Millions turning off fridges and freezers to cut high energy bills, charity warns

Quarter of low income households have gotten into debt to pay for food

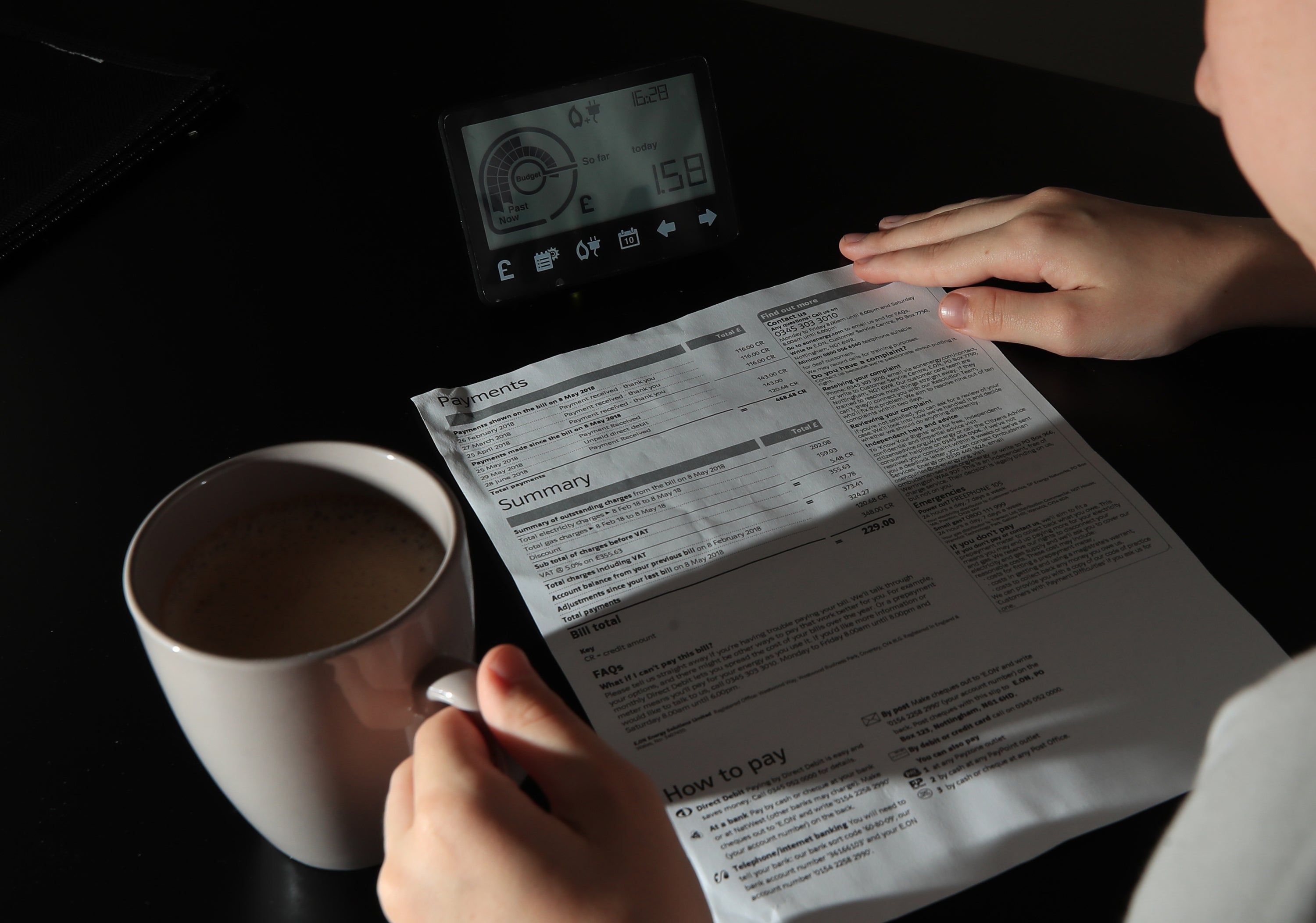

Around two million households have been forced to turn off their fridge or freezer to cope with rising energy bills, according to new analysis that lays bare the impact of the cost-of-living crisis.

New research from the Joseph Rowntree Foundation (JRF) found that one in six low-income families turned off their kitchen appliances to conserve energy costs, with almost half saying that they had switched them off at some point in the past six months.

It comes as another survey from The Children’s Society found that more than half of young people said they were worried about how much money their family has.

According to the JRF, 84 per cent of all families on universal credit went without essentials such as food, heating and clothing in the six months to October 2023. Some 24 per cent of low-income households – the equivalent of 2.8 million families – have fallen into debt in order to pay for food.

Some 33 per cent of these households had sold their belongings to help cope with rising costs, and 15 per cent had used a warm bank.

Over 4,000 households were surveyed in the JRF’s study on the impact of the cost of living crisis.

One in ten parents and carers reported “always” running out of money before the end of the month, while 14 per cent ran out of money “most of the time”, the survey for the Children’s Society found.

Peter Matejic, chief analyst at the JRF, said: “Millions of families unplugging their fridges and freezers is the latest chapter in a long-running story of hardship. People risk becoming sick from eating spoiled food and going without healthy, fresh food. This risks lasting harm to the health of millions.”

Are you in a similar position and want to tell your story? Contact holly.bancroft@independent.co.uk

Mark Russell, chief executive of The Children’s Society, said: “Behind these statistics are real-life stories of families making difficult choices: between heating and eating, between essentials and debt.

“Every child deserves a good childhood and as we head into the winter, these findings should serve as a wake-up call - we need an urgent government plan to lift families out of poverty.”

The organisation is calling for more investment in social security for children, an essentials guarantee to ensure families can afford basic needs, free school meals expansion to children whose parents or carers receive Universal Credit and the Household Support Fund, which is running until March 2024, to be made permanent “as a safety net whenever families are faced with a financial crisis”.

A spokesperson for the department for work and pensions said: “The cost of living payments have provided a significant financial boost to millions of households, and are just one part of the record £94bn support package we have provided to help with the rising cost of bills. This includes a 10.1 per cent rise to benefits earlier this year, and a more than £2bn Household Support Fund to help with the cost of household essentials.

“In the long term, the best way to secure financial security is through work, and thousands of Work Coaches in Jobcentres across the country are on hand to help people find a job, enhance their skills, and reap the benefits of work.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks