Labour’s shadow chancellor has promised not to make “political capital” out of any prospective Government U-turn on tax credits.

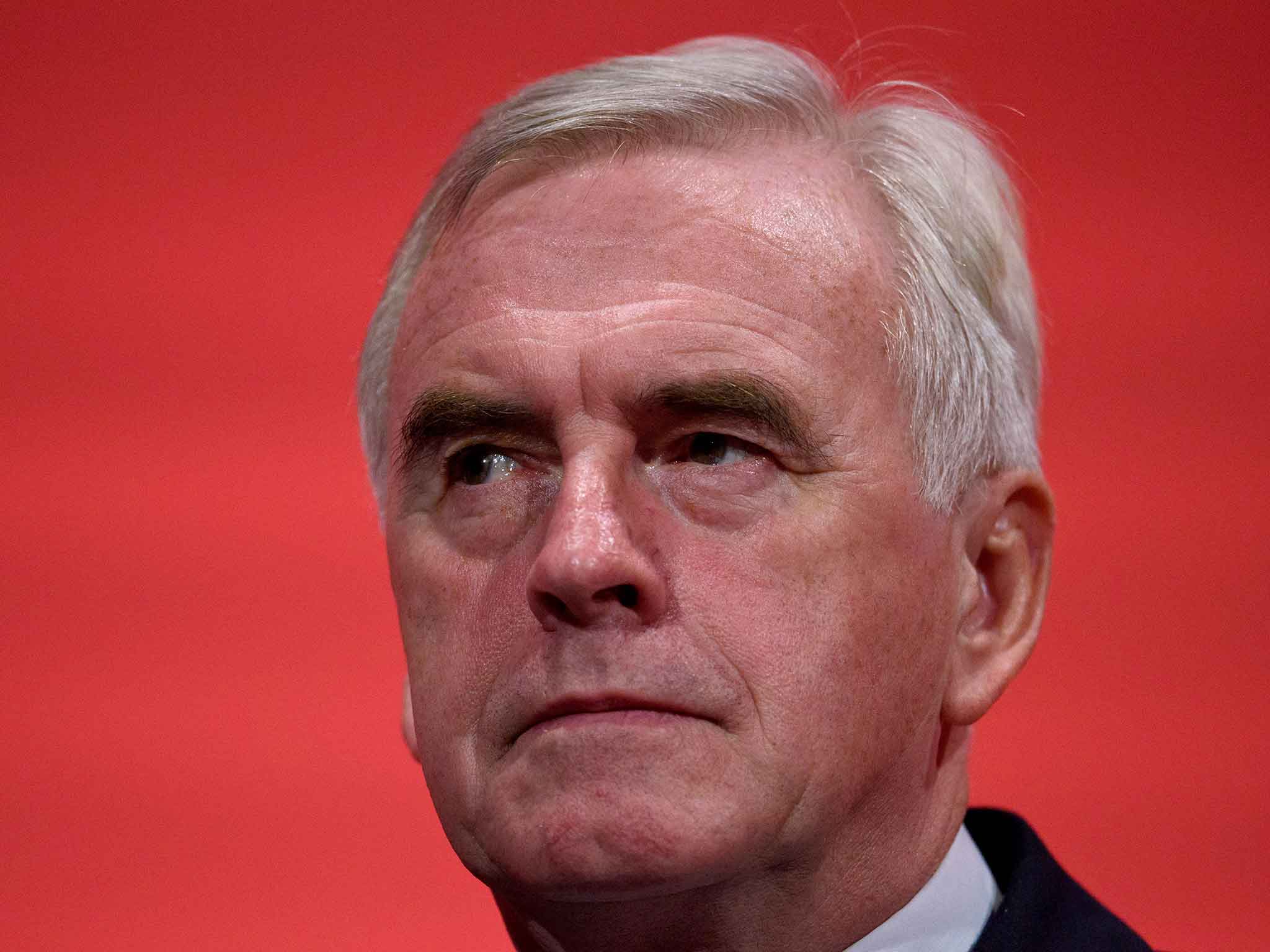

John McDonnell said he would support George Osborne if the Chancellor brought forward meaningful proposals to reverse the cuts.

“I’ve written to George Osborne to say ‘look, I know what a U-turn looks like and how it can damage you, but we need a U-turn on this one’. So I’ve said to him, look, if you can change your mind on this, we will not make any political capital out of this,” he told BBC One’s Andrew Marr Show.

“So if the Lords do throw this out tomorrow and put it back to the Government, I’ve said to him if you change your mind, bring back a policy in which people are protected – not a political stunt, but real protection – ‘we will not in any way attack you for that; in fact, we will support you.”

The House of Lords is set to vote on a so-called “fatal motion” on tax credit cuts tomorrow, with peers expected to either delay or reject the changes.

David Cameron has previously ruled out a U-turn on the policy and on Wednesday at PMQs said he was “delighted” that the cuts had been passed by Conservative MPs in the House of Commons.

But there has been sustained pressure on Mr Osborne to unveil measures to ameliorate the effects of the policy in his Autumn Statement.

Conservative MPs have spoken out publicly against the policy as has former chancellor Lord Lawson. A variet of free market groups ideologically close to Mr Osborne, such as the Adam Smith Institute, have called for a U-turn.

Tax credit cuts are a key part of the Conservatives’ planned £12bn welfare cuts, however – a policy central to their fiscal targets on reducing the deficit.

A study by the Resolution Foundation think-tank found that 200,000 children would slide into poverty immediately after the tax credit cuts go ahead.

The Institute for Fiscal Studies also found a concurrent increase in the minimum wage would come “nowhere near” to replacing the money lost by the tax credit cuts.

Mr Osborne said earlier this month that people on low incomes would suffer if their tax credit cuts did not go ahead.

“Working people of this country want economic security, the worst possible thing you can do for those families is bust the public finances, have some welfare system this country can’t afford,” he told BBC Radio 4’s Today programme.

“That includes a tax credit bill that’s gone up from the £1bn when it was introduced to the £30bn today.”

Public opposition to the policy appears to be hardening, with a ComRes poll for the Independent On Sunday suggesting that 43 per cent disagree that the cuts are needed – compared to 34 per cent who do.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments