Confused by Brexit? The answers to 8 questions raised by the referendum

Is my job safe? Should I be worried about Britain’s credit rating? How is my pension affected? James Moore addresses key economic issues in the wake of the vote to leave the EU

1. Is it possible that we now don’t leave the EU?

In a recent column, Boris Johnson set out the ultimate ultimatum – that, equipped with a mandate to leave Europe, he could negotiate tough on immigration, call Europe’s bluff, and strike the deal that Cameron failed to achieve. That is a fantasy, of the sort Boris and the Leave campaign peddled to sucker an increasingly large group of “Out” voters who are now experiencing “buyers' remorse”. The EU bent over backwards for David Cameron and gave him its best. There’s scant desire on the continent to give any more to the wreckers who look set to grab control of Britain’s Conservative Government.

However, there are scenarios in which one could see a second referendum being called, particularly given the close nature of the last one and the growing anger about the lies told during the campaign. Indeed, the will of the people might require it. The return of a more EU-friendly government in the wake of a general election is one possibility that might bring it about. There is historical precedent, too. In the 1970s there were two referenda in quick succession: one to decide upon Britain’s entry into what was then the European Community, and a second to decide whether it should stay within the bloc. It is true that it seems unlikely right now, but it is no longer correct to say a week is a long time in politics. Even a day seems like an age, so anything could happen.

2. Just how damaging was Friday’s trading on the stock market?

Friday’s violent swings were not particularly damaging in and of themselves. Markets do that sort of thing all the time. Remember last year’s “Flash Crash”? Many of you probably won’t, and no one would blame you. Big one-day falls are becoming really rather common, and it’s also really rather common for them to be swiftly forgotten. What would really be nasty is if Friday’s ructions turn into something longer term; if they are the precursor to something like the oil shock of the early 1970s, when some stockbrokers took to market trading to pay their bills. Or to the sort of longer-term rout that followed the events of the financial crisis. Companies are already scared witless by what is going on. If a volatile and falling market stops them from raising money when they need it, hold on tight. It could get very nasty, very quickly. The index we should pay attention to as regards Britain, however, is not the FTSE 100. It is dominated by big international companies that have the capacity to weather a UK, even a Europe-wide, storm. The 3 per cent fall didn’t even take it to its low for the year. The reaction of the FTSE 250 was more disturbing. It is made up of smaller businesses that are largely reliant on this country and its economy for their keep. It fell by more than 7 per cent. That could be just the start.

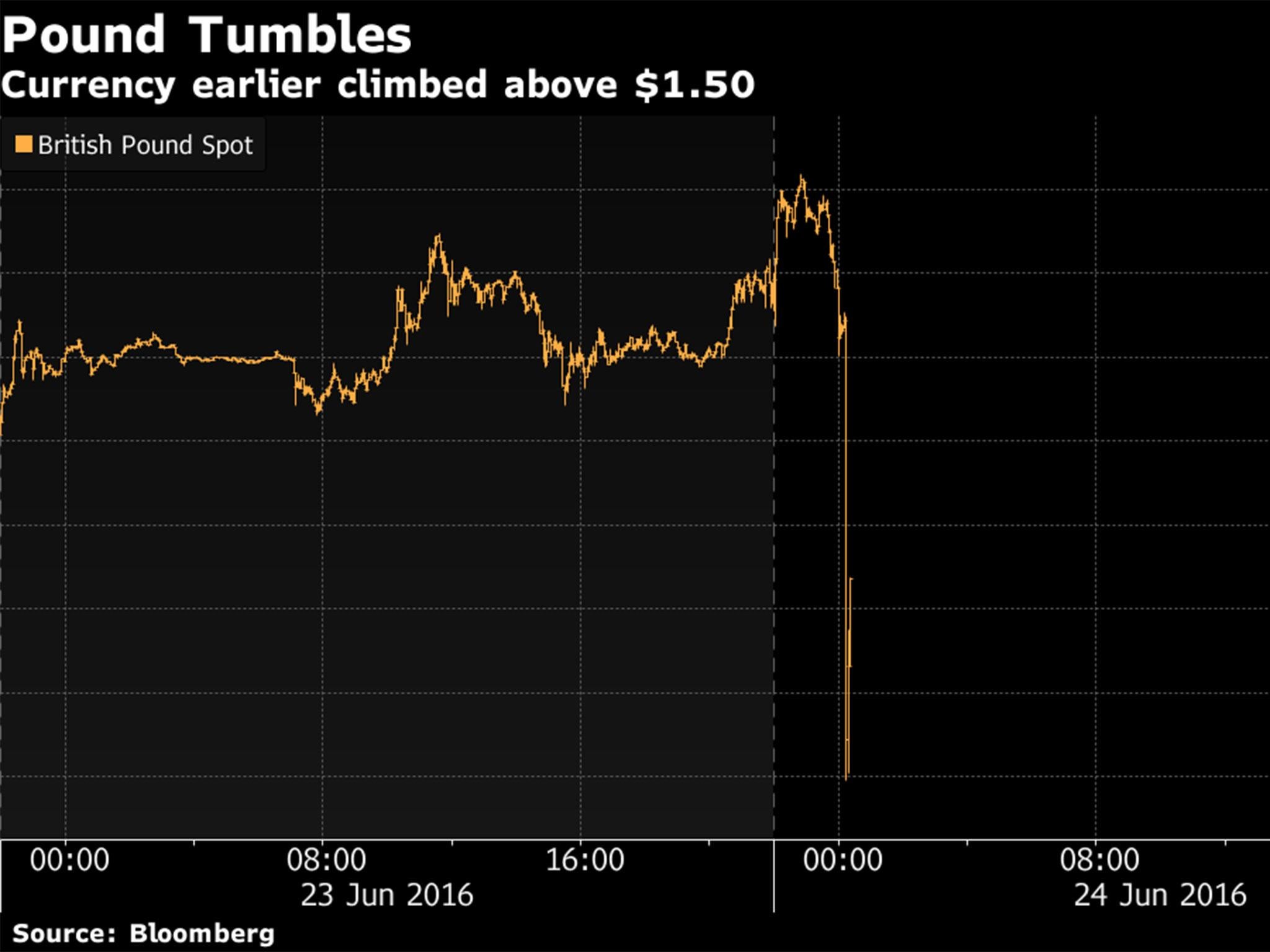

3. What about the currency markets?

The pound falling brings different challenges to those brought by the stock market falling. Bad luck if you didn’t buy your holiday currency before the referendum, but there are more serious issues than your holiday spending being crimped to contend with. On the upside exporters will like the fact that their produce is cheaper to sell overseas. Unfortunately, anything they have to import to make that produce will also get more expensive, which tempers this supposed benefit. Take the price of petrol – a material cost to both businesses and consumers. It has started to rise because oil, like most important commodities, is priced in dollars and the pound fell sharply against the dollar. Another thing to remember is that we currently operate a substantial trade deficit with the rest of the world. Most of the consumer goods we buy are imported, so they will get more expensive. It all puts the Bank of England faces in a difficult position. It might have to contemplate raising interest rates in the teeth of a developing recession. Such a move would compound that recession. There won’t have been many Brexiters on Threadneedle Street, and that’s why.

4. How much has this destroyed my pension, ISA and financial future?

See above. Short-term movements in markets – even big ones – don’t matter that much unless you happen to be planning to cash in on your ISA on Friday. The trend is what's important. The Leave campaign claimed that Britain would be better off out of the EU. That’s highly debatable when it comes to the long term. It is completely untrue of the short term, and probably of the medium term. The markets will be in turmoil until the future shape of Britain’s relationship with the EU is clearer, until the future of Britain is clearer given the likelihood of Scotland’s departure. That will inevitably have an impact upon your investments, savings and pension. The outlook for interest rates is similarly murky (see above). Some have them falling to zero. However, if inflation rears its head (again, see above) that could change quite quickly. Your financial future has suddenly got a whole lot murkier. My old colleague and friend Moira O’Neill, now the editor of Moneywise, pointed out one of the key financial lessons to heed in the wake of all this. If you invest in the markets, look to have a diversified, international, portfolio.

5. Will all the banks pull out?

In a word, no. Britain remains a big economy. The City has a deep pool of capital. There is business to be done here. Where there is business to be done you will find banks to arrange financing, to offer advice, to trade and to lend money. However, what we probably will see is the big international banks starting to move large parts of their operations on to the continent. They liked being in Britain for many reasons. While in the EU, it still offered them a favourable regulatory and legal climate. Guess what, Britain was an independent country then, just as it is now, and will be tomorrow. For the US banks in particular, it felt familiar and London benefited hugely from the “cluster effect" of having a large pool of well-qualified and available staff. Crucially, it also offered access to the world’s biggest market on favourable terms. That may not be true any more and the banks, which are some of the most moveable of businesses, may not be willing to wait on whatever deal or deals the UK manages to strike. Frankfurt is one of Europe’s duller locales, but it has suddenly got a whole lot more attractive to the financial community. The City of London will remain a major financial centre, but its size and power have been greatly diminished.

6. Will other companies pull out?

Much depends on the nature of their businesses, the markets that are important to them, and the size and scale of their investments here. A large majority of MPs favour remaining in the single market. So do many Leave campaigners. If Britain does this, they may be willing to stay put, particularly if the roots they have put down are deep ones. Expect to see multinationals operating on a wait-and-see basis. The real danger to this country is not so much from companies pulling out as it is from companies deciding not to come in. Britain just fell to near the bottom of the list when it comes to businesses that are considering locales for future investment. It will remain there until this awful mess is sorted out, and perhaps beyond because international business leaders will not look kindly on a country governed by the people who created their biggest current headache.

7. So will my job be safe?

Sorry to have to say this, but you’d be wise not to consider any major purchases for now. Companies respond to periods of uncertainty by sitting on their hands. They hoard cash, put off decisions on investment and hiring, and pay close attention to their cost bases. CEOs and finance directors need their bonuses after all! Unemployment will start to rise, while the level of employment in the economy will fall. Immigration may also fall, because Britain suddenly became massively less attractive as a destination, partly thanks to some of the ugly rhetoric indulged in by Leave campaigners. Thanks to the damage they’ve done to our economy with that rhetoric, there won’t be much to celebrate for the “they’re taking our jobs” brigade, because there are going to be fewer jobs about.

8. Should I be worried about Britain’s credit rating?

Credit ratings are overrated because markets tend to take their own view on a country’s credit worthiness long before the likes of Standard & Poor’s and Moody’s get round to updating them. Unfortunately for us, that means our debt will get more expensive long before the agencies’ analysts put pen to paper on a downgrade. Britain has been able to borrow extremely cheaply in recent years. That will change, and the Chancellor’s target for the UK’s deficit will also have to be changed. His talk of big tax rises and fresh cuts during the referendum campaign may have been overstated; after all, he isn’t as suicidal as his pal David Cameron, and he’d still quite like the job of Prime Minister. But this has driven a coach and horses through his economic projections. Austerity is likely to be with us for a lot longer as a result.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks