Autumn Statement: 10 things you need to know about George Osborne's plans

Ben Chu crunches the Chancellor's numbers

So the cuts are deep but not quite as deep as we’d been led to expect. But the Chancellor will only be able to let up on austerity for as long as the Office for Budget Responsibility remains committed to its optimistic economic forecasts.

What’s happened to the growth forecasts?

Not much since the Budget in July. Projected GDP growth for 2015 is unchanged at 2.4 per cent. It’s actually up very slightly in 2016 and 2017 at 2.4 per cent and 2.5 per cent respectively, despite the slowing global economy.

One of the reasons is that the government will cut spending by much less than expected in July. The Chancellor has also retreated on his plan to cut tax credits for the working poor. This extra spending in the economy will all help support growth in a classic “Keynesian” style.

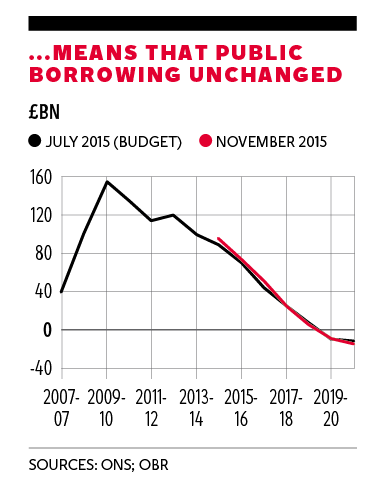

Does that mean more borrowing then?

No. The OBR still projects a £10bn overall budget surplus in 2019-20, exactly the same as in July. The downward path of the national debt is also very similar to July. It descends from 82.5 per cent of GDP in 2015-16 to 71.3 per cent in 2010-21. However the OBR does note that in this financial year debt only falls due to an avalanche of privatisations of public assets such as Royal Mail.

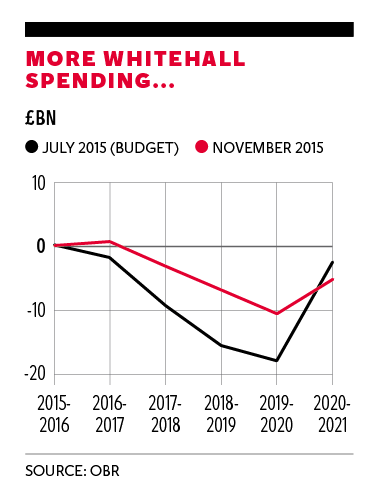

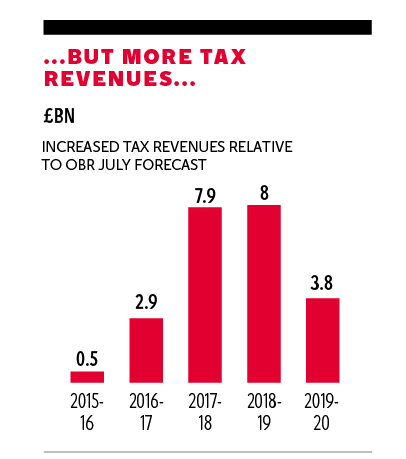

More spending but not more borrowing? How can that add up?

The Chancellor has been helped by a large upward revision in tax revenue estimates by OBR due to “modelling changes”. These include a correction of a “systematic overestimate of VAT deductions” and “improved modelling of national insurance contributions”.

It all adds up to a £23bn windfall for the Treasury over five years – and some analysts called it an “early Christmas present” for the Chancellor. This is a big surprise as the monthly public finances figures had suggested a deterioration of revenues relative to OBR forecasts.

What about tax?

Rather awkwardly for a Chancellor who claims to be a tax cutter, there are a host of effective net tax increases in his latest package. The apprenticeship levy on firms raises serious money: £11.6bn over the next five years. The OBR says it expects this to be passed on to employees in the form of lower pay or fewer jobs.

The Chancellor is also making it easier for local authorities to raise council tax. The OBR estimates this will raise £6.2bn over the five-year period. There are also little nibbles on company car allowances and a cut to a tax break for household and commercial renewable energy production.

George Osborne announced a lot of spending increases didn’t he?

Indeed he did. He boasted that the NHS would receive “the largest investment… since its creation”. He said the housing budget would be doubled to £2bn a year to fund “the biggest house building programme by any government since the 1970s”.

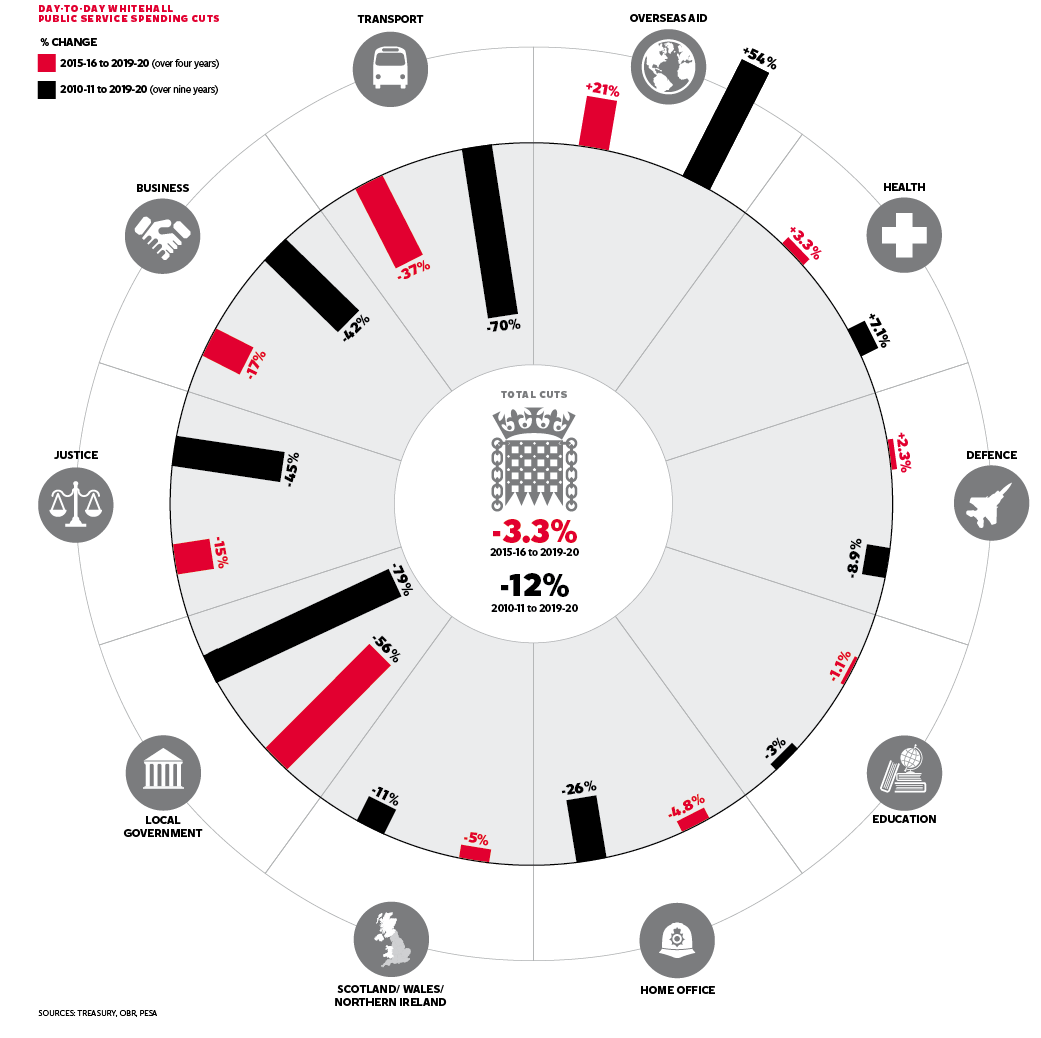

This isn’t all just bluster. Total day-to-day Whitehall spending is £22.9bn higher than the OBR’s projections in July. And spending falls by an average of 1.1 per cent a year, less severe than the 1.6 per a year average in the last Parliament. However, the reversal shouldn’t be exaggerated. Total public expenditure will still fall to just 36.5 per cent of GDP in 2019-20. Only twice since the Second World War has it been so low.

What about capital investment?

The Chancellor made a lot of his additional infrastructure spending commitments for new high-speed rail lines and the electrification of existing lines in Northern England. And capital spending will rise by 20 per cent over this Parliament according to the OBR. Yet that needs to be seen in the broader context. Public sector investment spending (excluding wear and tear) will only be 1.4 per cent of GDP by 2020, still pretty low in historic terms. And with interest rates still extremely low, many economists see this as a squandered opportunity to invest.

What will be cut?

For some departments it was still a brutal spending round. Day-to-day spending by the Business department will be slashed by 17 per cent over the next four years. Environment and Rural Affairs will be reduced by 15 per cent. Energy and climate change will take a 16 per cent hit. Transport’s budget will fall by 37 per cent. The Culture department’s administrative budget will fall by 20 per cent.

The implication of all these settlements will come into greater focus over the following days and weeks. The overall pain is less than feared – but it will nevertheless be great. And this is on top of some huge cuts to these departments in the previous Parliament. Over the decade to 2019-20 the Business budget looks set to be 42 per cent smaller. Justice is facing a 45 per cent contraction. Transport is in line for a 70 per cent hit. The impact of the cuts on local government are likely to be the most severe of all.

How will this be mitigated?

The Chancellor promised “far-reaching changes to what the state does and how it does it”. There will be more tax raising powers for councils to pay for social care. More additional user charges are likely in other areas of the state. Old prisons will close and be sold off. This suggests more convicts could be rehabilitated more cheaply in the community.

What about tax credits?

Here there was a massive retreat. Tax credits will not be withdrawn from the working poor as laid out in the July Budget – the decision that provoked a massive backlash and defeat for the Government in the House of Lords. The cost of that reversal is £9.4bn. But it’s not a complete reversal. The two-child limit on claiming tax credits from July still remains. The Universal Credit system, which will roll-up lots of benefits into a single programme, will also be less generous. This will hit future recipients.

How sustainable is it all?

Despite the Chancellor’s pledge to build lots more houses, the OBR still expects average house prices to rise by around 5 per cent a year. That’s quicker than it expects average wages to rise, which will make homes less affordable. Higher house prices also push up aggregate household borrowing to income ratios back up close to pre-2007 highs. The current account – a measure of how much the country as a whole is borrowing from the rest of the world – also remains high over the forecast period.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks