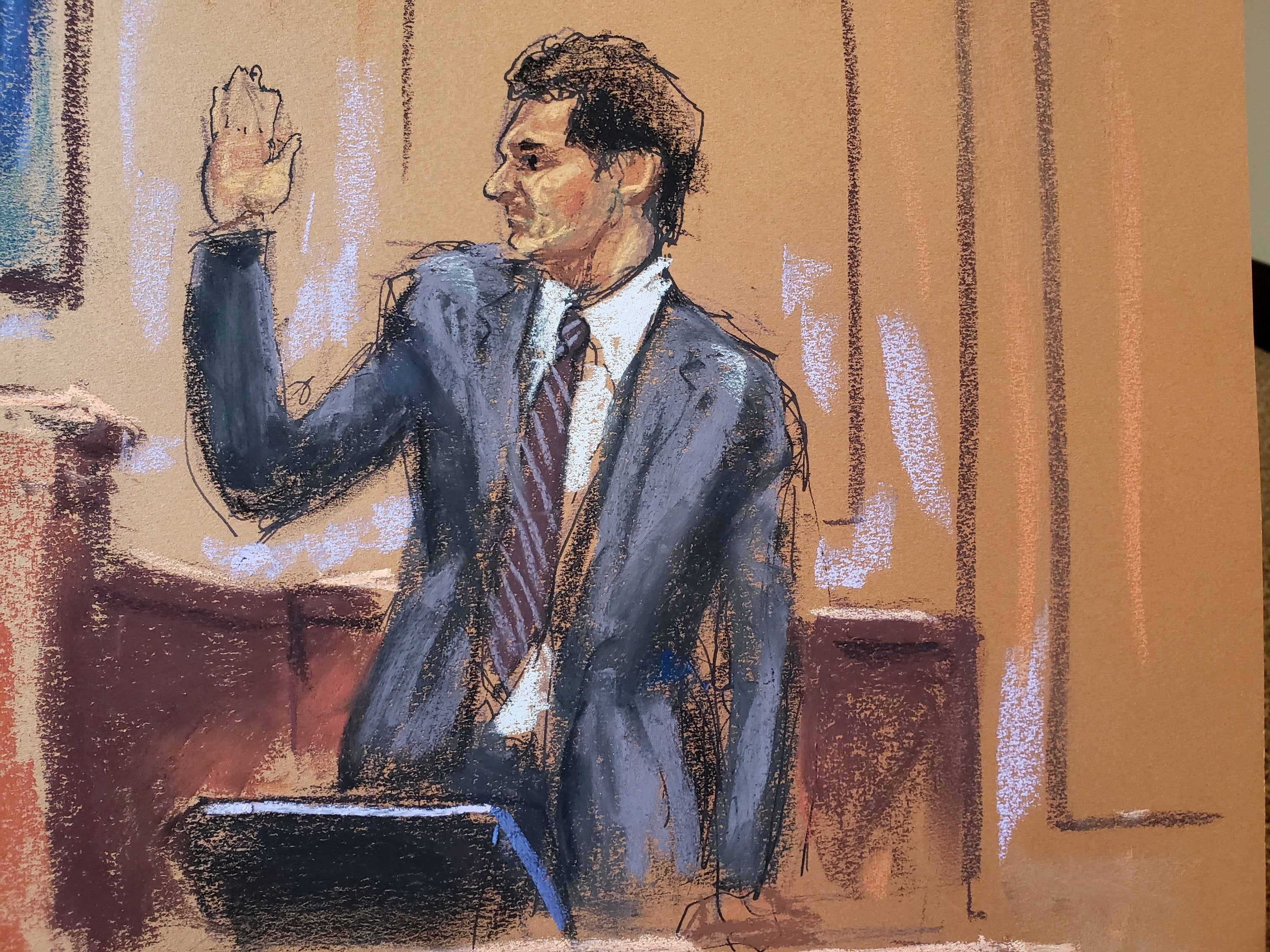

Sam Bankman-Fried on the stand: ‘A lot of people got hurt’

Disgraced crypto entrepreneur admits mistakes were made in FTX’s collapse but denies he’s a crook

Sam Bankman-Fried admitted making “a number of mistakes” but denied stealing from FTX customers as he took the stand at his multi-billion dollar fraud and money-laundering trial on Friday morning.

“A lot of people got hurt,” Mr Bankman-Fried said as he opened his testimony in a high-stakes move to try to avoid decades in prison over the collapse of his now-bankrupt FTX crypto exchange.

After hearing weeks of damning evidence against him, Mr Bankman-Fried was escorted the short distance from the defence table to the witness box by US Marshalls.

Dressed in a suit and tie, he leaned into his pre-arrest image as an “idiot savant” as he sought to convince the jury there was no criminal intent behind FTX’s collapse.

The 31-year-old, who started out as a Wall Street trader, gave a glimpse into how his cryptocurrency start-ups FTX and Alameda Research grew to amass billions of dollars in profits in just a few years.

He testified that he knew “nothing” about crypto when he founded Alameda Research in a San Francisco Airbnb in 2017 with his college friend Gary Wang.

He had hoped to cash in on the “tonne of excitement” around crypto at the time.

Mr Bankman-Fried said he chose to name his first business Alameda to stay “under the radar”, after initially using the working name “Wireless Mouse”.

“I didn’t want to call it ‘Sam’s crypto trading firm’ or anything like that,” he said.

Questioned by defence lawyer Mark Cohen about his intentions for the business, Mr Bankman-Fried said he and his co-founders wanted to build the best crypto exchange in the world.

“Did it turn out that way?” Mr Cohen asked.

“No, basically the opposite,” he replied, before emphatically denying he had defrauded anyone or stolen customers’ investments.

Mr Bankman-Fried said he initially put FTX’s chances of succeeding at 20 per cent, and thought he would sell the crypto exchange to a much larger rival Binance.

But as Binance built up its own internal exchange, his confidence grew that FTX could be a success.

Mr Bankman-Fried said he decided to move to Hong Kong in late 2018 to launch FTX as it had a looser regulatory environment. The two businesses grew quickly through friends investing, word of mouth, and organically on social media, he said.

Prosecutors have accused him of stealing billions from FTX customers to support risky bets by Alameda Research, invest in high-end real estate, fund sponsorship deals and make political contributions.

Mr Bankman-Fried’s highly anticipated testimony appears to be his best chance at acquittal, after his defence lawyers failed to land any significant blows against the three former FTX executives who testified against him.

Mr Wang, Caroline Ellison and Nishad Singh testified that Mr Bankman-Fried directed them to systematically take customer investments from FTX to prop up Alameda through a secret back door between the two companies. They have pleaded guilty in exchange for leniency.

On Thursday, Mr Bankman-Fried took the stand without the jury present where he blamed FTX’s internal counsel for its dramatic collapse in November 2022.

He said he had only “skimmed” FTX’s terms of service, which he understood allowed him to use customer deposits for crypto investments through Alameda, and had no intention of stealing customer deposits.

The courtroom and several overflow rooms at the federal courthouse in lower Manhattan were full of reporters, crypto influencers and interested onlookers.

Among the interested onlookers was author Michael Lewis, who spent months embedded with Mr Bankman-Fried in the Bahamas for his book Going Infinite, which was published on the eve of the trial.

Mr Bankman-Fried has pleaded not guilty to seven counts related to fraud, conspiracy and money laundering.

He faces up to 110 years in prison if convicted.

Bookmark popover

Removed from bookmarks