Founders of ‘PayPal for criminals’ Liberty Reserve are charged with money laundering

New York lawyers say $6bn of ill-gotten gains were processed though money-transfer service

A federal grand jury in the United States has charged the operators of a digital currency and money transfer business with running a sprawling enterprise that allegedly helped criminals to launder some $6bn in ill-gotten gains over the past seven years.

The allegations against Costa Rica-based Liberty Reserve, its founder, Arthur Budovsky, and six other men connected to the business, were made in an indictment unsealed in New York. The accusations follow a series of arrests late last week in Costa Rica, New York and in Spain, where authorities detained Mr Budovsky.

Liberty Reserve had described itself as being the internet’s “oldest, safest and most popular payment processor... serving millions all around a world”. But prosecutors claim that the business, which was established in 2006 and was shut down last week, was “one of the principal means by cyber-criminals around the world to distribute, store and launder the proceeds of their illegal activity”. One law enforcement official told The New York Times that Liberty Reserve, which allowed users to transfer large sums money without ever identifying themselves, was “really PayPal for criminals”.

At the heart of the system, authorities allege, was a digital currency called ‘LR’, which formed the basis of transactions. Third parties would buy and sell LR “in bulk” from Liberty Reserve in exchange for real world currency. “The exchangers in turn bought and sold this LR in smaller transactions with end-users” in exchange for dollars or euros or other mainstream currency, making LR a kind of credit within the Liberty Reserve system.

Crucially, however, this third-party system allowed Liberty Reserve to avoid having to validate the identities of users, according to prosecutors. They say that while users were required to supply basic information such as name and date of birth, this was never cross-checked with official documents, or even a credit card. “Accounts could therefore be opened using fictitious or anonymous identities,” according to the indictment, which adds: “Liberty Reserve users routinely established accounts under false names – including such blatantly criminal monikers as ‘Russia Hackers’ and ‘Hacker Account’.”

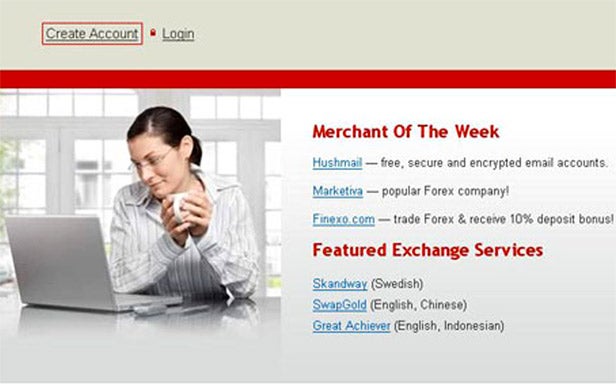

Liberty Reserve also offered users the chance to transact with certain merchants who accepted LR as payment. These merchants were “overwhelmingly criminal in nature”, according to prosecutors, and are said to have included “traffickers of stolen credit cards and personal identity information”, “computer hackers for hire” and “underground drug-dealing websites”.

Liberty Reserve’s founder, Mr Budovsky, has been in trouble with US authorities before, having been convicted, along with Liberty Reserve co-founder Vladimir Katz, in December 2006 of operating Gold Age Inc, an unlicensed money transmitting business.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments