Greece finally unveils reforms plan in bid to unlock eurozone bailout cash

Over the next two weeks, Greece needs to pay €2bn in pensions and salaries

Greece submitted a long-awaited list of reforms to its eurozone partners yesterday in the hope of unlocking the bailout money Athens desperately needs to avoid a calamitous default.

In a sign of the intensifying financial pressure on the Greek government, local media reported yesterday that Athens has been forced to draw on the cash reserves of state-owned corporations in order to meet its liabilities.

The Eurogroup of eurozone finance ministers will need to approve Greece’s list of reforms – which include measures to boost tax revenues and liberalise labour markets – in order for Athens to receive the final €7.2bn of bailout cash it requires. Eurozone officials said that the analysis of the proposals will begin in earnest today.

Over the next two weeks, Greece needs to pay €2bn in pensions and salaries plus another €500m debt repayment to the International Monetary Fund.

Greece struck an interim deal with creditors last month to extend its bailout to June, enabling the country’s banking system to continue to receive support from the European Central Bank. But the eurozone refused to release the final tranche of cash due to the country until it had seen a detailed list of structural economic reforms from Prime Minister Alexis Tsipras’ administration.

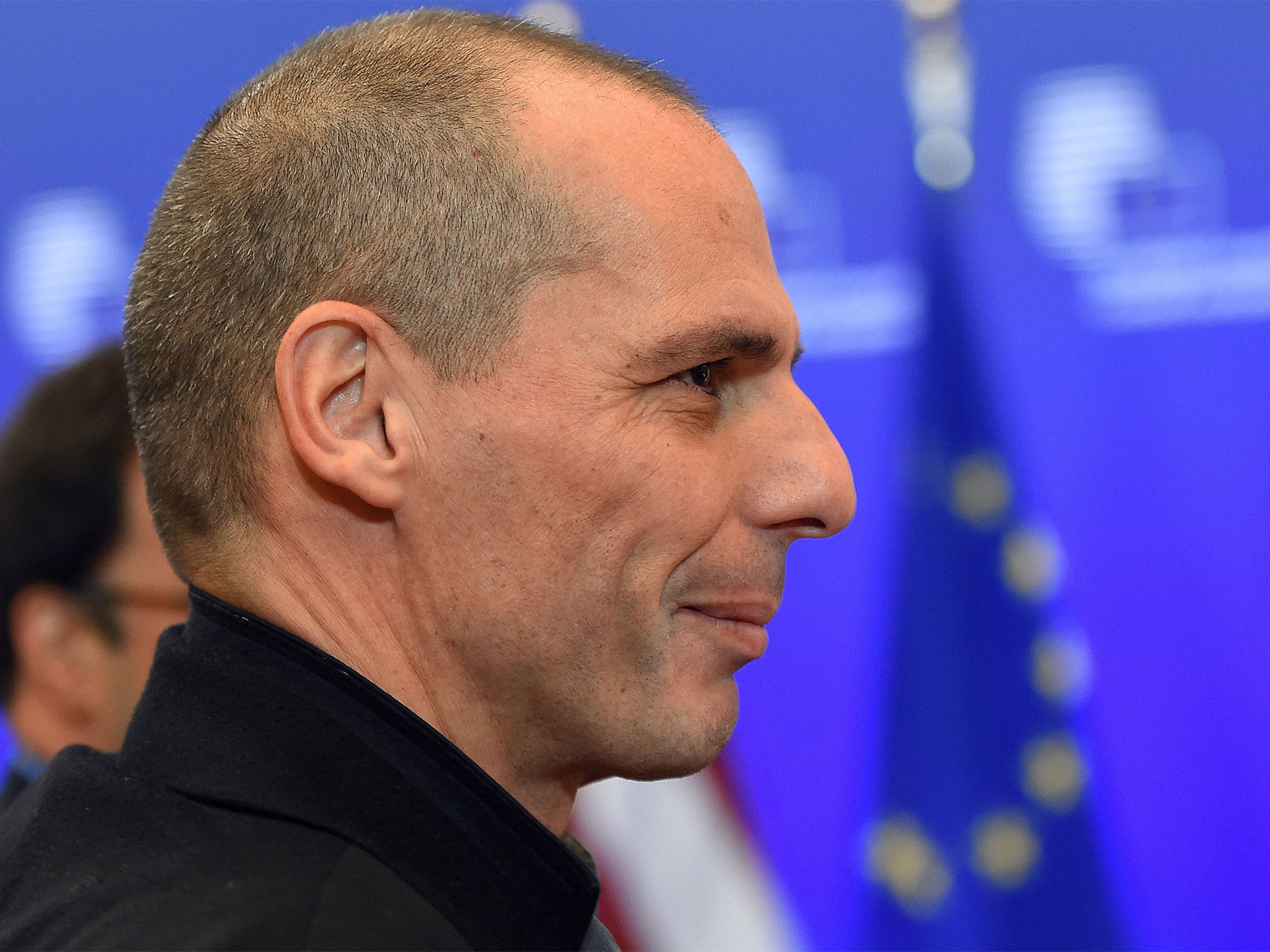

Relations between Greece and its partners have been rocky. Officials in Athens were forced to deny reports in the German tabloid Bild yesterday that its rebarbative finance minister, Yanis Varoufakis, was planning to resign.

Data from the Greek central bank this week showed companies and households pulled €7.6bn out their bank accounts in February, as the country was locked in negotiations about its bailout extension.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks