Tom Hicks launches legal battle against Liverpool

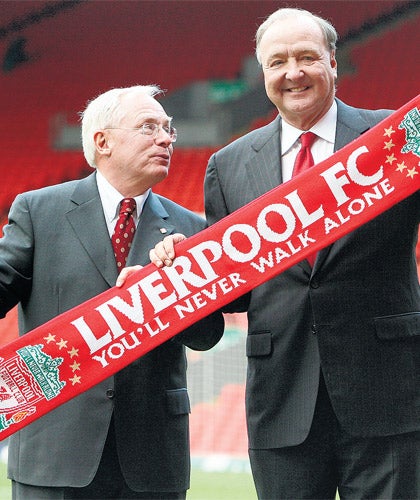

Former Liverpool co-owner Tom Hicks today applied to the High Court to lift orders preventing him from launching a massive damages claim in the US courts over the sale of the Premier League side.

The Texan believes he was the victim of an "epic swindle" when the club was sold against his wishes to New England Sports Ventures for £300million.

The sale went ahead after Mr Justice Floyd granted anti-suit orders which prevented Hicks taking action in the Texas courts.

If Hicks is successful at the new two-day hearing, he will be able to make damages claims against the Royal Bank of Scotland and former club directors.

Paul Girolami QC, representing Hicks, told the same judge today that he was applying to strike out or dismiss claims by Sir Martin Broughton, former chairman of the club, seeking damages against his client for his actions while owner.

He said he also sought to discharge the anti-suit injunctions which were granted to stop any frustration or obstruction of action being taken in the UK courts over the sale.

Actions brought by RBS against Hicks are no longer in issue and should be stayed, he said.

Mr Girolami said he would be opposing applications by Sir Michael and RBS to amend their court actions.

The bitter courtroom battle began last October and ended with the sale of the club.

Now Hicks is seeking to clear the way for a series of multi-million-pound damages claims against the bank and former club directors.

RBS wants to block Hicks and his former partner George Gillett from suing over the sale in which they lost £140million.

New England Sports Ventures is also applying to the court to be added to the application for a permanent anti-suit order blocking action outside the UK and European Union.

It bought the club after repaying a £237million loan Hicks and Gillett took out with RBS and Wells Fargo and Co.

Philip Marshall QC, representing Sir Martin, said it was obvious from public pronouncements by Mr Hicks that his action against his client remained live.

"We have a case where serious allegations have been made in public."

He said this was having an effect on the reputation of Sir Martin - "a very prominent director and chairman of British Airways and he remains under a cloud".

Mr Marshall said that was a situation that should not be allowed to continue and he sought permission to amend the proceedings to seek a declaration that Sir Martin had no liability and that he had behaved reasonably and honestly over the sale.

The hearing was adjourned until tomorrow.

An RBS spokesman said: "The courts described the claims made by Hicks and Gillett last year as 'not realistic and abusive'. Any further claims against RBS will be vigorously opposed."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks