Brexit latest: Trade gap widens as imports surge

Exports rise 1.5 per cent in November but imports jumped by 6.9 per cent in figures branded 'disappointing' by analysts

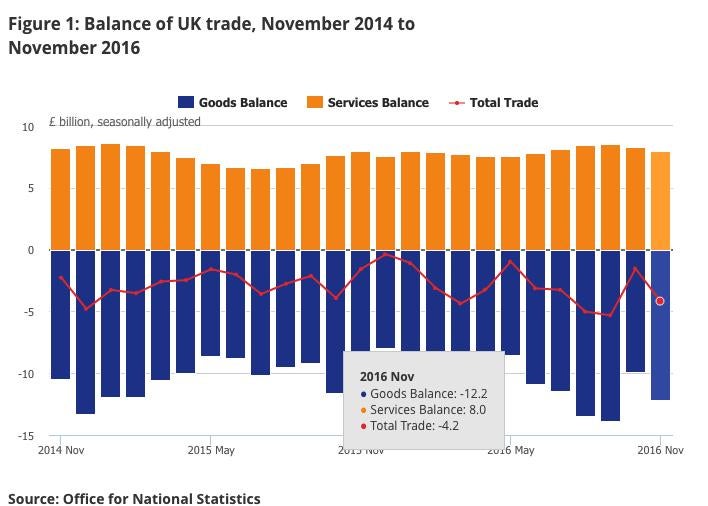

The UK's trade deficit ballooned in November as imports surged and swamped the rise in exports, confirming that there has been no major improvement yet to the UK's yawning balance of payments gap from sterling's sharp depreciation.

The Office for National Statistics reported that exports rose 1.5 per cent in November, while imports jumped by 6.9 per cent.

That took the total trade deficit to £4.17bn for the month, up from £1.57bn in the same month of 2015.

The figure was worse than the £3.5bn consensus of City of London analysts.

No sterling boost yet

Philip Shaw of Investec noted that core export prices are rising faster than core import prices, with the former up 12 per cent and the latter up just 7.2 per cent.

"It seems as though UK manufacturers are using the depreciation in the pound to boost their margins, rather than to press for greater market share," he said.

Samuel Tombs of Pantheon predicted that this will not change rapidly.

"Exports will not pick up until new entrants undercut incumbents and bring export prices down again. This process, however, likely will be even more gradual than in the past because huge uncertainty about the UK's future trade ties will dissuade firms from investing in the capacity required to export."

Suren Thiru of the British Chambers of Commerce called the trade figures "disappointing" saying that they signify a considerably weaker trading position than the average for the year.

"Trade is likely to make a greater contribution to UK GDP in the next few years, as the persistent currency weakness feeds through into improved price competitiveness for some exporters, and diminishes demand for imports. However, the extent of any improvement is likely to be curbed by subdued global trade growth, and the higher cost of imported raw materials," he said.

The UK's broader current account deficit - which includes trade and income flows - hit a record 5.4 per cent of GDP in 2015.

Sterling is currently trading at its lowest levels against the dollar since last October at around $1.2115, having slumped more than 10 per cent in the wake of last June's Brexit vote.

However, industrial production figures also released by the ONS on Wednesday were better than expected.

Output rose by 2.1 per cent in November, following the previous month's 1.1 per cent decline.

This was mainly thanks to the major Buzzard oil field in the North Sea coming back online after a prolonged shutdown.

But manufacturing output also rose by 1.3 per cent in the month, ahead of City expectations of a 0.5 per cent rise and reversing the previous month's 1 per cent fall.

Separately, construction figures on Wednesday also showed an 0.2 per cent decline in output in November, mainly due to non-housing repair and maintenance. This followed a 0.6 per cent decline the previous months, although the figures are notoriously erratic and prone to revision.

Kate Davies of the ONS said that Wednesday's batch of figures "continue to paint a mixed picture of the UK’s economic performance".

The economy is estimated by the ONS to have grown by 0.6 per cent in the third quarter of 2016, a rate of expansion unchanged from the previous quarter, mainly thanks to strong household consumption.

The latest survey data suggests robust growth in the final quarter of 2016 too.

But most forecasters including the Bank of England and the Office for Budget Responsibility are expecting a slowdown in 2017 as consumers are hit by higher inflation, caused by sterling's slump, and businesses pull back on investment in the face of uncertainty over the outcome of the two year Brexit negotiations which are expected to begin in March.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks