business in the same shared office. The pair have been together ever since.

To differentiate from the doorstep lenders and pawnshops that besmirched the payday loans industry, one of Mr Damelin’s first hires – even before the website was up and running – was a communications director, an extremely unusual move for a technology start-up. He claims it was not because they anticipated the huge criticism they risked, but because they wanted to be up front and clear about how the business operated without using the kind of jargon that so irritates the public about traditional banks. That includes lengthy explanations of that 5,853 per cent annual interest rate. When the technology worked, the team launched a marketing blitz which has led to Wonga signing sponsorship deals with Newcastle United and Blackpool, while plastering its ads all over the country’s billboards and TV screens.

This high profile, and the company’s huge success in becoming the market leader, is what has left it in the line of fire for the likes of the Archbishop of Canterbury this week. “Look,” says one director, “Errol was not naive. He always knew there would be some controversy, some explaining to do, but this has been off the radar.”

While he does not mind debating the ethics of his business with people who have done their research – sources say he “really enjoyed” his meeting with the Archbishop of Canterbury – he hates people criticising Wonga without hearing the facts first. The trouble is, his view of the pertinent facts are not necessarily the same as the public’s.

For example, that using a cartoon character of a sweet old grandma when advertising high-interest loans could be seen as irresponsible, or that the loans industry is not regulated carefully enough to protect the vulnerable. MP Stella Creasy has described payday lenders as “legal loan sharks” – a phrase Damelin detests being attached to his business.

In the end, though, the no-publicity-like-bad-publicity principal means it is the straight-talking Mr Damelin who gets the last laugh. Sources say that in the past week, visits to Wonga’s websites have shot up more than 30 per cent.

A life in brief

Born: Errol Damelin, 1969, South Africa.

Family: Lives in Primrose Hill, London, with his wife Julie and family.

Education: Boston University’s School of Management, Cape Town University.

Career: After eight years in Israel, he became an investment banker and co-founder of Barzelan, a producer of galvanised steel wire. In 2000, he was founder and chief executive of Supply Chain Connect Ltd. He set up Wonga, an online short-term loan company in the UK, in 2007. Awards include Entrepreneur of the Year at the UK’s Growing Business Awards.

He says: “The way most people operate is they take risk out. We don’t. We take risk, but we get really good at taking risk.”

They say: “Here was this guy who had no background in this kind of technology, yet I have enough pattern recognition from everything I’ve done to know Errol was going to be a great entrepreneur.” Robin Klein of the Accelerator Group

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks