Bitcoin price will recover from worst ever start to a year, analysts predict

One analyst tells The Independent that recent price falls 'will appear trivial' in the long run

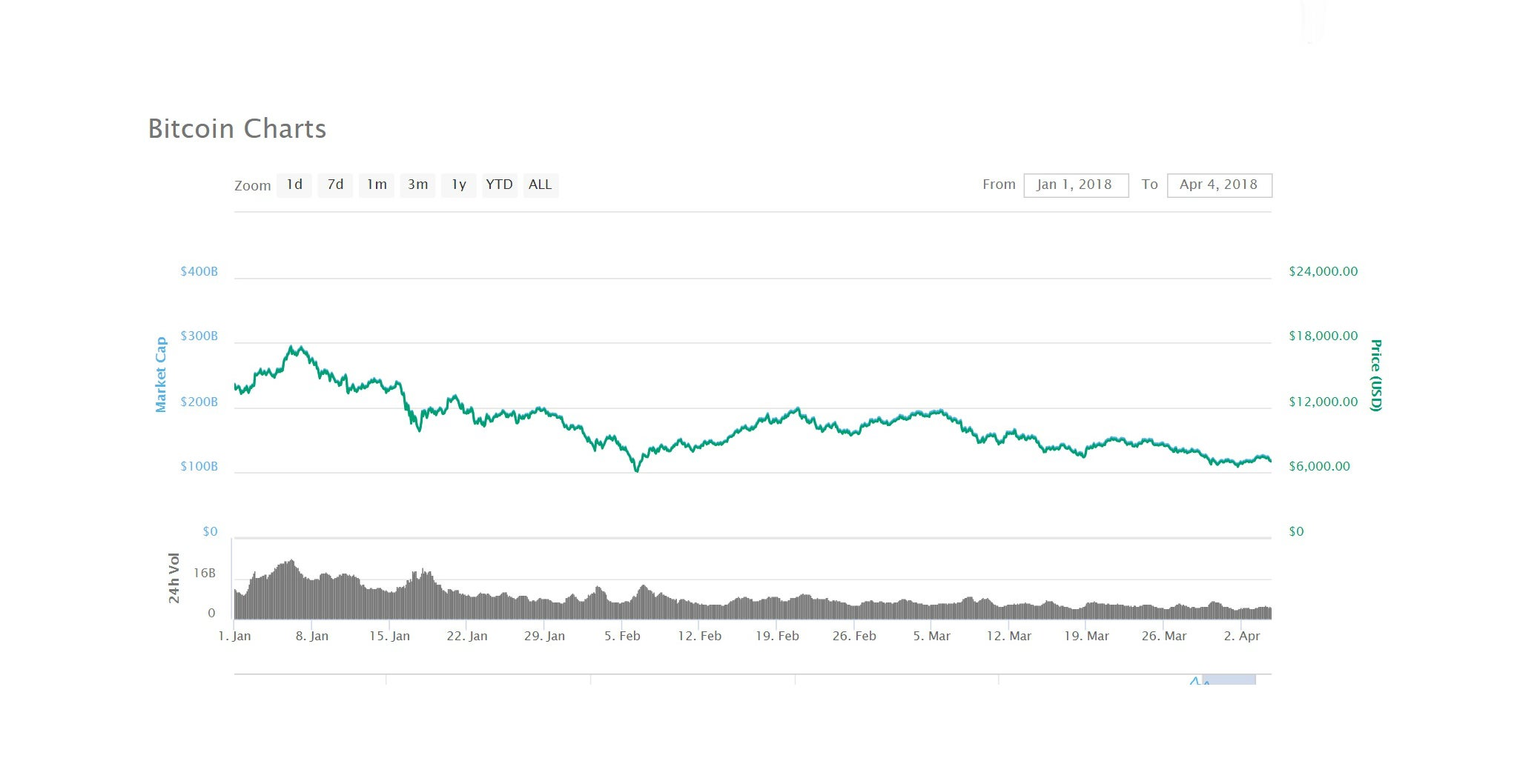

Bitcoin is reeling from its worst ever start to a year, having fallen in price by more than $10,000 since the beginning of January. But despite these losses, some analysts believe the cryptocurrency’s value will recover and could even go way beyond the highs of late 2017.

The price of bitcoin fell below $7,000 on Wednesday, 4 April, to around a third of highest ever price reached in December of around $20,000.

The crash has been attributed to a number of factors, such as the tightening of cryptocurrency regulations in major markets like South Korea, which have resulted in greater investor caution. Yet Michael Jackson, a bitcoin expert and the former COO of Skype, told The Independent he is hopeful that bitcoin’s fortunes will soon reverse.

“The price has been driven by speculators and they suddenly got cold feet but there’s considerable effort going on behind the scenes, including new underlying technology that is powering faster transactions,” Jackson said.

“Meanwhile, regulators seem open-minded and are now working to eliminate the risks for consumers. So I see no reason why bitcoin shouldn’t fulfil its dream. And if it does then recent price falls will appear trivial.

Jackson, who is now a board adviser to the bitcoin wallet provider Blockchain, has previously suggested that bitcoin’s inherent value as a payment mechanism and store of value means that the price of one bitcoin could eventually be worth millions of dollars.

“If it reaches even one per cent of the value store of other major money supplies, like the US Dollar, it could be worth 100-times what it is today,” Jackson told Newsweek in December.

Despite its scale, the fall in price is not unusual for the volatile cryptocurrency. Over the last five years, bitcoin’s value has rarely increased in the first quarter of the year.

Leading cryptocurrency publication CoinDesk also noted that over the last few months, “the correlation between the stock markets and bitcoin has strengthened,” indicating that bitcoin is still being treated by investors as a speculative asset and is therefore prone to turbulent prices.

Other analysts believe the price of bitcoin is incidental compared to the real implications of the underlying technologies that power the cryptocurrency and others like it.

Jeff Schumacher, founder and chairman of venture firm BCG Digital Ventures, claims the excitement surrounding bitcoin’s price distracts from the potential of other digital currencies like Ethereum, which are more efficient than bitcoin and offer greater scalability - key characteristics for allowing mainstream adoption.

“While the buzzwords are ‘bitcoin’ and ‘blockchain’, the power words are ‘world computer’ [referring to Ethereum] and ‘third-generation protocols’ [referring to newer cryptocurrencies like Tron and Cardano],” Schumacher told The Independent.

“Bitcoin is just a distraction but world computer and third-generation protocols are the game changers - that’s what we’re excited about.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks