They used to say 'don't fix', now they say 'fix'. Should you take them at their word?

Suddenly the experts are saying the next move in rates will be up, not down. Julian Knight looks at the case for locking in your mortgage costs

As the economy judders, the mortgage market is rocking back and forth. A short time ago the smart money was on UK interest rates being cut by the Bank of England to stave off a recession; a couple of worse-than-expected inflation figures later and some market watchers are predicting rates will be closer to 6 per cent than 5 per cent by the end of the year. With such huge changes in sentiment, how can the estimated 116,000 people a month nearing the end of a fixed-rate mortgage – or even the many thousands who just fancy paying less for their home loan – get the best possible deal?

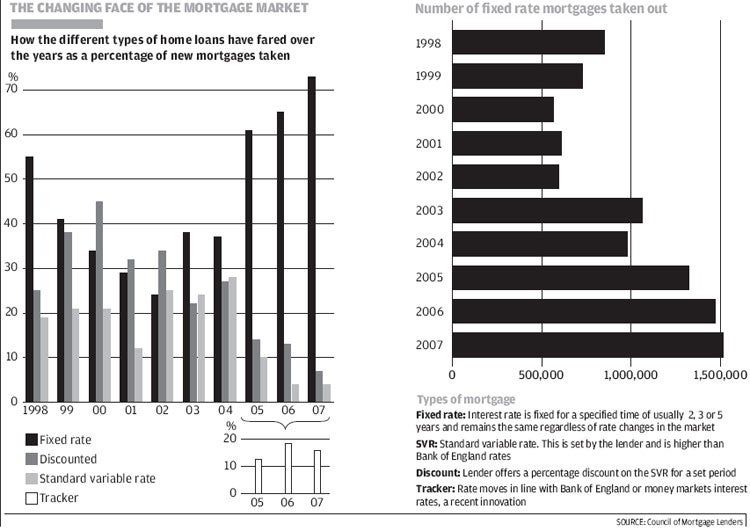

When it looked as if rates were on the slide, brokers recommended tracker mortgages, which are pinned either to the Bank of England base rate or those available through the international money markets. It seemed obvious: if rates are falling, make the most of it by letting your re- payments join the descent. But now the opposite seems to apply and fixed-rate deals are back in vogue.

"Fixes are popular because the future direction of interest rates is so uncertain," says David Hollingworth of broker London and Country. "There is a lot of noise out there and alarming headlines. People want stable payments. They want to dissociate their finances from rate moves."

But they will have to get their skates on. "Being a quick mover is key if you want as low a rate as possible," he adds. "In recent days the situation on the money markets has deteriorated further and the rates on two- and three-year offers are bound to rise to reflect this. Already both Abbey and Bradford & Bingley have increased the rates on their fixed deals."

Drew Wotherspoon from broker Charcol adds: "De- pressingly for borrowers, it will not end here, with other [lenders] certain to follow. So the message for those who want a fixed rate is act now."

Those seeking very long-term fixes – more than the usual two or three years – could be well placed as Mr Hollingworth points out that the "best buy" five-year deals are currently 0.1 per cent cheaper than the top shorter-term fixes.

There are downsides, though, to locking yourself in. First, a good rate today can become an uncompetitive one tomorrow. For instance, if the credit crunch eases and money market interest rates fall, borrowers who have already signed up for a fixed-rate deal will be left paying over the odds.

And getting yourself out of a fix may prove expensive. "The devil is always in the detail with fixed mortgages – some of the fees for coming out of a deal early can be punitive," says Sean Gardner from comparison site MoneyExpert.com. He points to Loughborough building society and Alliance & Leicester, charging redemption penalties of 5 and 3 per cent respectively on their two-year fixes.

As well as being whacked on the way out of a deal, borrowers face paying more on the way in. Since September 2006, MoneyExpert reports, the number of fixed-rate mortgages with an upfront application fee of £750 or more has risen from just 22 to 323 today.

"It's fairly common to see fees around the £1,000 mark or even higher," says Mr Gardner. "This all adds to the costs of remortgaging or moving home and will make the woes of the housing market worse as it clogs up the whole sector."

It is not just fixes, he adds, that are struck by the curse of the upfront fee. Lenders are applying these charges "across the board on all manner of mortgages". As for the option of delaying the fee pain by adding it to the mortgage loan – a process called capitalisation – this is being curtailed by some lenders. Abbey, for instance, announced last week that it would no longer allow fees to be capitalised on its range of 95 per cent mortgages.

Mr Hollingworth says more lenders are set follow. "What Abbey has done is very much in tune with the general credit crunch and the threat posed by negative equity. They know that when borrowers capitalise fees, in effect it adds to the loan-to-value [how much of the property's purchase price is not accounted for by the deposit). And if this takes them over 95 per cent, it means that with the current falls in property prices, the mortgage holder is soon stuck in negative equity. Abbey won't be alone in doing this."

Disturbingly, it is becoming increasingly common for lenders to specify that some upfront fees are non-refundable. In other words, if the mortgage falls through at a later stage then the borrower won't get their money back.

Among the big lenders, Lloyds TSB started the ball rolling with its £99 booking fee, while last week Abbey joined in by levying a £150 fee.

As Mr Wotherspoon makes clear, this trend can be costly to consumers. "There are many things that can happen during a mortgage application that may result in a borrower being unable to complete. Traditionally, this has not cost borrowers anything other than wasted time and maybe some legal fees. However, should they not complete on a mortgage with an upfront fee now, it will cost them actual cash."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks