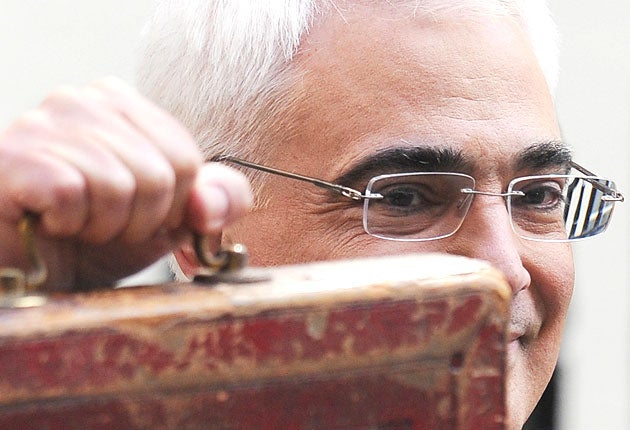

The Big Question: Should pre-election giveaways feature in Mr Darling's Budget?

Why are we asking this now?

The Chancellor has been presented with a modest windfall of £8-12bn from higher-than-expected tax receipts, thanks to the rally in share prices, lower borrowing and lower-than-expected unemployment reducing the cost of the jobless. So in spite of predicting in last year's Budget that Britain's economy faced the worst year since the Second World War, Darling could afford a flutter with his windfall.

He could announce a series of populist measures, like cutting the cost of a pint of beer with so many pubs closing, or reducing the duty on petrol and diesel (that's what the AA/RAC would like on behalf of millions of motorists moaning about recent price hikes, in spite of falls in the price of oil) or slashing corporation tax to boost business (that's what the Confederation of British Industry would like). But the City might be unnerved by a giveaway Budget after the billions of pounds pumped into the economy to keep it afloat, and it would be deeply damaging if there was a fresh run on the pound, after the Budget. On the BBC's Andrew Marr Show on Sunday Darling said it would not be a giveaway Budget. People would "roll their eyes" at any "Christmas trees", he said.

So he's going to put his country before his party?

Not entirely. People are already comparing Darling's last Budget before the election to the Labour Chancellor Roy Jenkins in 1970. Jenkins, who became a leader of the SDP, put his country before his party, and refused to offer crude pre-election sweeteners to the voters with tax cuts. Instead, Jenkins took the high moral ground, saying a giveaway Budget would be "a vulgar piece of economic management below the level of political sophistication of the British electorate". Labour lost the subsequent general election, which was won by the Tories under Ted Heath.

Hugh Gaitskell's austerity Budget in 1951 was also blamed for losing Labour the election that year – he increased income tax, profits tax, purchase tax and introduced prescription charges which led to the resignations of Aneurin Bevan and Harold Wilson. The Tory Chancellor Geoffrey Howe introduced an austerity Budget – but it was in 1981, two years after the General Election of 1979 that brought Margaret Thatcher to power.

Many said it was too tight, and led to wholesale job losses in Britain's smokestack manufacturing industries which were never recovered but with the Falklands factor, she won the next election in 1983. Voters in street interviews today say they want politicians to tell them the truth, even if it is painful. But Gordon Brown wouldn't like to see Labour Budget history repeating itself with Darling's Budget.

But Darling is Gordon's poodle, isn't he?

Not any more. Brown did have Darling on a tight leash, but Darling has bared his teeth and snapped back after his two previous Budgets – heavily influenced by Brown – were panned by the critics. Darling is likely to make a nod to the City by announcing that he is paying down some of the debt on top of the expected fall in the borrowing total of £178bn – possibly by as much as £5bn. He may also defer the planned 2.5p increase in fuel duty although it would cost him over £1bn. Darling said it would be a "Budget for ensuring that we secure the recovery... a Budget for the future."

Will Darling cut spending to reduce the deficit?

The Tories say Darling should be more radical and announce cuts in spending now. Brown has refused to allow Labour to go into the election promising suicidal spending cuts – putting off the usual review of spending until the autumn, safely after the election. There are rumours of tensions between Darling and Brown on this point.

Darling will confirm today that the spending review will be delayed, but he may show some independence by hinting at possible areas for cuts in the future on the Arts, Justice and the roads programme, while allowing spending on schools to increase by more than the inflation rate, and health to rise in line with inflation.

He may also have a party political trick up his sleeve with VAT. He is already "making the pips squeak" with tax rises – Darling has already announced a 1 per cent increase in National Insurance Contributions for everyone in work from April 2011, and restored VAT to 17.5 per cent with a hike of 2.5 per cent this year.

He is likely to confirm today that he has no plans further to increase the rate of VAT – and challenge the Tory Shadow Chancellor George Osborne to match that commitment at the election. There is a strong suspicion that the Tories want to raise VAT to 20 per cent in their promised emergency Budget to get the deficit down, and this could spike their guns.

So it's all been leaked in advance?

The contents of the Budget box dating back to William Gladstone used to be secret – the Labour Chancellor Hugh Dalton had to resign after telling a journalist in the lobby what was in his Budget.

Brown lifted the Budget "purdah" (from the Hindi word, parda, meaning veil) by introducing pre-Budget reports. Last year's pre-Budget report brought in a tax on bankers' bonuses with the promise of a supertax on the rich, of 50p in the pound for everyone earning over £150,000 a year, from April this year. Leaks of today's Budget include plans to force banks to provide access to a bank account for everyone, no matter how poor they may be, and a new tax on the highest risk activities of any banks based in the UK, which is expected to be the centre-piece of the Darling package.

Darling has refused unilaterally to adopt an "insurance fund" tax on the banks without international agreement, although the Tories have said they would be prepared to act alone. Darling's apparent attack on toffs will also include renewed efforts to chase tax cheats with earnings or accounts abroad.

Will the Budget give Labour a poll boost?

Labour's popularity in opinion polls actually has a habit of going down after a Budget, rather than up. That may be the fault of Mr Brown – he was in No 11 for a decade. And some of his Budgets backfired badly on Brown, like the 2p cut in income tax to 20p in the £ in 2007.

It was partly paid for by the abolition of the 10p tax band, resulting in some of the poorest people in the country seeing their tax bills increase. Darling had to introduce changes in tax for millions of people to compensate the losers.

Will it squeeze the bankers, but help the poor?

Shadow Chancellor George Osborne says it will still hit most earners, not just the bankers, and he will accuse Brown and Darling of a deception with the Budget. He says: "Labour politicians only talk about the taxes on the better-off like the new 50p tax. But the single biggest tax rise they are planning is in National Insurance and an increase in personal tax on everyone earning more than £20,000... The greatest burden of dealing with our deficit must fall on lower spending, not higher taxes."

Who should I blame then?

William Pitt the Younger. He introduced income tax in 1789 to pay for the Napoleonic war.

Should the Chancellor dole out gifts for all today?

Yes...

* Jenkins (1970) and Gaitskell (1951) show adopting austerity Budgets before an election means losing

* Darling has a windfall of between £8-12bn, and he can afford to pay for a "feelgood factor"

* A small giveaway could put much more pressure on the Shadow Chancellor, George Osborne

No...

* Voters already don't trust politicians after the expenses scandal, and now the lobbygate fiasco

* The City will panic if Darling starts pumping more money into the economy, after all the reflationary tactics

* Budget "booms" quickly turn to "bust" – witness Gordon Brown's giveaway (or not) in 2007

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks