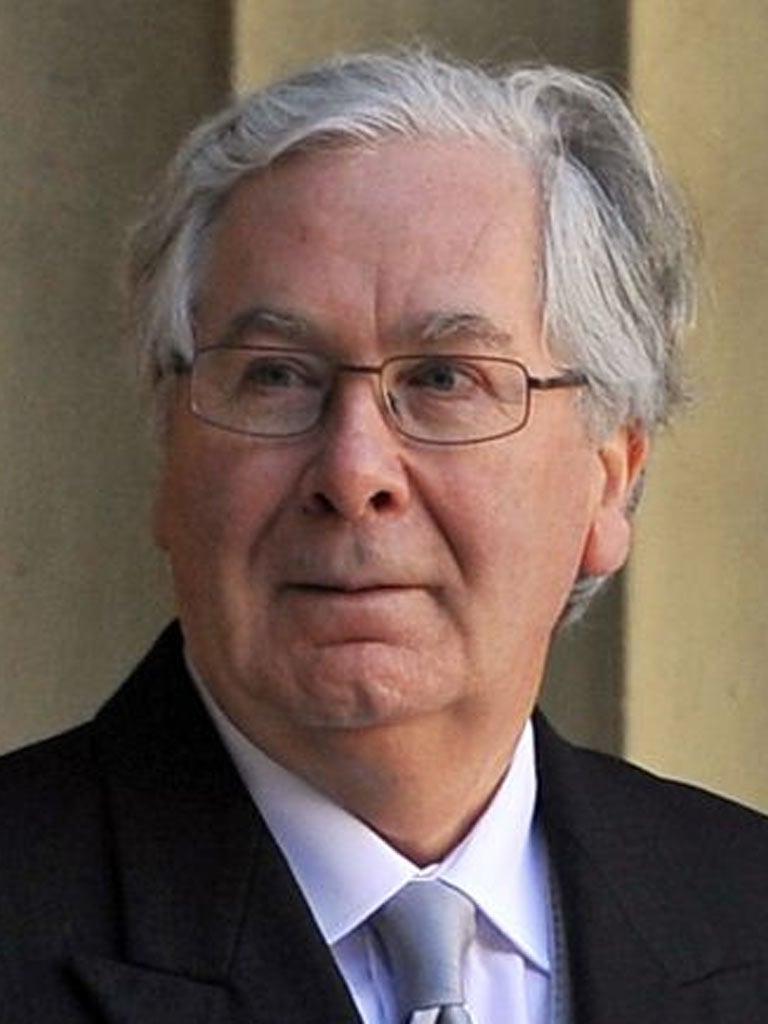

Economic outlook worsening, says Mervyn King

The Bank of England slashed its official growth forecasts yesterday and warned that the British economy could be plunged into recession if the eurozone sovereign debt crisis takes a turn for the worse.

In its quarterly inflation report, the Bank's Monetary Policy Committee (MPC) projected growth of 1 per cent for 2011, down from 1.7 per cent forecast in August, and growth of about 1 per cent for 2012, down from 2 per cent expected in the summer.

The Governor of the Bank of England, Sir Mervyn King, said yesterday that economic activity is likely to be "broadly flat" until the middle of next year. But the MPC report also admitted that it has "no meaningful way to quantify the most extreme outcomes associated with developments in the euro area", implying that the risks to the British economy from events on the Continent are potentially very grave.

The Governor also voiced support for the European Central Bank, which has been resisting demands from European politicians to buy up more bonds of eurozone governments that have come under pressure in the bond markets. Referring to the failure of eurozone political leaders to agree to a comprehensive and decisive resolution strategy for the crisis, Sir Mervyn said: "I think it's very important to recognise that there are circumstances when governments will try and put pressure on central banks to do things they would like central banks to do, in order to avoid their having to own up to the actions that they would like someone else to carry out."

The report forecasts that CPI inflation will fall to 1.3 per cent by late 2013, below the Bank's 2 per cent target, despite the MPC's expansion of its programme of Quantitative Easing in September. This implies that the MPC might decide to extend its £275bn asset-purchase programme in the coming months. But Sir Mervyn was keen to stress the uncertainty of the inflation picture. He said: "We do believe that inflation is likely to come down sharply next year but who knows what's going to happen tomorrow, let alone in the next 12 months."

Sir Mervyn reiterated his support for the Coalition Government's deficit-reduction strategy, describing it as "the right macroeconomic response to the position in which we found ourselves". And he urged policymakers and the public to "be patient" while the strategy is implemented. Sir Mervyn also repeated his call for trade-surplus nations to do more to increase their levels of domestic demand to facilitate a rebalancing of the global economy. He said: "The underlying global problems of trade imbalances, unsustainable levels of external and internal indebtedness and loss of competitiveness remain.... The journey to a more balanced world economy will be long."

The Bank has been criticised for repeatedly missing its inflation targets and downgrading its growth forecasts in recent years. But Peter Dixon, an economist at Commerzbank, defended the MPC, saying: "Despite all the criticism aimed at the Bank, it is to a large extent a prisoner of circumstances. It cannot be expected to conjure up a recovery in activity in the face of headwinds from the eurozone and from domestic fiscal tightening."

The inflation report also referred to a difference of opinion on the nine-person MPC about the growth projections for the economy. It said: "There remains a range of views among committee members about the likely strength of the recovery." This implies that there are some MPC members who believe that the 1 per cent growth projected for next year is over-optimistic.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks