Budget 2015: Millions of low paid workers to see pay rise by more than a third by 2020

The surprise introduction of a national living wage will see the over-25s earn £9 an hour by 2020

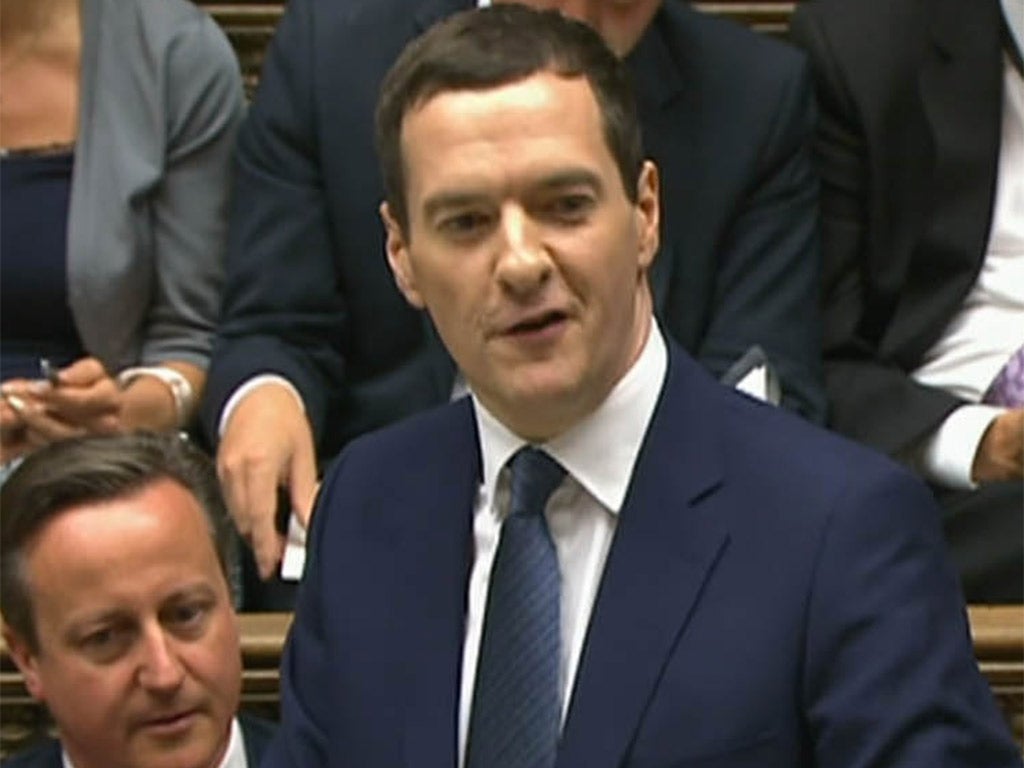

George Osborne masked £12bn of welfare cuts with the surprise introduction of a national living wage under which 2.5m low paid workers will see their pay rise by more than a third by the 2020 election.

Presenting the most radical Budget for many years, the Chancellor wrong-footed Labour as he promised that the current £6.50 an hour national minimum wage would rise to £7.20 an hour for those aged 25 and over from next April and to £9 an hour by 2020.

Mr Osborne hailed a “new settlement” and a “One Nation Budget,” which will set the political agenda for the next five years. Jubilant Conservative MPs said the Chancellor was also staking another claim – to succeed David Cameron when he stands down before the next election. They believe the landmark Budget will boost his prospects of doing so.

The Chancellor eased the spending squeeze a little by spreading his £37bn of cuts over a slightly longer period. The nation will be back in the black in 2019-20, a year later than planned.

But there will be painful welfare cuts after what Whitehall sources described as difficult negotiations between Mr Osborne and Iain Duncan Smith, the Work and Pensions Secretary. The £30bn-a-year cost of tax credits will be pared back by £9bn and, in a controversial change, new claimants will not receive them or housing benefit for any more than two children. The two-year freeze on most working age benefits promised in the Tories’ election manifesto, was extended to four years. So was a 1 per cent ceiling on public sector pay rises, which could provoke industrial action.

As The Independent revealed, the Chancellor scrapped £3bn of maintenance grants for university students from low income families in England and Wales by converting them into loans from 2016-17.

Mr Osborne predicted that six million workers would see their pay rise as the effect of his new national living wage rippled up the pay scales. “Britain deserves a pay rise,” he said.

All employers will be forced by law to pay the new minimum from next year. The move will cost an estimated 60,000 jobs and the Confederation of British Industry called it a “gamble” that would have a big impact on firms.

Labour accused Mr Osborne of taking away more in benefit cuts with one hand than he was giving with higher wages with another. It said the new wages floor was “spin” and a “rebranding” of the minimum wage—not the acceptance of the living wage already paid voluntarily by 1,600 employers, which is worth £7.85 an hour and £9.15 in London. This reflects the real cost of living but pressure groups pointed out that it would need to be higher to reflect the tax credit cuts Mr Osborne announced.

Gavin Kelly, chief executive of the Resolution Foundation think tank on whose work Mr Osborne’s move was based, said: “We shouldn’t think that a higher minimum wage will compensate all low income working families for their losses. Many working households will be left significantly worse off.”

Chris Leslie, the shadow Chancellor, claimed the living wage policy had already unravelled. He said:“ He is trying to pull the wool over people’s eyes by rebranding the national minimum wage a living wage. The whole point about the living wage is that it is set assuming the full take up of tax credits. Families on low incomes will see almost half the benefit of a higher minimum wage taken away from them by the Chancellor’s new work penalties in the tax credits system.”

However, Labour is expected to back Mr Osborne’s plan for the Government to run a surplus in normal economic times; a lower welfare cap for families and the public sector pay squeeze.

Treasury officials insisted the highee wages floor would more than offset the tax credit cuts for those in work. “People will always be better off,” they said. The Budget document claimed that eight out of 10 working households would be better off by an average of £130 in 2017-18 when welfare changes, the national living wage and personal tax allowance rises were taken into account.

Mr Osborne announced that the £10,600 personal tax allowance would rise to £11,000 next April and the threshold for the 40p tax rate from £42,385 to £43,000.

The Budget document revealed a net tax rise of £5.8bn over the five-year parliament, which Mr Osborne did not announce. Paul Johnson, director of the independent Institute for Fiscal Studies, said: “This is a tax-raising Budget, it is not a tax-cutting Budget. It is cutting taxes for some groups of people but across the economy it is raising tax. He [Mr Osborne] came into this parliament saying ‘we are going to sort the deficit out by 2018’, he is now pushing that back by another year. So the rhetoric does seem to be stronger than the reality.”

Robert Chote, chairman of the Office of Budget Responsibility fiscal watchdog, said the revised spending plans were “much less like a rollercoaster but still a bit of a bumpy ride.”

Mr Osborne promised an extra £10bn a year for the NHS by 2020 and announced that defence spending will meet Nato’s target of 2 per cent of Gross Domestic Product for the next five years. However, these moves will put non-protected Whitehall departments—already facing cuts of 15 per cent –under even more pressure in a government-wide spending review this autumn.

Mr Osborne hailed his package as “a plan for Britain for the next five years to keep moving us from a low wage, high tax, high welfare economy to the higher wage, lower tax, lower welfare country we intend to create.”

At a glance: Key points

* A compulsory national living wage for people aged 25 and over, starting in April 2016 at £7.20 an hour and reaching £9 an hour by 2020.

* Corporation tax to be cut from 20 per cent to 18 per cent by 2020.

* The tax-free personal allowance raised from £10,600 to £11,000 next year.

* Higher-rate 40p income tax threshold to rise from £42,385 to £43,000 from next year.

* Rises in public sector pay restricted to 1 per cent per year for the next four years.

* Four-year freeze for working-age benefits.

* Reduction from £6,420 to £3,850 in income level at which tax credits begin to be cut.

* Support for children through tax credits and universal credit to be limited to two children, affecting children born after April 2017.

* Benefits cap to be reduced from £26,000 per household to £23,000 in London and £20,000 in the rest of the country.

* Social housing tenants earning more than £40,000 in London and £30,000 elsewhere to pay rent at market rates.

* Abolition of automatic entitlement to housing benefit for 18 to 21-year-olds.

* Rate of employment and support allowance aligned with jobseeker’s allowance for new claimants deemed able to work.

* Rents in social housing sector to be reduced by 1 per cent a year for the next four years.

* Permanent non-dom tax status to be abolished.

* Inheritance tax reform to allow estates worth up to £1m to be tax-free if they include a home.

* Britain committed to meeting Nato target of spending 2 per cent of GDP on defence for rest of this decade.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks