Ex-treasury secretary predicts recession with 2 million more Americans unemployed

Larry Summers, who held the post during the presidency of Bill Clinton, is sounding the alarm over the impact of Donald Trump’s tariffs

Former Treasury Secretary Larry Summers has predicted that the U.S. is headed for a recession that may leave some two million Americans unemployed.

Summers, who held the post during the presidency of Bill Clinton and now teaches at Harvard University, said individual households could see a $5,000 loss in income from the potential economic downturn.

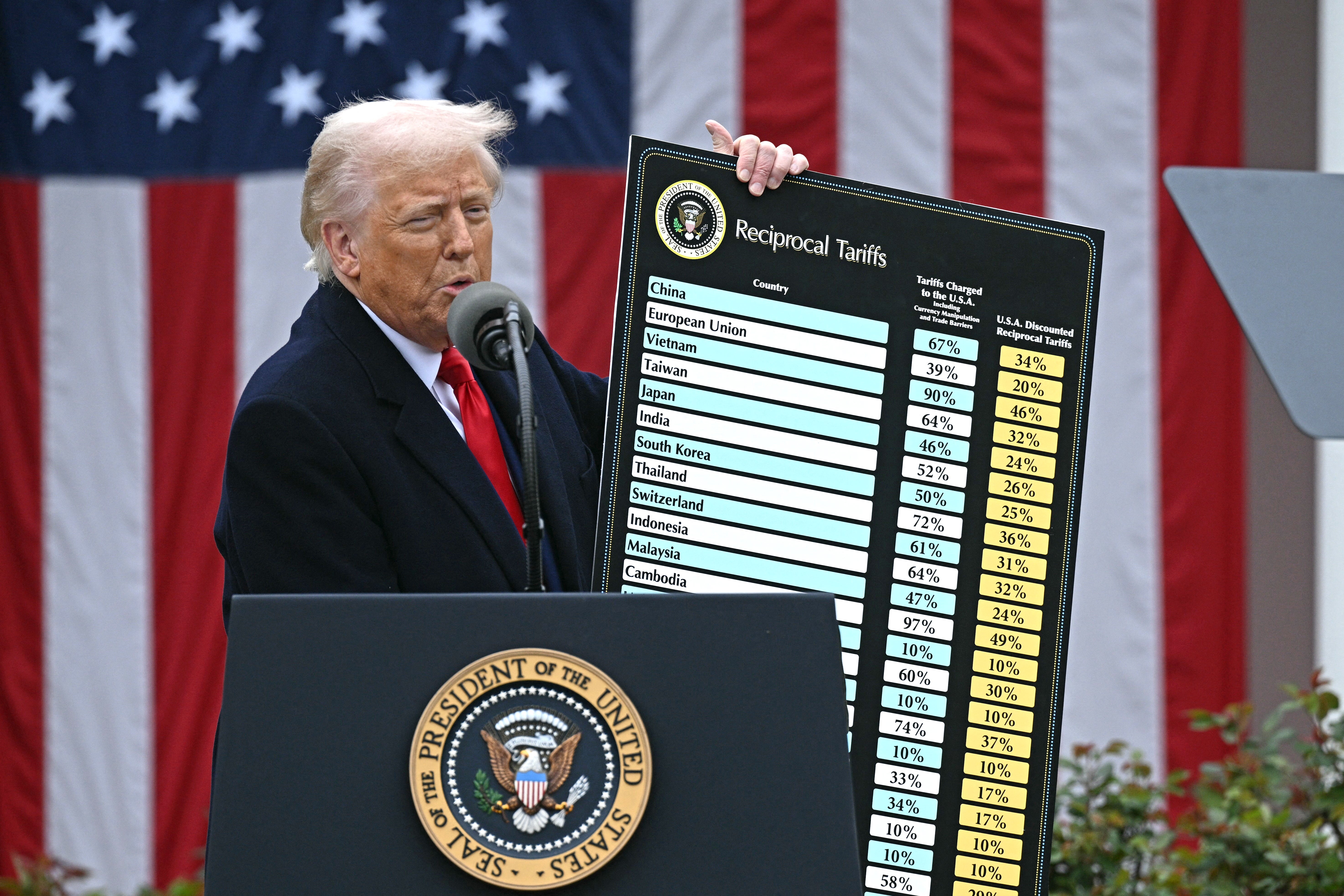

His warning comes as stock markets in Asia fell at their opening on Wednesday morning, continuing the ongoing chaos seen on Wall Street amid fears over Donald Trump’s eye-watering tariffs on China. Despite the uproar, the president has insisted that his economic strategy is a “war with the world” in pursuit of fairer trading conditions for the United States. The White House has dismissed widespread concerns of a coming recession.

“It’s more likely than not that we’re going to have a recession — and in the context of a recession, we’ll see an extra two million people be unemployed,” Summers said, speaking to Bloomberg Television’s Wall Street Week on Tuesday.

“We’ll see losses in household income” of $5,000 per family or more.”

He added: "I think we could be looking for fairly serious economic problems, and I think it will cast a shadow forward because if we have a recession, the budget deficit will go up, the accumulated debt that we have to deal with will go up."

An extra two million unemployed Americans would be a 28 percent increase from the 7.1 million who were out of work in March.

Summers suggested Trump should “back off” the tariffs already announced, suggesting their impact could be worse than the 1930 Smoot-Hawley tariffs, which are historically considered to have worsened the Great Depression of the 1930s.

Summers warned that the impact of the tariffs would spread to other countries, saying: "there will be financial distress that will affect higher-risk companies and also higher-risk countries in the global economy.”

It comes as some of the largest U.S. banks issued similar warnings, with Goldman Sachs raising their predictions of the chances of a recession over the next year to 45 percent.

Economists at JPMorgan predicted an even bleaker outcome, putting the chances of a recession at 60 percent. In a note released on Friday the bank labeled Trump’s policies as the “largest tax increase” since 1968 which will “fall heavily on the US consumer.”

“The fact that everything is sort of happening under the [International Emergency Economic Powers Act] and there's sort of no process is adding to the uncertainty,” Arend Kapteyn, UBS Investment Bank’s chief economist, told reporters on Monday

She added that multiple economic surveys are “already effectively at recessionary levels.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks