'Currency war' showdown looms as leaders head to G20 summit

World leaders flew into South Korea last night to meet and try to avert an international "currency war".

Tensions have been rising between the United States and China, with Washington accusing Beijing of keeping the value of its currency artificially low to give itself an export advantage over rivals.

China has retaliated by protesting about the US decision to boost the dollar by pumping extra cash into the American money supply. The Beijing administration is digging in its heels. It is sitting on a $2.6 trillion surplus in its currency reserves, against the $4.7 trillion deficit facing the US.

The acrimonious stand-off will dominate the two-day G20 summit which begins today in the South Korean capital of Seoul. It has provoked fears of a return to protectionism around the world, in turn dealing a blow to the fragile recovery in the global economy.

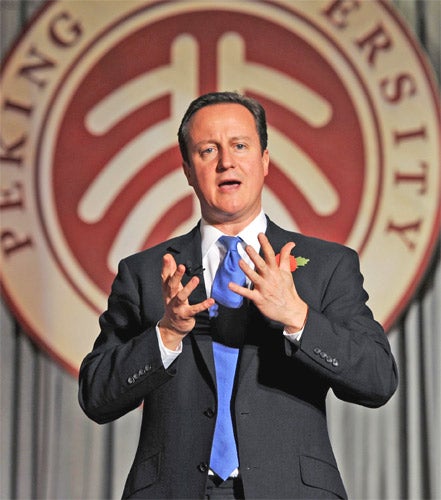

David Cameron urged China to loosen its purse strings and start spending. He warned that a "dangerous tidal wave of money" moving between continents threatened to pitch the world into a fresh financial crisis.

Mr Cameron criticised western nations – including Britain and the US – for stoking up an artificial boom by spending beyond their means for years.

But speaking in China at the end of a trade mission to the world's fastest growing major economy, he also stepped up pressure on his hosts to allow their currency, the yuan, to rise in value to help make other countries' exports more competitively priced.

He urged the Chinese government to encourage its increasingly wealthy consumers to save less and spend more to stimulate global trade. China's huge economic strength gave it a responsibility to act in the global interest, he said.

"China is already talking about moving towards increased domestic consumption, better health care and welfare, more consumer goods as its middle class grows and in time introducing greater market flexibility into its exchange rate," he said. "This cannot be completed overnight, but it must happen."

At a time of slow growth and high unemployment, he said, there was a danger of states turning to protectionist measures which could damage the recovery. "If we follow that path, we will all lose out. The West would lose for sure, but so would China."

He added: "The truth is that some countries with current account surpluses have been saving too much while others, like mine with deficits, have been saving too little. And the result has been a dangerous tidal wave of money going from one side of the globe to another. We need a more balanced pattern of global demand and supply, a more balanced pattern of global saving and investment."

President Barack Obama is to hold talks with the Chinese President, Hu Jintao, to try and find common ground. But President Obama has been weakened by the Democrats' disastrous showing in the mid-term Congressional elections and will be wary of appearing to make concessions to China.

Mr Cameron also urged China to play a constructive role on international issues such as climate change, Africa, the nuclear ambitions of Iran and North Korea, stability in Sudan and the disputed elections in Burma.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks