New stamp duty could be stealth tax on middle classes, Tory MP claims

Dominic Raab warns that rising house prices could catch people out

The Government’s stamp duty reforms could turn into a new stealth tax – ensnaring thousands of home buyers into higher rates of tax as house prices rise, MPs have warned.

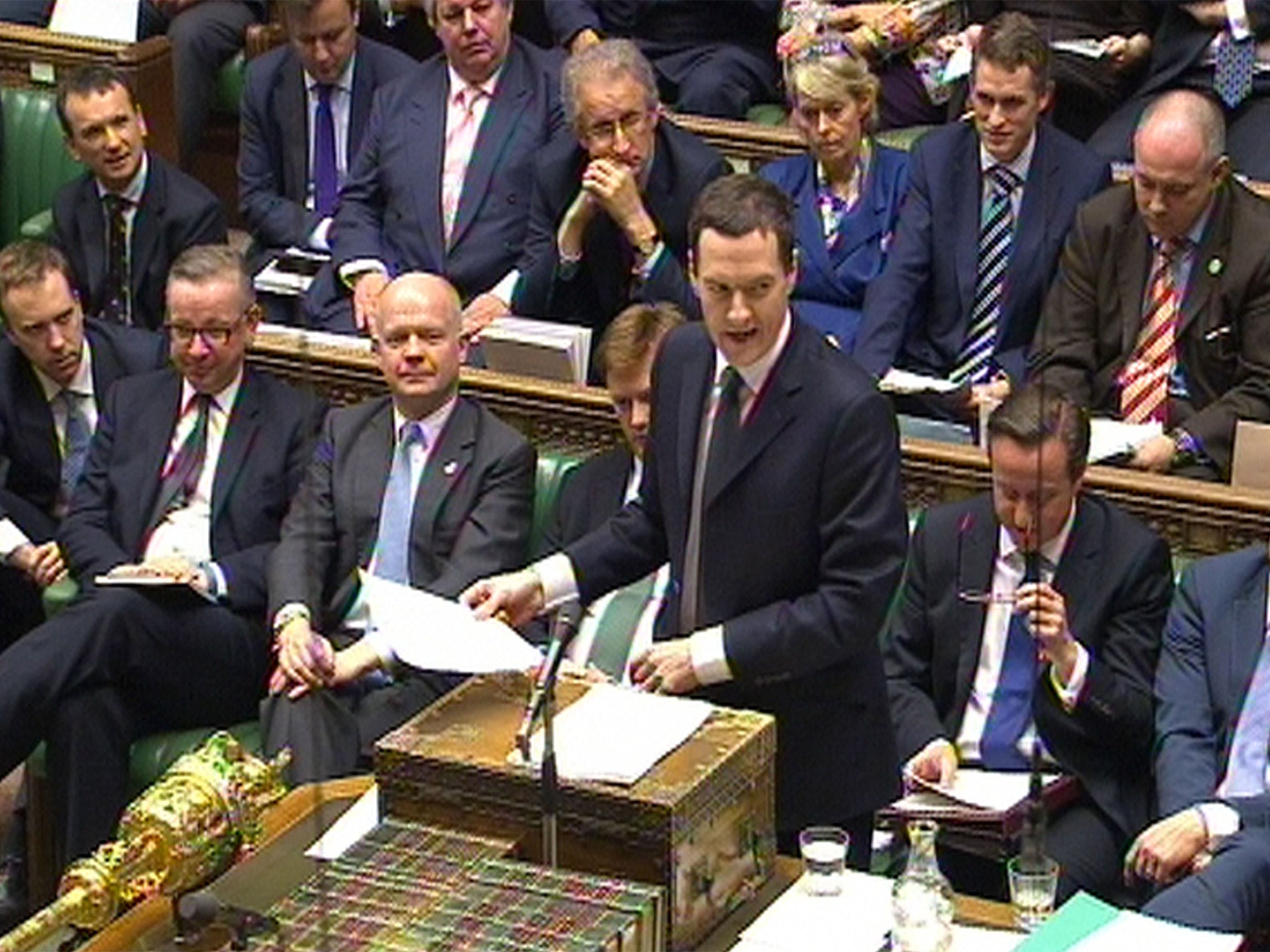

Anyone buying a home worth £927,000 will pay more in stamp duty, following the overhaul announced by George Osborne in his autumn statement.

But with house prices due to rise by over 30 per cent by the end of the decade, there are fears that unless the bands are increased in line with prices many people could eventually be worse of under the reforms.

“Within more or less a decade, average homeowners could get hit by this 10 per cent rate,” the Conservative MP Dominic Raab told a debate on the new measure in the House of Commons.

“Recent experience shows that what starts as a tax aimed at the rich, within a relatively short period of time if we are not very careful ends up clobbering the middle classes.”

Mr suggested indexing the different rates to house-price inflation.

“If we do not address fiscal drag now, and instead kick it into the long grass, we risk ending up over time robbing middle-class Peter to pay working-class Paul,” he added. “I do not think that we should be engaged in that, as a matter of sound economics, social fairness, or indeed long-term sustainable politics."

The bill to reform stamp duty is expected to pass with cross-party support – and has already taken effect from midnight on Wednesday.

This led to high end estate agents and lawyers spending a manic 12 hours trying to force through sales on the most expensive properties. Mr Osborne said that properties that had already exchanged contracts by midnight on Wednesday could choose whether the tax was paid under the old or the new system.

One of the biggest sales was a £30 million house in Surrey where the buyer saved more than £1.4 million by pushing the deal through at 11.45pm.

The buyer will pay £2.1 million in tax on the house, which had not been offered publicly, but had they sealed the deal 15 minutes later it would have cost them £3.5 million.

A deal on a £5.75 million home in central London saved the purchaser £203,000, while another property, believed to have been worth several million, was sold on a deposit of just £5,000 because that was all the buyer could raise at short notice.

Jamie Lester, Head of Haus Properties managed to save his client £55,000 on a £2 million home.

“We've had a number of last-minute attempts to exchange as a result of the announcement including one at £2 million,” he said. “The lawyer had to cancel his wedding anniversary plans in order to get the deal done.”

James Robinson, a director at central London mews specialist estate agent Lurot Brand, told the Evening Standard: ”I was on the phone until midnight with six solicitors who all earned a lot of money last night. When we got the first deal through I thought ‘thank goodness for that’, and we went across the road for a bottle of wine.

“Then we looked at each other and said ‘hang on what about the other two?’ We had to get one of the clients out of bed as he was in America. We got the last email confirming exchange at 11.58pm, it was very close. On one deal the difference was £150,000 in stamp duty. The incentive was £10,000 to each of the lawyers.”

Other MPs said they feared the change in stamp duty could increase house price inflation. But the Treasury minister David Gauke, insisted it was a progressive reform. He added that the Government would look at the rates again as house prices rose.

“We have not set out plans for indexation or future uprating, but future Governments will clearly wish to return to that in the long term,” he said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks