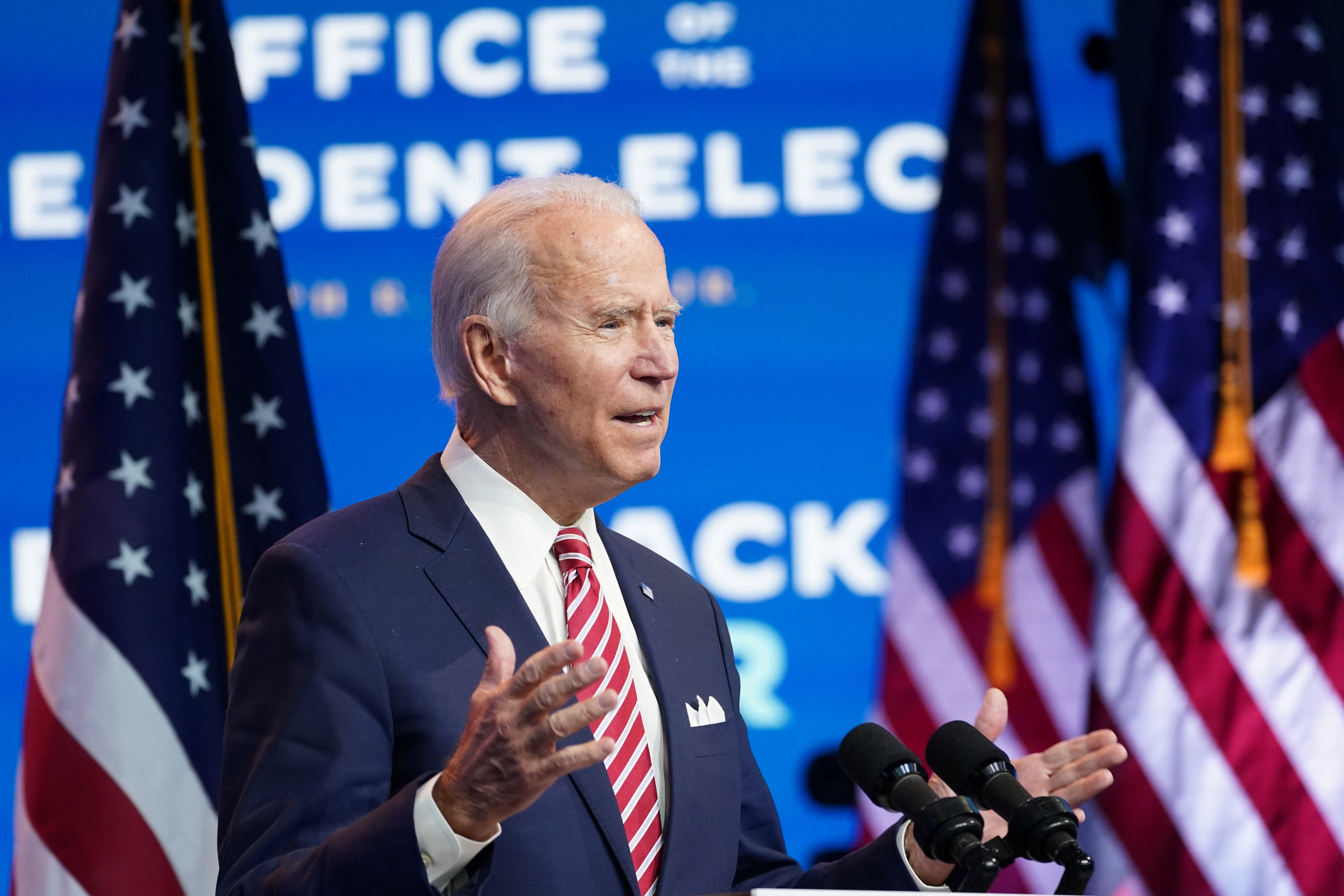

‘This is the moment’: Biden faces pressure to cancel student debt – here’s how he could do it

With an exploding debt crisis in the middle of a pandemic, advocates say the incoming president could wipe out debts for millions of students with the stroke of a pen, Alex Woodward writes

Without major intervention from the White House or Congress, millions of Americans with student loan debt could be thrown back into repaying student loan payments, with garnished wages and collections resuming after moratorium comes to an end during a still-raging pandemic.

In March, the Department of Education was ordered to suspend student loan debt payments, pause accruing interest and stop collecting on defaulted federal loans. Donald Trump’s administration extended the suspension through the end of January, days after president-elect Joe Biden takes office, while relief proposals from the Democratically controlled House have been deadlocked with a GOP Senate.

But even if Congress agrees to extend those moratoriums, granting a sigh of relief to millions of borrowers, there still remains a system that has exploded debts for millions of Americans over the last decade.

On day one his administration, Biden could potentially eliminate billions of dollars in student debt by answering a call from a broad coalition of progressive Democrats, student debt advocates and borrowers: Cancel it.

“As we work to deliver meaningful economic relief for workers and families that meets the scale and scope of the crisis we face, student debt cancellation must be front and center,” Congresswoman Ayanna Pressley told The Independent.

More than 45 million Americans hold more than $1.6tn in student loan debt, a figure that has surged within the last decade as private university enrollment grew and federal and state governments made steep cuts to higher education funding against growing wealth inequality. Within the next four years, if unchecked, outstanding student debt is expected to hit $2tn.

To eliminate that burden, “it really is just two pages of paper work, some signatures and $1.5tn in debt is gone,” said Thomas Gokey, co-founder of student debtors union Debt Collective.

Biden has supported cancelling $10,000 in loan debt through legislation, but he’ll face Republican roadblocks in the Senate if Democrats fail to capture a majority of Congress.

One measure, from senators Chuck Schumer and Elizabeth Warren, proposes that Biden cancel up to $50,000 in debt, along with any tax penalties, and pause future federal loan payments and interest through the duration of the pandemic.

But Biden could cancel a significant chunk of debt through executive action without relying on a GOP-dominated Senate at all, a move that activists and advocates argue could have sweeping economic and racial justice impacts and deliver a much-needed boost to a lagging economy.

The president-elect could simply tell his education secretary to do so.

“Across-the-board student debt cancellation is a racial and economic justice issue, and is precisely the kind of bold, high-impact policy that the broad and diverse coalition that elected Joe Biden and Kamala Harris gave them a mandate to deliver,” Congresswoman Pressley said. “On day one of his administration, president-elect Biden will have the executive authority to cancel billions in student debt with the stroke of a pen – he must do exactly that.”

The state of student debt

In September 2019, New York Congresswoman Alexandria Ocasio-Cortez – among roughly 60 members of Congress with a student debt burden – made a loan payment while in the middle of committee hearing on the state of student debt.

“I literally made a student loan payment while I was sitting here at this chair, and I looked at my balance and it was $20,237.16,” said the congresswoman, among progressive lawmakers calling for debt cancellations. “I just made a payment that took me down to $19,000 … so I feel really accomplished right now.”

An average monthly student loan payment is $393. Graduates from the class of 2019 owe an average of nearly $30,000. Those debts soar among postgraduate degree holders, of which nearly a quarter owe $100,000 or more.

The Department of Education reports that about 20 per cent of borrowers are in default – or have not made a payment within at least 270 days – while millions of borrowers are behind. More than 1 million loans go into default each year.

More than 90 per cent of that outstanding debt is in the form of government loans, according to the Consumer Finance Protection Bureau. That leaves more than $130bn of outstanding loans from private institutions.

Over the last several decades, federal and state governments have stripped funding for higher education, while tuition has spiked, federal policy changes effectively eliminated limits on borrowing, and predatory lending schemes and sky-high interest rates have trapped a generation of borrowers into a lifetime of debt.

In the 1970s, federal grants covered up to 80 per cent of student costs for undergraduates. That figure has plummeted by more than half. Average annual costs at public institutions, including tuition and housing, have reached nearly $22,000 for in-state universities and more than $38,000 for out-of-state universities, according to the Center on Budget and Policy Priorities. A year at a private university costs more than $49,000, on average.

The pandemic, its economic fallout and inadequate federal relief have likely exacerbated the crisis. A Pew survey earlier this fall found that 58 per cent of borrowers whose payments had been suspended during the pandemic would have difficulty paying them if they were to return.

Through pandemic relief, interest has been suspended for approximately 41 million borrowers relying on federal student loans; payments for 33 million of those borrowers have paused, and the Education Department has stopped collecting from 8 million others who were in default.

“The temporary freeze on student loan interest and repayments implemented in the CARES Act earlier this year has been a critical lifeline for millions of individuals and families with student loan debt across our country,” Congresswoman Pressley told The Independent. “We must extend that freeze – and several other relief provisions in the CARES Act – while also pursuing the systemic reforms that address the root of the student debt crisis and will provide permanent relief to student loan borrowers and help stimulate the economy.”

Cancelling debt could also begin to close the wealth chasm between white Americans and people of colour overnight.

Student debt burdens reveal a staggering racial gap – 90 per cent of Black students and 72 per cent of Latino students rely on college loans, compared to 66 per cent of white students, according to a 2016 analysis from the Consumer Financial Protection Bureau. The Brookings Institute found that Black college students owe $7,400 more on average than their white peers the moment they graduate – but those costs explode in the years that follow, with interest rates and graduate school borrowing, saddling Black graduates with nearly twice as much debt as their white counterparts.

A recent report from the Roosevelt Institute found that the wealth gap between Black and white recent college graduates increased by over 50 percent from 2000 to 2018, in part because of higher borrowing by Black students. Congresswoman Pressley pointed to “generations of systemic racism and entrenched inequities that have denied Black folks the opportunity to build wealth” compared to white counterparts.

“Canceling student debt is one of the most effective ways we can stimulate our economy, reduce the racial wealth gap, and ensure an equitable and just long-term recovery,” she said.

The Biden plan

In remarks on 1 December as he formally announced his nominees to his economic policy team, Biden told Americans that “times are tough, but I want to let you know that help is on the way.”

Borrowers are “in real trouble,” he said during remarks on economic policy last month. “They’re having to make choices between paying their student loan and paying their rent.”

Most government student loans are on income-based repayment plans, with 10 to 20 per cent of discretionary income tied to their payment plan.

Under Biden’s higher education platform, people who earn $25,000 or less would not owe any payments or accrue interest on their undergraduate loans at all. People who make more than $25,000 a year would owe 5 per cent of their discretionary income. Remaining balances for debt holders who make on-time payments for 20 years would be eliminated.

He also has proposed two years of tuition-free community college or similar training programs, and tuition-free college for students from families earning less than $125,000, along with a boost to federal financial aid.

Any relief towards easing student debt burdens would mark a departure from Donald Trump’s administration, whose education secretary Betsy DeVos has largely failed on all of her own policy commitments while legitimising a far-right education platform from the nation’s highest perch.

Senator Bernie Sanders – who has endorsed legislation to fully fund public universities – dubbed DeVos "the worst education secretary in the history of America” following her comments at a financial aid conference this month in which she attacked student debt relief as “shrill calls to cancel, to forgive, to make it all free.”

"Any innocuous label out there can't obfuscate what it really is: Wrong,” she said.

Senator Warren shot back on social media: “Because we were all just dying to know what the unqualified billionaire who made this problem worse thinks about helping people.”

In 2019, Secretary DeVos proposed handing the federal government’s $1.6tn student loan portfolio to a “stand-alone government corporation,” rather than the department's Office of Federal Student Aid.

That year, the Government Accountability Office found that her Education Department rejected an overwhelming 99 per cent of applications for federal loan forgiveness.

The Trump administration has also been sued for failing to stop all debt collections against defaulted borrowers and mismanaging the federal order to fully freeze loans during the pandemic.

Cancelling debt

Advocates argue Biden can single-handedly eliminate student debt by invoking the Higher Education Act, which grants the Education Secretary the authority “to modify, compromise, waive, or release any right, title, claim, lien, or demand, however acquired, including any equity or any right of redemption.”

While the Department of Treasury collects debt owed to the government, the Education Department collects defaulted student debt, relying on contractors for collections. The Treasury also appoints the chief student loan official with the Consumer Financial Protection Bureau.

Janet Yellen, who served as chair of the Federal Reserve under former president Barack Obama, is Mr Biden’s pick to lead the Department of the Treasury. She said she would spend the role “thinking about you, your jobs, your paychecks, your struggles, your hopes, your dignity and your limitless potential.”

As Fed chair in 2016, Ms Yellen told Congress that the administration has been “very attentive” to the student debt crisis as it has “escalated to an extraordinary degree.”

A diverse coalition of more than 200 organisations, including the NAACP and labour groups, has also urged the incoming administration to unilaterally cancel student debt, joining a chorus with progressive Democrats and debt activists who have organised for nearly a decade against economic injustice.

The public health crisis and government inaction with looming evictions and mass unemployment has revealed the depth of inequality in the US, while the cycle of American debt – high rates of borrowing at sky-high interest to compensate for low wages – masks the scale of the crisis, with mass debt becoming a major driver of financial insecurity.

“The suffering is extremely real,” said the Debt Collective’s Gokey. “At the same time, if debt organising and debt resistance is ever going to take off, this is the moment. … The real economic pain in families’ lives is deep. Even when we all get a vaccine, the damage is going to remain.”

Modeling itself after labour unions in the wake of the Occupy Wall Street movement, Debt Collective has worked to eliminate more than $1bn in debts “between one massive economic crisis and another,” Gokey said.

“What we realized during Occupy is that this is the tie that binds the 99 per cent,” he told The Independent. “If we’re going to have any genuine power over Wall Street or the government it needs organizing around that point of contact, around mass refusal.”

Debt Collective – which recently published its Can’t Pay, Won’t Pay: The Case for Economic Disobedience and Debt Abolition – has sought to abolish “every penny, no exceptions” for student borrowers, urging the government to reject austerity politics, and relying on moral argument that debt itself is unjust.

“Debt Collective is not advocating debt ‘forgiveness’ – which implies a benevolent creditor taking pity on a blameworthy debtor – but rather debt abolition and the creation of a new economic paradigm in which our individual well-being and shared liberation is a socially financed project,” the book argues.

The implications of canceling debts will force the incoming administration to confront institutionalised crises in higher education, from predatory loans and for-profit universities with soaring tuition costs and the prospect of cancelling another trillion-dollar debt crisis in the future, without any checks in place to curb the current crisis.

Universities also are borrowing at high levels just to stay open. In the decade following the Great Recession, annual state funding for public colleges remains more than $6bn below 2008 levels.

“It’s not adequate to press the reset button and leave the next generation imisserated,” Gokey said.

Critics argue debt cancellation is a “regressive” tax policy, a means-tested and targeted form of aid that rewards college graduates more likely to have a better footing in the workforce, or that it’s “unfair” to borrowers who already paid off their student loans, or to those who will be taking them out in the years ahead.

But organisers and advocates say those arguments create an either-or spending scenario, while a unilateral cancelation would have an immediate impact among lower-income families and borrowers, relieving a generation of debtors.

Even with Biden’s proposed elimination of a $10,000 debt, “cancelling that would transform their lives because it gets them to zero,” Gokey said. “We should be focusing on that.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks