Oxbridge academics demand end to fossil fuel investment

Unprecedented alliance of leading intellectuals calls on universities to use their wealth to support green energy instead

More than 300 eminent academics at Oxford and Cambridge have signed a joint statement calling on the institutions to pursue more “morally sound” investment policies that have no basis in fossil fuels.

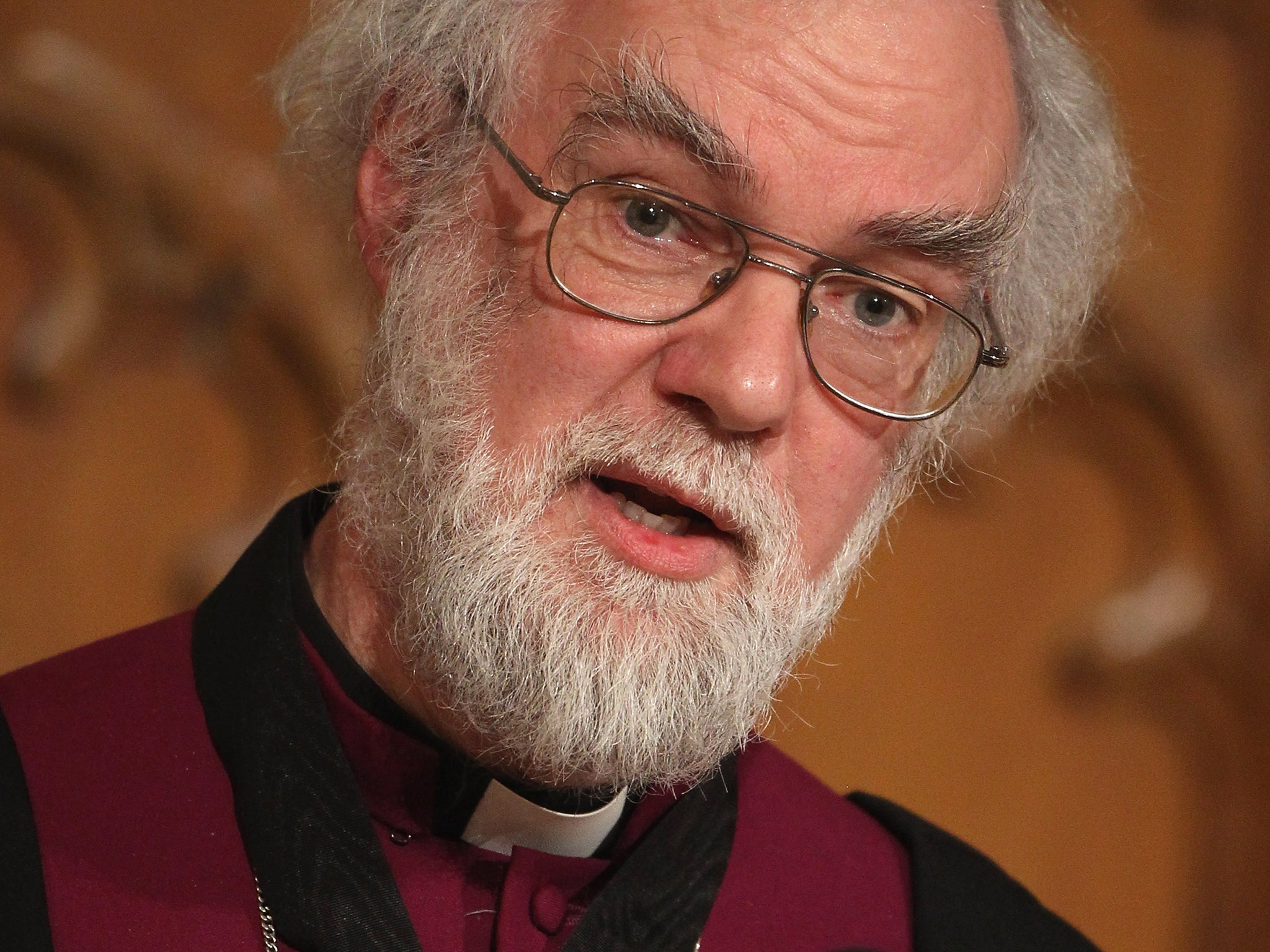

The signatories, who include the former Archbishop of Canterbury Lord Williams and the Astronomer Royal Lord Rees, say that Oxford and Cambridge should put their multibillion-pound endowment funds to better use in the light of “looming social, environmental, and financial pressures”.

The organisers of the student-led campaign hope that the involvement of so many Oxford and Cambridge faculty members will prove to be a watershed moment for the fossil fuel divestment movement, which applies pressure to institutions to get rid of any stocks, bonds or investment funds that are unethical or morally ambiguous.

The University of Cambridge’s endowment totals more than £5bn, making it the largest in Europe, while Oxford’s stands at around £4.2bn. This includes the sums controlled by individual colleges, many of which have their own specific investments. Positive Investment Cambridge, the student group which organised the joint statement, said that it wanted both institutions to align their investment practices with their publicly stated values.

Around 50 of the signatories are academics at Oxford while 250 are from Cambridge, including the incoming president of the Royal Society, Sir Venki Ramakrishnan, and Sir David MacKay, the former chief scientific adviser to the Department of Energy and Climate Change.

Organisers said they hoped to persuade both institutions to create an ethical investment blueprint which could then be copied by other universities. “We’d like to create a template for the smartest, most ethical investment strategy there has ever been,” said Ellen Quigley, a Cambridge PhD student who helped with the campaign.

“We think that if that is developed at Oxbridge it would be taken very seriously on the global stage, and at least parts of it could end up being implemented by other funds the world over.”

Lord Deben, chairman of the independent Committee on Climate Change and a Cambridge alumnus, has also lent his support. He said responsible investing by leading institutions such as Oxford and Cambridge could prove “crucial” in keeping global warming at safe levels.

“These universities are doing tremendously important work on the research side; it would be great to see those contributions reflected in the investment strategies of Europe’s two largest university endowments,” he added. “This open letter, signed by so many esteemed fellows, is a sure sign that there is widespread support for positive investment among Oxbridge academics.

“It is clear that, at the faculty level and among the student body alike, there is significant concern over climate change and other great ethical issues of our time – and positive investment appears to be viewed as at least part of the potential solution to the growing crises of the modern age.”

In 2014, Glasgow University became the first academic institution in Europe to divest from the fossil fuel industry, withdrawing investments worth £18m, and last year 10 other UK universities with endowments worth £115m followed suit. The movement originated on campuses in the US. Oxford has already ruled out future investments in coal and tar sands from its multi-billion-pound endowment, but stopped short of divesting from all fossil fuels.

Cambridge is currently reviewing its investment decisions with the aim of making them more “environmentally and socially responsible”.

The campaign is being advised by Abundance Investment, which specialises in green and ethical investment products. “Investing is not just about future returns, it is also about building the future you want for yourself and future generations,” said the company’s co-founder Bruce Davis.

The University of Cambridge said it already “seeks to invest responsibly for the good of the university in accordance with our mission to contribute to society”. It added: “In summer 2015, the university commissioned a thorough and unique review whose broad purpose is to explore fully environmental, social, and governance aspects (including but not limited to fossil-fuel investments) in investment decisions.

“The working group established for this purpose is able to take evidence and call upon expertise beyond its membership as necessary. It will produce a report for publication and presentation to the University Council. The findings of this working group will further inform our decisions.”

A response is being awaited from Oxford University.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks