Fergie, the racehorse and the battle for Manchester United’s soul: inside the Glazer years at Old Trafford

An ugly falling out over a racehorse between Sir Alex Ferguson and two Irish billionaires. A high stakes summit hosted at Donald Trump’s gaudy Palm Beach resort. Two decades of furious fan hatred. In an extract from his new book, Chris Blackhurst reveals how the enigmatic Glazer brothers took control of Manchester United – and shattered its soul

As if ending champions Arsenal’s 49-game unbeaten run were not enough, Manchester United supporters had more reason to celebrate at the end of October 2004 when the club rejected a possible £800m takeover by Malcolm Glazer.

In a statement to the London Stock Exchange, the United board said that it would regard an offer from the American tycoon as “not being in the best interests of the company”. The board said that it had “terminated discussions” with the club’s second-largest shareholder three weeks after first revealing a potential bid was on the table...

The fans were cock-a-hoop. Malcolm Glazer and his sons had been seen off; their swanky, uncaring City of London advisers had also gone.

Quite what would happen to United was not known, but, for now at least, the club was safe.

That was how they saw it. To reinforce that belief, the United board had turned 180 degrees and was giving its backing to the supporters, to the ordinary people.

Perhaps, though, if the fans had been a fly on the wall at Donald Trump’s gaudy pleasure palace at Mar-a-Lago in the first week of January 2005, they might not have been so ecstatic.

The Florida club was still cleaning up after the traditional New Year’s Eve extravaganza when a poolside table was taken by a lunch party comprising three bankers from Rothschild in the UK and the Glazers, led by Joel.

Mar-a-Lago may have seemed an unlikely choice of venue for the low-key, low-spending Glazers. But they were local, they lived down the road, and while other members used it for more lavish purposes, to them it was a neighbourhood restaurant, albeit one with high security which they also appreciated. They were not fixtures of Palm Beach high society and did not go to Mar-a-Lago’s glitzy parties; rather Trump’s club was a facility nearby where they could pop in for a business lunch and not be disturbed.

Over the meal, they discussed how the Glazers were left, sitting on 28.1 per cent of the shares. They could fold, which they did not want to do; they could stick at 28.1; or they could twist, but if they went higher – over 29 per cent, according to the takeover rules – they would have to bid for the whole lot.

The Glazers take control

There must be something in the air at Mar-a-Lago, part of the DNA of its brash, always bullish proprietor, because as the lunch wore on, they resolved to go for it. Effectively, they were playing double or quits – they would buy out the Irish billionaires John Magnier and JP McManus who fell out with Sir Alex Ferguson over ownership of the racehorse, Rock of Gibraltar, and had a large holding in United, and then table a formal bid.

As Magnier and McManus saw it: the fans had chosen to support Ferguson over Rock of Gibraltar; as a result, they were abused and vilified, and forced to endure a vicious campaign that even encroached on their beloved horses and racing. So, on their heads be it – they would happily exact their revenge by selling out and enabling a new owner, who the fans loathed, to come in. But they did want hard cash.

The Glazers’ offer was for £790m. The Glazer family had spent £222m so far acquiring the shares and they were prepared to put in another £50m. The rest was coming from US bank JP Morgan and US hedge funds. The latter had a clause in their agreements: if the hedge funds were not paid back within 63 months of the takeover, the hedge funds get 30 per cent of the club.

In the trade, the hedge fund debt was known as “fingers crossed” debt or “payment in kind” or PIK. They received higher interest which accrued over the term of the loan and they were paid back at the end, not during the term. In United’s case, the hedge funds were thought to be accumulating interest at 20 per cent or up to £54m a year. If Red Football, the name given to the Glazer vehicle making the bid, failed to hit 85 per cent of its target operating profit in the first three years, the hedge funds received “extraordinary powers” including the right to appoint 25 per cent of Red Football directors.

As details filtered out, fan incredulity and rage grew. As they saw it, their club had gone from being debt-free, in sound financial shape, to being in hock to a bunch of American financiers who shared none of their feelings for Manchester United, who were out to make a fast, fat buck at the Reds’ expense. The Glazers did not have the money but they had swooped in and borrowed and borrowed, using the club as security. Others, with similar degrees of chutzpah and access to the City and Wall Street, could have done the same.

On 12 May 2005, the Irish sold their shares to the Glazers. For Magnier and McManus their dalliance with United was finished.

“We were seen as enemies of a man who was regarded as untouchable,” said a Magnier insider. “There was no hatred because we were shareholders, it was all because of the Rock of Gibraltar.”

How 33 words spoke volumes

Malcolm Glazer only ever said 33 words in public about Manchester United: “We are enjoying it [owning United] greatly, it is a wonderful franchise, we just love it. I just want to say hello to the fans. It is a great franchise. It will do just great.”

There you are, you’ve bought the biggest football club, one that has a pedigree like no other, whose players and former players are household names, that fills its colossal stadium with devoted followers and has millions more all over the world, for whom the club, the team, is everything and that is all you can manage?

Worse, he used the word “great” three times and “franchise” twice. That’s all he could think to say. There’s no humility, no passion, no connection. Instead, it’s banal and empty. There’s nothing there, except reliance on a term, a word from US major league sports, that football fans find offensive.

Reading it back now, it’s striking that it could have been someone else saying this. Close your eyes and think Donald Trump: “I just want to say hello to the fans. It is a great franchise. It will do just great.”

When United fans are asked what it is about the Glazers they can’t abide, they say the lack of interest; the sense, as one said to me, that “the Glazers don’t give a s***”.

Davos and dissent mark Glazers’ tenure

During the 18 years of Glazer ownership, there were at least four attempts to gauge their attachment to United and whether they might consider selling.

These never developed into serious discussions; at every turn, the Glazers rejected the opportunity to explore further a possible sale, even through intermediaries. No price was posited by the Glazers or their agents; no formal talks were ever held.

Throughout, there were fan protests, frequently of the most horrible, personal kind. Not once did the Glazers relent. “The Glazers do what they want to do, they don’t do what people tell them to do,” said someone who knows them well. He reiterated: “Joel and Avie, they love it, absolutely love the sport. They’re addicted to it, they watch every minute of every United game, just not at Old Trafford. They love the business side, they’re very business-focused. If they sold the club, they would no longer have a card which says ‘owner of Manchester United’.”

At the 2023 World Economic Forum at Davos, United set up a pavilion. It seemed incongruous: a lounge dedicated to a football club amid those from the multinational corporations, big tech, big pharma, banks and global institutions.

Far from being out of place, Davos was somewhere the Glazers wanted the club to be, where they thought they belonged. Owning United entitled them to attend this gathering of the world’s business elite.

“Manchester United is proud to be the first sports team to partner with the World Economic Forum,” said the club. “Our global community of 1.1 billion fans and followers provide us with powerful opportunities to engage across cultural and geographical boundaries. We are in Davos to explore ways to maximise the impact of that extraordinary reach.”

Avie was there in person and rubbed shoulders with the titans present. He clearly loved being in such company. One delegate struck up a conversation with him, about football and United.

A fan, he was chuffed when Avie gave him his card, thinking he’d got his personal contact details and he could follow up. He put it in his pocket. When he looked at it later, it said simply “Avie Glazer, co-chairman, Manchester United.” There was nothing else, no private email or phone number.

After 18 years, enter Sir Jim Ratcliffe

When US tycoon Todd Boehly paid £4.25bn for Chelsea in 2022 it made even the Glazers sit up. For the first time, they decided to test the market. On 22 November 2022, the Glazer family announced it was “commencing a process to explore strategic alternatives” for Manchester United. This would consider various options, “including new investment into the club, a sale, or other transactions involving the company”. But there was a catch before their opponents rushed to celebrate: “There can be no assurance that the review being undertaken will result in any transaction involving the company.”

It was never clear from the off what the Glazers desired, as their initial statement said this wasn’t simply about a sale – they were open to alternative ideas – and they might not do anything at all.

The bidding came down to two, then one. In some respects, Jim Ratcliffe, 70, ticked the boxes for an ideal Reds proprietor. Exceedingly wealthy, worth an estimated £29.7bn thanks to his vast Ineos petrochemicals group, he’s a self-made Manc (he grew up in Failsworth outside Manchester and his family moved to Yorkshire when he was 10), and a self-declared, lifelong United fan.

Even “JR”, as he was inevitably called, did not have such deep pockets, however. Ratcliffe has a more lived-in, rumpled, friendlier face than the scheming oil tycoon from Dallas. Longer hair, too. Still, he could not afford or would not commit to buying United outright. If he did a deal, it would be for a majority holding, and for Joel and Avie to remain in some diluted form.

That would not appease the Glazer-haters, and would thrust Ratcliffe, who is relatively unknown – he only became an entrepreneur at the age of 40, and quit the UK to become a tax exile living in Monaco in 2018 – into the unforgiving gaze of the public arena.

Ratcliffe was a keen triathlete in his spare time. He decided he wanted to be more than a participant. He aspired to be an owner, using the lessons in management and motivation he’d gleaned from his business career.

His first foray into ownership was in November 2017, when he bought FC Lausanne-Sport, who played in the Swiss Super League. He described it later as “dipping my feet in the water”. In that first season with Ratcliffe as owner, Lausanne were relegated. Since then, Lausanne have bounced up and down. Currently, they are in Swiss football’s second tier.

In 2016-17, Nice were one of the very top clubs in France, challenging for the Ligue 1 title. Ratcliffe bought them in 2019 for €100m (£88m). “The ambition is to reach Ligue 1’s top four and regularly reach the [Champions League] within three to five years,” said Bob Ratcliffe, Jim’s younger brother and chief executive of Ineos Football. Ratcliffe – Bob, that is – added: “Without spending too much money on expensive transfers of players.”

In 2019, Ratcliffe bought Team Sky, the World Tour cycling team, winners of the Tour de France in six of the previous seven years. It was another considerable outlay (the team’s annual budget is around £50m) and has so far been a failure.

Buying Team Sky brought Dave Brailsford, the founder of Team Sky, into the Ineos fold. Ratcliffe rated Brailsford highly; somewhat bizarrely, he later put the former Team GB cycling coach in charge of Nice’s finances and transfer policy.

In cycling, Brailsford was known for his “marginal gains” philosophy – the idea that if you broke down everything you could think of that goes into riding a bike, and then improved it by 1 per cent, you would get a significant increase when you put them all together. It extends into every aspect of the rider’s life, not just training and how they perform in races.

“Do you really know how to clean your hands? Without leaving the bits between your fingers? If you do things like that properly, you will get ill a little bit less. They're tiny things, but if you clump them together it makes a big difference.”

Talks between Ratcliffe and the Glazers continue. But whether football, its players and fans, have the time and patience for this holistic, micro-detailed strategy remains to be seen.

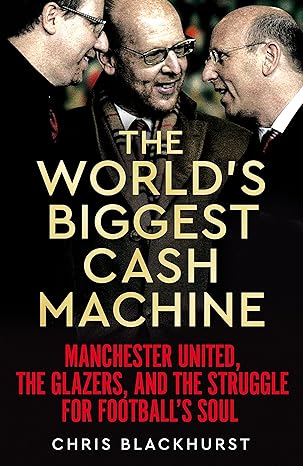

Extracted from ‘The World’s Biggest Cash Machine – Manchester United, the Glazers, and the Battle for Football’s Soul’ by Chris Blackhurst (Macmillan)

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks