More than 300,000 families in poverty despite parents working full-time

Health and social care workers, shop assistants and construction workers among those still in poverty despite being in work

More than 300,000 families with children are living in poverty despite their parents being in full-time work, new analysis reveals.

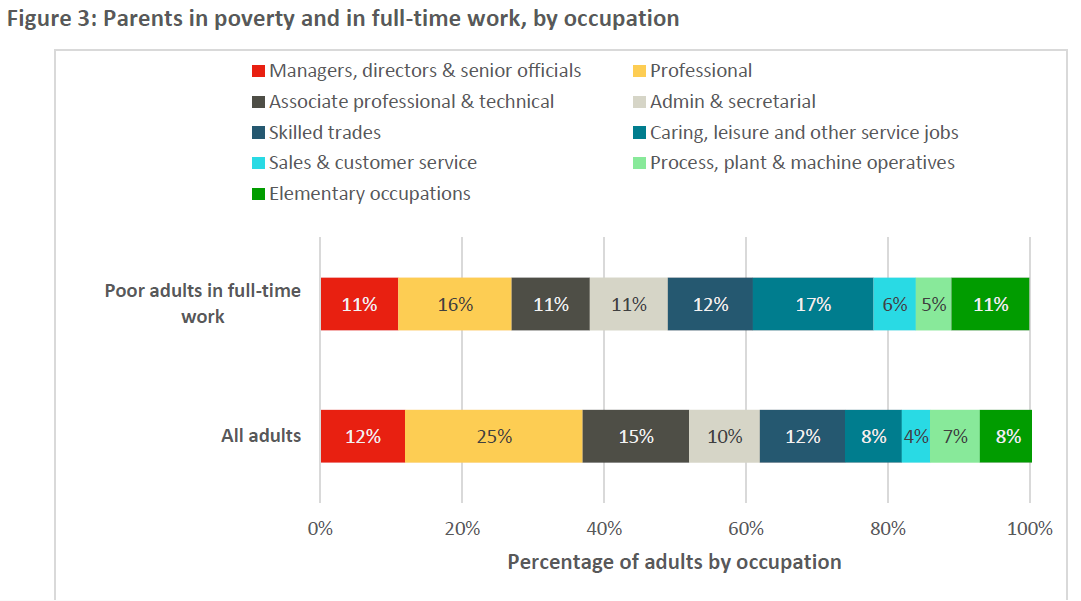

Health and social care workers, shop assistants and construction workers are among those who are still in poverty despite being employed. Almost one in four low-income parents in full-time work are employed in health and social care, research from charity Action for Children has found.

The study found one in five of the 300,000 families in poverty live in London and nearly half - 46 per cent - are single parents. They are also disproportionately more likely to be from Black and minority ethnic backgrounds, compared to the wider population, and twice as likely to be self-employed.

The poverty line is classed as having a net household income of less than 60 per cent of the UK average, after housing costs.

Researchers calculated that these parents would have to work eight days a week if they wanted to earn enough in their current jobs to be able to escape poverty. Housing costs were one of the major expenses for low-income families, the research found.

It comes as analysis from housing campaign group Generation Rent found that renting in London would be impossibly expensive for a range of key workers, such as nurses and carers.

The median rent for a one-bedroom home in inner London was 106 per cent of a teaching assistant’s salary, they found. It was 97 per cent of a cleaner’s average income, and 82 per cent of a care workers’.

Dan Smith, 37, who lives in Kent with his fiancée Leanne Jones and their four-year-old daughter Beau, said they were having to eat into their savings despite both working.

Mr Smith is self-employed as a behaviour specialist working with neurodivergent children, which gives him time to support Beau - who has down’s syndrome.

Ms Jones works part-time, five mornings a week, as a senior administrator for an incineration waste disposal company. With expensive nursery fees for Beau, the couple worked out that they would be financially worse off if Ms Jones went back to work full-time.

Mr Smith said: “Before Beau was born and Leanne had to go part-time, we were a £60,000 a year household - but we’re now living hand to mouth. We’d worked really hard for many years to save £30,000 for a deposit for a house but when we looked into it, incredibly £30,000 wasn’t enough to make the repayments affordable on our incomes.

“The mortgage repayments would’ve been almost twice our rent at the time.” He added: “It’s just an awful thing to think I’m 37-years-old and the idea of owning my own home is now unimaginable. We both have good jobs, we’ve worked hard to be educated people, to do all the things we were told we should do. Now just through the way society has gone, we’re really struggling.”

They instead used their savings to rent a two-bed home but Mr Smith added: “It wasn’t long before we needed to bite into the savings more and more every month just to cover our day-to-day expenses as the cost of living went up and up.”

“I’ve never labelled myself as someone in poverty, others are far worse off of course - but I realise we’re slowly falling into that low-income group now unless things pick up.”

The family are bracing for their landlord to increase their rent to over £900 a month, to match the rents at her other properties. “Last night, we sat down and budgeted because we emptied our savings account yesterday and it all went into covering our rent for this month.

“The next step is looking at potential credit cards, the usual things that become a spiral and that we don’t want to do if we can help it.”

Paul Carberry, from Action for Children, said their research showed that the government needed to “confront the myth that work alone is a passport out of poverty”.

The charity called for more research on low-income earners, increase in benefits, and more support for families to find jobs or extra work.

Responding to the analysis, chief executive of Child Poverty Action Group, Alison Garnham, said: “The families behind these statistics are the people that make the country run - the healthcare workers and service staff we all rely on - but their budgets are running on empty.”

It comes after food bank charity the Trussell Trust revealed that more than half of people receiving universal credit were unable to afford enough food in the last month. Some 780,000 people on universal credit have turned to a food bank for emergency help in the past month, estimates from the charity showed.

Henry Parkes, principal economist at think tank Institute for Public Policy Research, said: “Universal credit was supposed to make work pay. However, the shambles of administration that has been overseen by nine DWP ministers in 14 years has led to a threadbare system that neither prevents poverty nor supports people into meaningful work.”

A government spokesperson said: “There are 1.7m fewer people living in absolute poverty compared to 2010, including 400,000 children, as we continue to support families with cost of living support worth on average £3,700 per household.

“Children are five times less likely to experience poverty living in a household where all adults work, compared to those in workless households, which is why this Government has reduced the number of workless households by almost 700,000 since 2010.”

They added that the national living wage is being increased to £11.44 from April and £2.5bn is being spent on back to work measures.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks