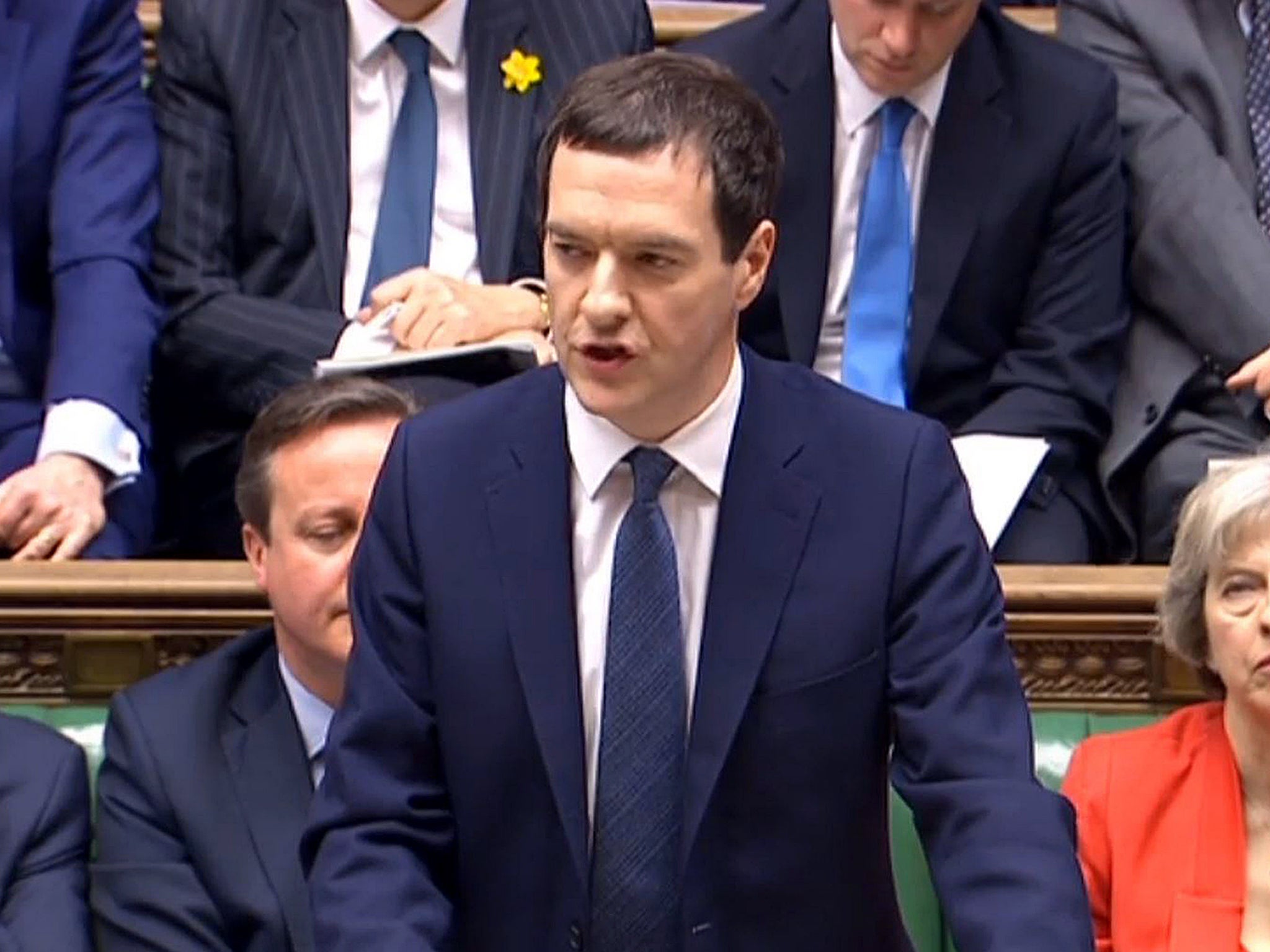

Budget 2016: George Osborne's main announcements at a glance

Growth down, borrowing up, tax cuts for capital gains and higher earners, tax on sugary drinks

The Chancellor delivered his Budget to the House of Commons on the afternoon of 16 March 2016. Here are the main points.

Debt forecasts up, growth forecasts down

The OBR’s new forecasts have downgraded growth in all of the next five years to 2020. The watchdog says the economy will only grow by 2 per cent in 2016, as opposed to the anticipated 2.4 per cent. Borrowing and productivity growth are also down – with forecast borrowing in 2018-19 £16 billion higher. The Chancellor said he would make £3.5 billion of new cuts before 2020.

New tax on sugary drinks

The Chancellor announced a new tax on sugary soft drinks, which is projected to raise £520 million. At least some of the money will be spent on doubling funding for school sport, the Chancellor says. Pure fruit juices and milk-based drinks will be exempt. Labour leader Jeremy Corbyn welcomed the levy.

Tax cut for higher earners paying the 40p rate

The Chancellor has raised the threshold for paying the higher rate of income tax to £45,000. The higher rate is paid by roughly the richest 15 per cent, currently people earning over £42,386.

Increase in tax-free income tax threshold

The tax-free allowance increase to £11,500 in April 2017 – up from £10,600 now. The Chancellor previously raised the allowance from £6,475 in coalition with the Liberal Democrats. The Conservative manifesto pledges to put the allowance up to £12,500 by the end of the Parliament.

New devolution for counties, London, and Manchester

The West of England, the East of England and Greater Lincolnshire will all get elected mayor-led combined authorities with new powers. The Chancellor says they are backed by £1 billion new funding. Greater Manchester will get new powers of criminal justice while London will keep its business rates – giving whoever is elected Mayor a lot more spending power.

Fuel duty frozen for sixth year running

The Chancellor had planned to end the fuel duty freeze he had put in place for the whole previous parliament. In the event, he has announced a freeze for another year.

Capital gains tax cut

The Chancellor has cut the headline rate of Capital Gains Tax from 28 per cent to 20 per cent. He had previously raised the rate from 18 per cent to 28 per cent under the 2010 Coalition as part of agreed efforts to equalise the tax paid on income and capital gains.

Business and corporation taxes cut again

Corporation tax will be cut to 17 per cent by April 2020 under the Chancellor's plans. It was already due to fall to 19 per cent - having being brought down from 28 per cent in 2010 and 20 per cent at the start of this parliament. The Chancellor also doubled business rates relief for small businesses, with the threshold going from £6,000 to £15,000 and £18,000 to £51,000 at the higher rate.

All schools to become academies

As reported yesterday the Chancellor unveiled legislation to turn all schools into academies. He said all schools would either be academies or on their way to being academies by 2020, and that funding had been set aside to fund the change.

Lifetime ISA

The Chancellor announced a new savings account to encourage under-40s to save for retirement – for every £4 saved, the Government will top this up by £1 up to the value of £4,000 a year. Tax-free ISAs will also be increased from £15,000 to £20,000.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks