Brexit vote sees UK credit rating downgraded to AA negative by Fitch

Ratings agency's decision follows similar moves by Moody's and S&P

Fitch has downgraded the UK's credit rating to AA negative, after similar moves by Moody's and S&P, following Britain's vote to leave the EU.

The credit ratings agency says it made decision because Britain's vote will have “a negative impact on the UK economy, public finances and political continuity.”

It warns of an “abrupt slowdown in short-term GDP growth” to British businesses.

It said in a statement: "Fitch has revised down its forecast for real GDP growth to 1.6% in 2016 (from 1.9%), 0.9% in 2017 and 0.9% in 2018 (both from 2.0% respectively), leaving the level of real GDP a cumulative 2.3% lower in 2018 than in its prior ‘Remain’ base case.

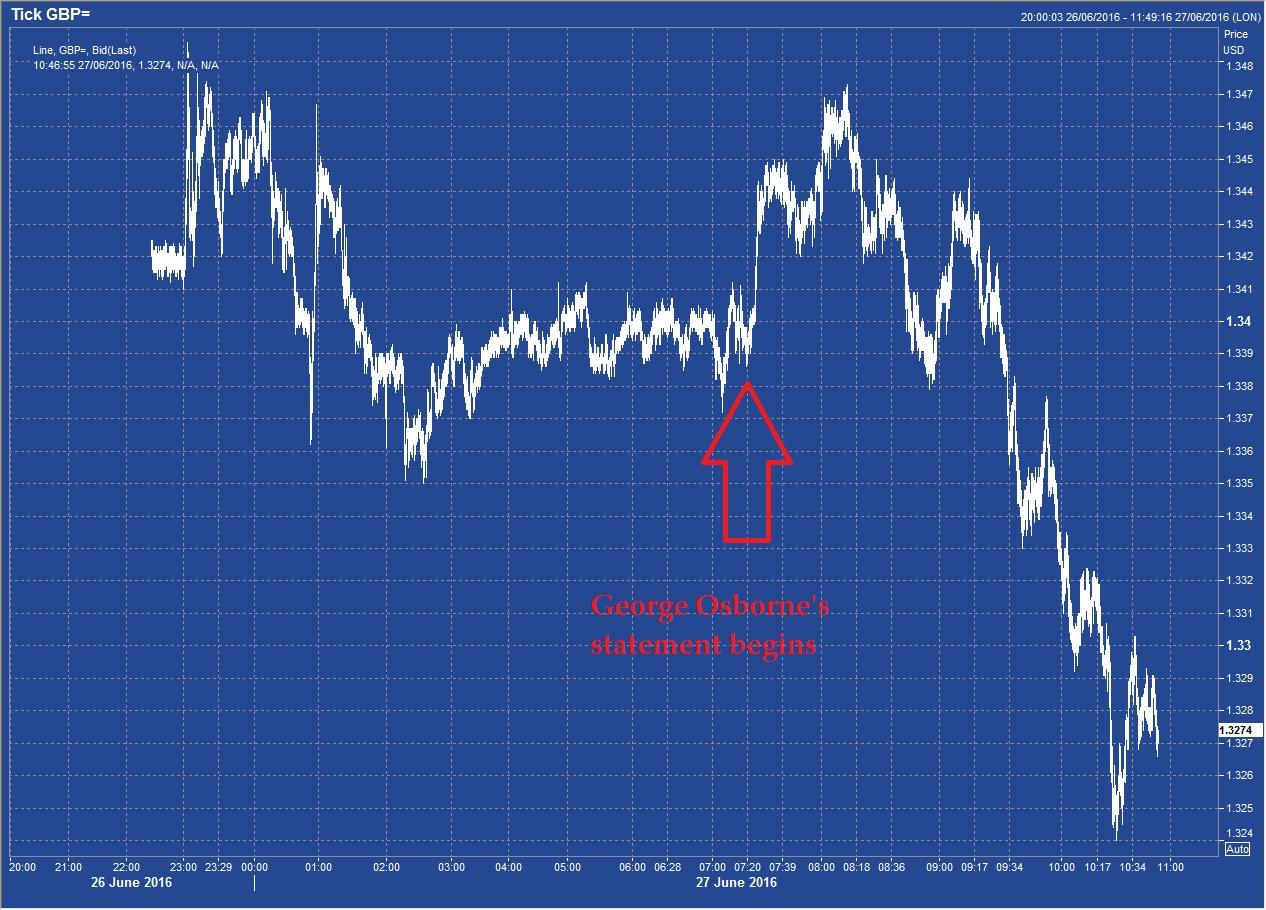

"Statements by UK and EU leaders will provide some guidance on the UK government’s policy objectives, the likelihood of achieving them and the timeframe for negotiation. However, Prime Minister David Cameron has indicated that negotiations with the EU will not begin in earnest until 4Q16, and the final position may well not be known for several years."

The company, based in London and New York, suggests the UK's medium-term growth will also likely be weaker, as Britain will find it harder to export to the EU. Lower immigration, and a fall in investment from overseas, will also hurt the economy, as could a weaker pound.

It continued: "This implies that the general government debt ratio will continue rising over the forecast horizon, reaching 91% of GDP in 2017, compared with the debt ratio stabilising previously.

"The outcome of the referendum has precipitated political upheaval, including the announced resignation of the Prime Minister, contributing to heightened uncertainty over government economic policies and diminished scope for policy implementation at the current conjuncture.

"Furthermore, the fact that a majority of voters in Scotland opted for ‘Remain’ makes a second referendum on Scottish independence more probable in the short to medium term. The Scottish First Minister Nicola Sturgeon has indicated that a second referendum on Scottish independence is 'highly likely'.

"A vote for independence would be negative for the UK’s rating, as it would lead to a rise in the ratio of government debt/GDP, increase the size of the UK’s external balance sheet and potentially generate uncertainty in the banking system, for example in the event of uncertainty over Scotland’s currency arrangement."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks