The Government’s planned cut to Capital Gains Tax will give an average of £3,000 to people in the richest 0.3 per cent of the population, according to new figures.

Labour, which drew up the analysis, said the tax cut was a “giveaway to millionaires” and that the Chancellor George Osborne was “looking after a wealthy minority”.

In this month's Budget the Chancellor cut the rate of the tax from 28 per cent to 20 per cent for higher rate income taxpayers and 18 per cent to 10 per cent for basic rate taxpayers.

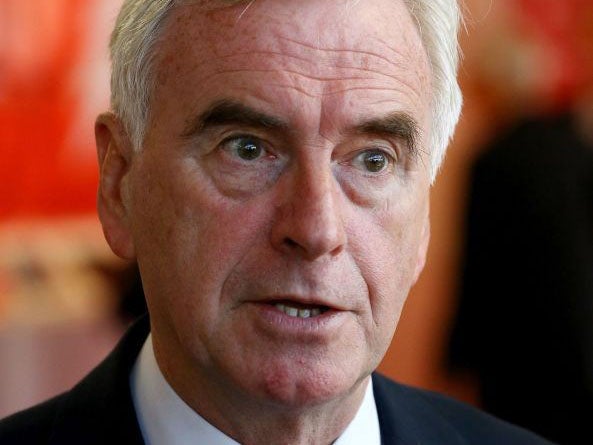

The party’s shadow chancellor John McDonnell has previously highlighted that the capital gains tax cut costs taxpayers about as much as would have been saved by planned cuts to disability benefits.

Those cuts, to the Personal Independence Payment, are now scrapped – following the resignation of the former Work and Pensions Secretary Iain Duncan Smith.

Mr Duncan Smith warned that the Government was balancing the budget on the back of the most vulnerable in society – citing steep cuts to taxes paid by the wealthy which were announced alongside sharp cuts to support for vulnerable people.

A spokesperson for George Osborne told the Guardian newspaper the criticism from Labour of the tax cut was “hypocritical” because CGT would still be two per cent higher than it was under Gordon Brown.

Mr Osborne had raised the tax while in Coalition with the Liberal Democrats – who believed it should be equalised with income tax for reasons of fairness. Now the liberals have left government the tax has again been cut, however.

Mr McDonnell said: “These figures show the priorities of George Osborne. He planned to fund this £3,000 giveaway to 0.3 per cent of the population by taking over £3,000 from hundreds of thousands of disabled people.

“When you consider the small number who benefit from this tax cut or that the pattern of taxable receipts from capital gains tax come from those who trade in financial assets, it blows apart any claim the Tories make about ‘we are all in it together’.

“This crass tax cut should not be going ahead because we need an economy that works for the many, not tax cuts for the few.”

The overall effect of the tax and spending changes in the Budget is distributionally regressive – taking from the poorest and giving to the richest.

The Institute for Fiscal studies said in its analysis that many households in the bottom 20 per cent of earners would end up losing 12 per cent of their income by 2019, while households in the top half of the income scale would not lose anything.

Paul Johnson, the director of the IFS, said just after the Budget: “Raising the threshold for paying higher-rate tax is clearly helping people in the middle- and upper-income brackets, while the cuts to benefits reduce the incomes of families on lower incomes.”

A spokesperson for George Osborne said: “The government wants to ensure that companies can access the capital they need to grow and create jobs. These changes are about incentivising individuals to invest in shares, helping British firms access the capital they need to grow and create jobs.

“For the first time, gains from residential property will be treated differently from other types of investment, attracting an 8 per cent surcharge. The 18 per cent and 28 per cent rates for residential property means the government is encouraging investment in shares over property. That’s a pro-growth, pro-enterprise policy that will boost the economy at a time of global uncertainty.

“We certainly won’t take any lectures from Labour on this: at 20 per cent, the rate of CGT paid by higher rate taxpayers on other types of gain will still be two percentage points higher than it was when they were last in power, and for residential property and carried interest will remain at least 10 percentage points higher. For Labour to complain now is shameless and hypocritical.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments