Online influencers’ claims to go under the microscope in new school lessons

New resources aim to help children and teens protect themselves and their money online

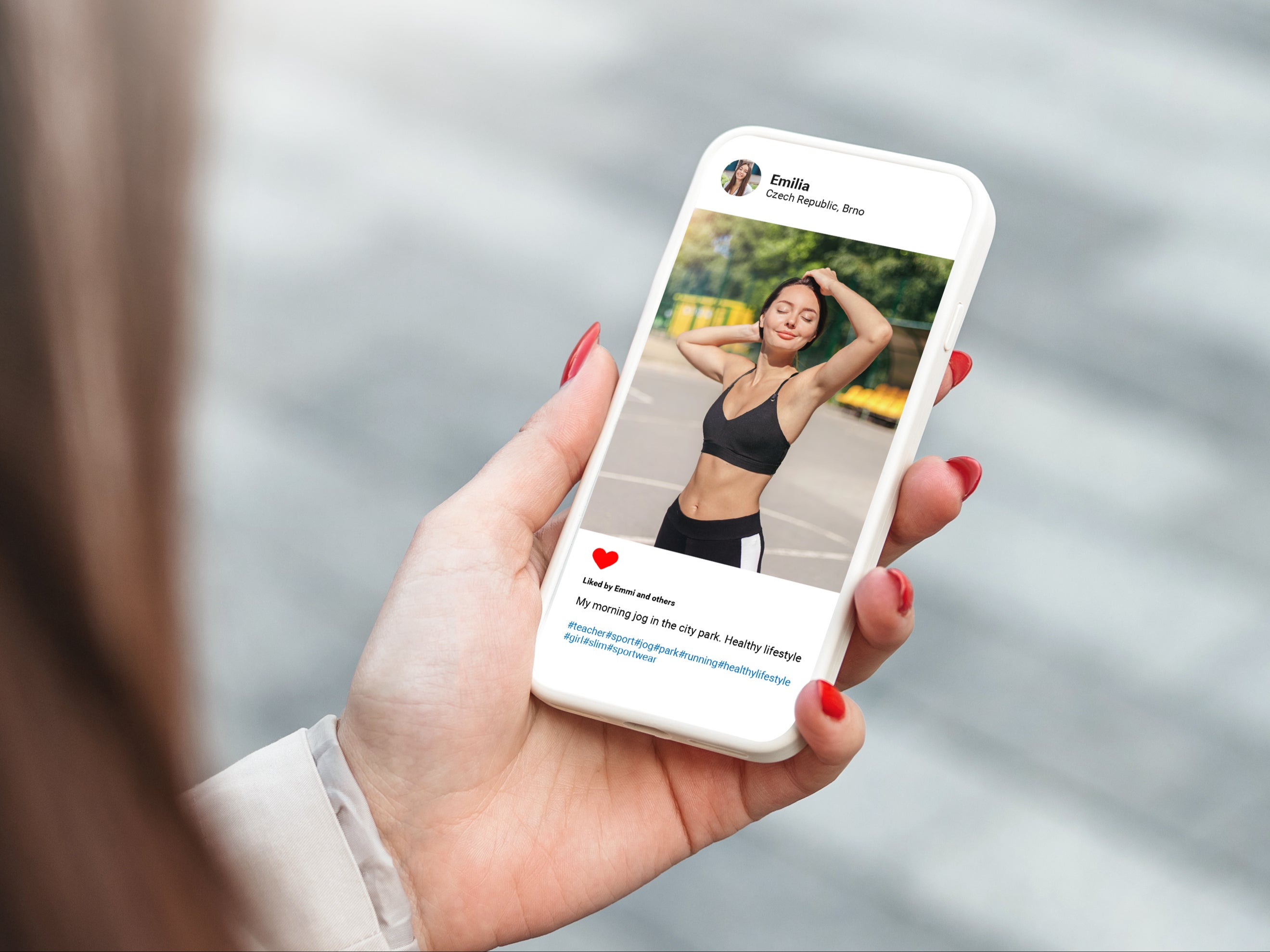

New teaching resources aim to educate children on the potential pitfalls of in-game spending, virtual currency, and claims made by social media influencers.

The Oak National Academy has launched a package of over 80 financial education lessons, covering budgeting, borrowing, and online spending.

Resources aimed at Year 4 (aged 8-9) will highlight the ease with which real money can be spent on in-game extras like "loot boxes," emphasising the risks associated with such purchases.

Primary school pupils will be introduced to the functions of credit and debit cards, and learn to recognise the persuasive tactics employed by advertisers. The resources also address online safety and protecting money in the digital sphere.

Secondary school resources will delve into the world of online influencers, teaching pupils to critically analyse data and claims, and to determine their accuracy.

They will also introduce students to concepts such as inflation, personal risk, cryptocurrency and investing, and lessons will help them to interpret important financial documents like bank statements and payslips.

This initiative responds to calls for greater emphasis on practical life skills in education. The interim report of the independent curriculum and assessment review, released in March, highlighted consistent feedback from young people and parents desiring more focus on applied knowledge, particularly in areas like financial literacy.

The Oak National Academy, which is a publicly funded creator of optional curriculum resources for schools in England, will roll out the teaching resources for pupils aged five to 16 to schools by summer.

In March 2024, consumer champion Martin Lewis suggested that introducing financial education to the national curriculum in England was “counterproductive” as schools lacked the resources to deliver it.

Earlier this year, MPs used a Commons debate to call for children to receive “effective” financial education at school and they suggested the topic could be weaved into existing subjects.

John Roberts, interim chief executive of Oak National Academy, said: “We’ve got to make sure young people leave school with the fundamental knowledge and skills they need to navigate life in the complexities of the modern world.

“Oak’s new financial education resources are designed to help schools introduce pupils to core financial concepts from the age of five and frame them in contexts they understand and can relate to.

“By giving teachers the tools to provide well-sequenced, engaging financial learning, we can make sure it resonates with children to support them through adulthood.”

Pepe Di’Iasio, general secretary of the Association of School and College Leaders, said: “It is great to see these resources addressing real-world issues like in-game purchases, and we’re sure this will be welcomed by parents and teachers alike.

“There’s a strong case for more financial education in the curriculum in general but we must be mindful of not further overloading an already packed school day.

“We know that the curriculum and assessment review team recognise the importance of getting this balance right and we look forward to their recommendations in the autumn.”

Sarah Hannafin, head of policy at school leaders’ union NAHT, said: “Schools recognise that financial education is vital to prepare children for the opportunities and responsibilities of adulthood.

“Online platforms also need to step up to the plate, however, by strengthening age verification procedures, improving monitoring, providing clearer functions for reporting concerns, and introducing more transparent codes of conduct setting out the implications of misuse.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks