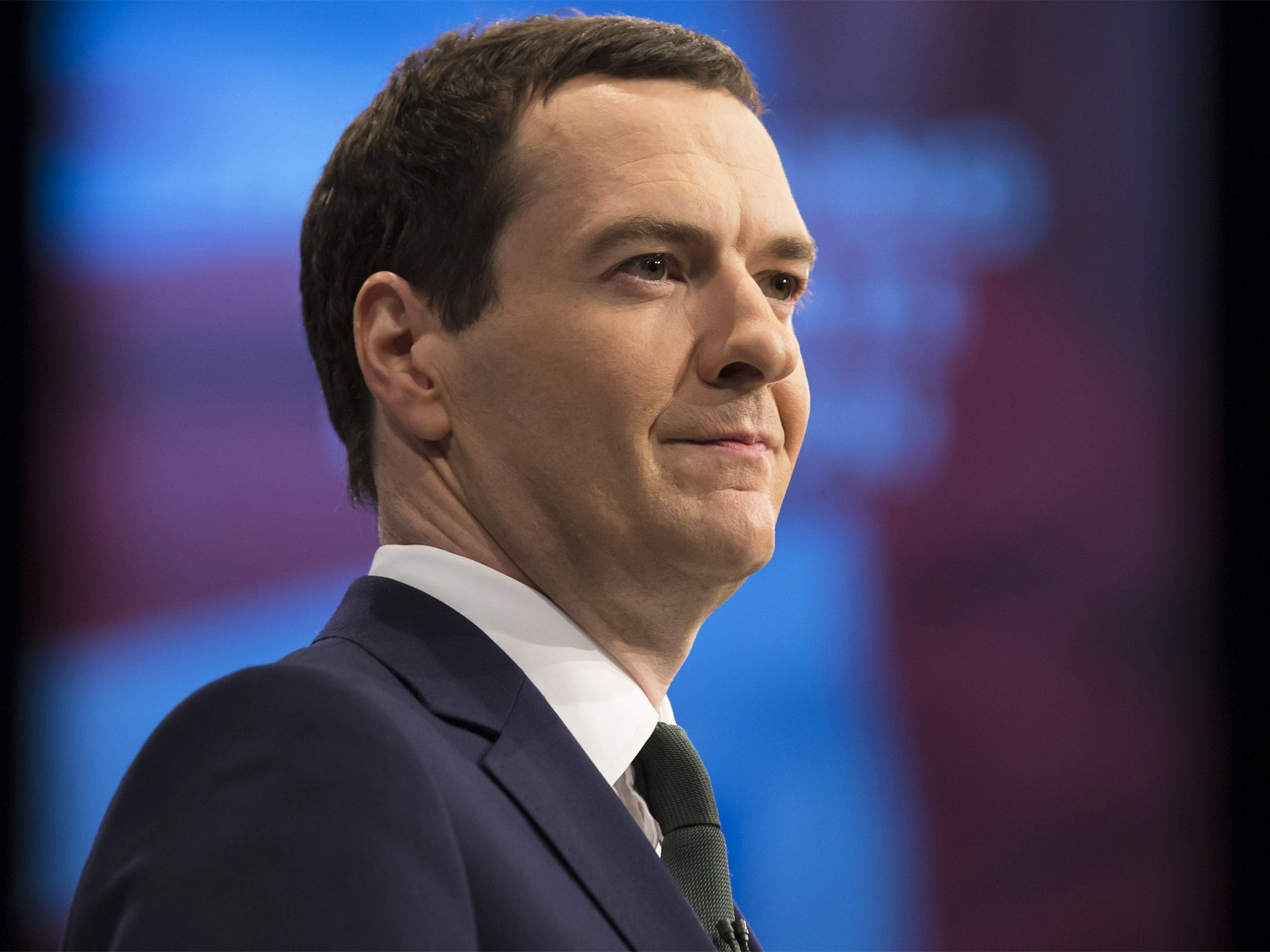

Tax credits: George Osborne faces race against time as Tory rebellion over controversial cuts grows

The Chancellor has promised to soften the impact of the policy while insisting he will press ahead with the reforms

George Osborne’s hopes of cutting tax credit payments for more than three million low-paid workers in less than six months’ time are fading following his double defeat in the Lords over the controversial measure.

Under his original plans, claimants would have received letters in December telling them their tax credits were being reduced, with the cuts coming into effect in April 2016. But the timescale is slipping as Mr Osborne attempts to find a way to revive the proposals after the Lords blocked the scheme.

The Chancellor, who faces a growing Tory rebellion in the Commons over the planned £4.4bn of cuts, has promised to soften the impact of the policy while insisting he will press ahead with the reforms.

He will set out his conclusions in the Autumn Statement on 25 November, leaving Mr Osborne with a race against time to bring in the changes by April 2016.

Downing Street conceded that the letters are highly unlikely to be sent out in December, which will raise questions over whether the cuts can be implemented four months later.

Video: Baroness Hollis savages Osborne

The Prime Minister’s spokesman said: “Clearly any reform to the tax credit system would need to be in place before the letters detailing the changes go out.”

Any delay would in turn throw Mr Osborne’s financial calculations into doubt as reducing the tax credit bill was the largest single element of moves he announced in the Budget to reduce welfare spending by £12bn.

Among the options he is understood to be considering to ease the impact of the cuts are increasing either the personal income tax allowance or the National Insurance threshold and raising the level at which tax credits are removed.

The Government is braced for further Tory opposition when the tax credit plans are debated in the Commons on Thursday. Ten Conservative MPs have already backed a motion tabled by the former Labour minister Frank Field urging the Government to “reconsider the effect on the lowest-paid workers of its proposed changes” and to “bring forward proposals to mitigate it”. Others are expected to support the move amid signs that alarm over the measure is spreading across Tory ranks.

The Chancellor faced concerted Labour criticism in the Commons over the tax credits debacle, with the shadow Chancellor John McDonnell saying the Lords votes showed the time had come for a “full and fair reversal” of the policy.

Stewart Hosie, the SNP’s economy spokesman, accused Mr Osborne of being in “absolute denial” over opposition to the measure. He added that the Lords defeats demonstrated the “Chancellor has lost his political touch and his chance of being Prime Minister has just gone up in a puff of ermine-clad smoke”.

Labour’s Caroline Flint, a former welfare reform minister, accused Mr Osborne of being “afraid” to publish reports that detail the impact of tax credit changes.

Mr Osborne, who earlier discussed the implications of the Lords defeat with the Cabinet, told MPs: “I believe we can achieve the same goal of reforming tax credits, saving the money we need to save to secure our economy, while at the same time helping in the transition. That is what I intend to do at the Autumn Statement.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments