Crypto crash: Is this cryptocurrency’s ‘Lehman Brothers moment’?

Celsius Network, Babel Finance, Three Arrows and Hoo are latest casualties of market chaos

More than $2 trillion has been wiped from the overall cryptocurrency market in the seven months since it peaked last November. This averages out at nearly $10bn per day, with retail investors, corporations and even some countries all seeing their holdings wiped out.

Just like the crypto crashes following all-time highs in 2013 and 2017, several leading companies in the space have also suffered potentially critical damage that could have ramifications for the entire industry.

Among the casualties is Celsius Network, a popular cryptocurrency lender that used the slogan “Unbank Yourself”. After freezing customer accounts last week, some fear that insolvency is unavoidable.

A short squeeze of the Celsius (CEL) cryptocurrency also trended on social media with the hashtag #CELShortSqueeze, prompting concerns about what one commentator described as “another GameStop situation”.

It is one of several platforms that appear to have been caught off guard by bitcoin’s monumental price drop, which saw the world’s most-traded cryptocurrency fall from close to $69,000 last year, to below $20,000 over the weekend. The fall led to forced liquidations of large leveraged bets, which in turn pushed the price lower and led to worries of it spiralling into a complete capitulation for the market.

The turmoil began last month when Terra’s UST stablecoin lost its peg to the dollar and caused its sister coin Luna to plummet by more than 99 per cent in value. The market instability that arose led to a broad sell-off, which ultimately led to Celsius’s issues, as well as those of fellow crypto lenders Babel Finance, crypto hedge fund Three Arrows, and just yesterday Hong Kong-based exchange Hoo.

Cryptocurrency news site CoinDesk likened the current climate to the 2007-08 financial crisis, warning this week that if Luna was cryptocurrency’s Bear Stearns moment, then Celsius Network “threatens to become the industry’s Lehman Brothers” by serving as the failure that exacerbates a market crisis.

In its latest update for customers, Celsius described “unprecedented challenges” in its bid to resolve its issues, which have left customers unable to withdraw or transfer funds for a week and counting.

The company claims to still be committed to “stabilising liquidity and operations” in order to fulfil its obligations to its customers; however, it simultaneously cut key communication channels for users by pausing its Twitter Spaces and AMAs.

Bitcoin and crypto are not alone in experiencing a massive downturn – stocks and bonds have also taken a hammering – but the extent of the crash has seen a surge in people once again questioning whether this is the end for bitcoin and cryptocurrencies more broadly.

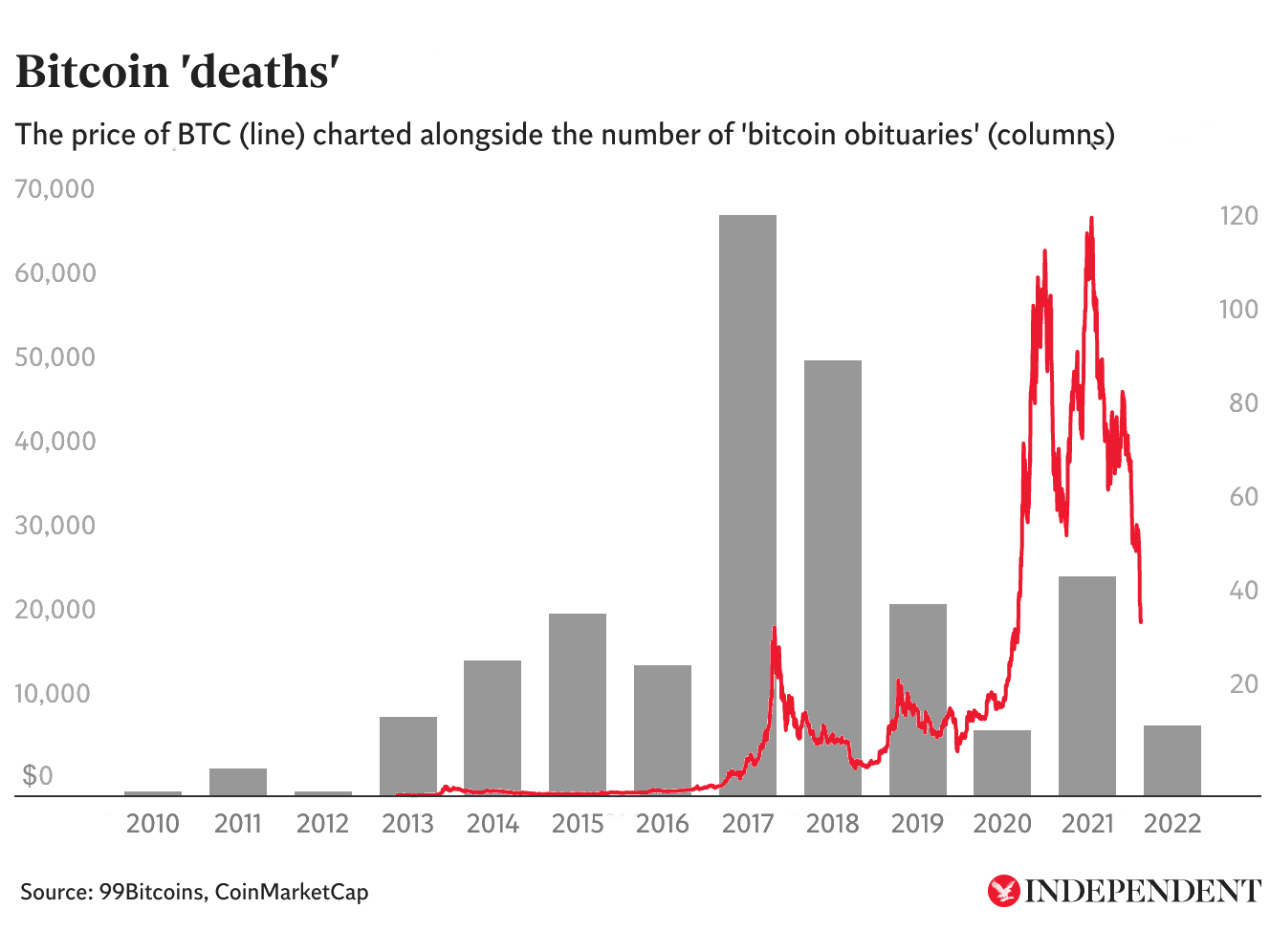

One website tracking bitcoin obituaries in the media has recorded more than 450 since 2010, with each price crash typically resulting in a flurry of new reports.

The latest collapse also appears to have exacerbated a growing divide between the so-called Bitcoin Maximalists, who consider anything other than the original cryptocurrency a “s***coin”, and the rest of the crypto space.

This week, one of the most prominent bitcoin advocates and investors called on regulators to crack down on the “parade of horribles” that he claimed were dragging down the BTC price. Michael Saylor, who as the head of software firm MicroStrategy has ploughed close to $4bn into bitcoin, argued that the 19,000+ cryptocurrencies currently in circulation were preventing mainstream adoption of bitcoin.

“What you have is a $400bn cloud of opaque, unregistered securities trading without full and fair disclosure, and they are all cross-collateralised with bitcoin,” he told NothmanTrader founder Sven Henrich on a webcast titled “Navigating the Storm”.

“The general public shouldn’t be buying unregistered securities from wildcat bankers that may or may not be there next Thursday.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks