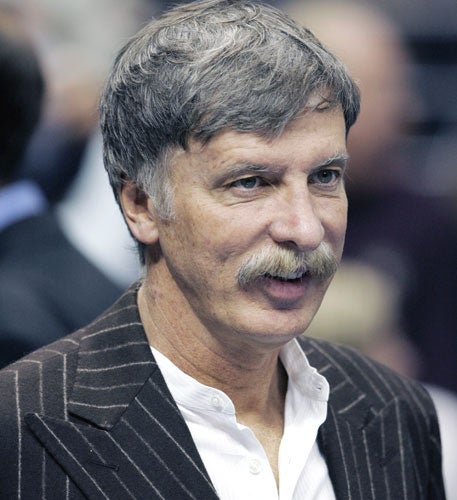

Kroenke edges closer to Arsenal takeover

Stan Kroenke was this afternoon within 17 shares of the threshold which would force him into making a takeover bid for the London club.

The American business tycoon has bought up another 25 shares inside the last week and, although his stake in Arsenal remains at 29.9%, he is edging ever closer to the 30% holding that requires him to make a formal takeover bid and offer to buy the entire stockholding.

The latest share acquisition is reported to have cost Kroenke around £212,500 and he has gradually increased his stake in Arsenal this year through a number of different transactions.

Arsenal's other main shareholders are Uzbek tycoon Alisher Usmanov, who holds a stake of about 25%, Danny Fiszman, and Lady Bracewell-Smith.

Denver-based Kroenke owns the NBA's Denver Nuggets basketball side and the Colorado Rapids MLS football team.

In the last few months, he has bought hundreds of Arsenal shares, which ultimately increased his stake in the club to 29.9%.

At Arsenal's annual general meeting at the Emirates Stadium back in October, Mr Kroenke was asked what his intentions were for the north London club.

But he chose not to speak to the gathered shareholders, with chairman Peter Hill-Wood intervening.

Mr Hill-Wood pointed out that under takeover rules any public statements regarding future bid intentions must be unambiguous, otherwise the individual concerned would be prevented from making a formal takeover move for six months.

Once someone reaches a 30% shareholding in a company they are deemed by the Takeover Panel to have "effective control" of the firm and must then make an offer for the remaining shares.

The price offered cannot be lower than the highest price the potential buyer has paid for shares in the firm in the previous 12 months

If, after the offer has been made, the potential buyer has more than 50% of the shares they are deemed to have been successful in their takeover and legally in control.

If an offer is unsuccessful and the 50% shareholding level is not breached then the potential buyer cannot come back with another takeover attempt for 12 months, unless invited to do so by the company.

Lady Nina Bracewell-Smith, who left the board in December last year, could well hold the balance of power with her family's 15.9 per cent stake.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks