Cryptocurrency price collapse: Why have bitcoin, ethereum and ripple all suddenly crashed?

For once, the market-wide crash is not being blamed on bitcoin

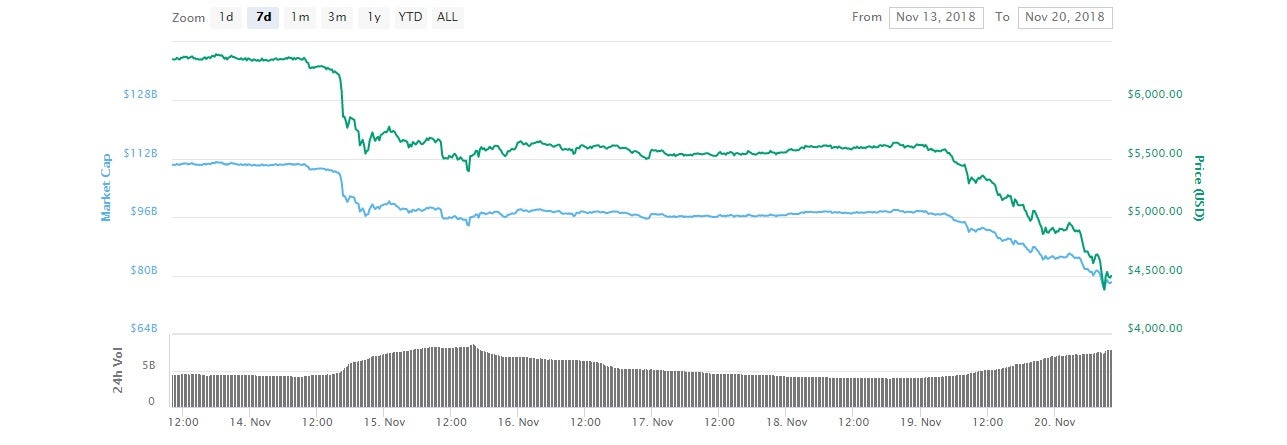

Cryptocurrency markets have lost more than $60 billion in value in less than a week, following a price crash that has caused bitcoin, ethereum and ripple to hit their lowest levels since 2017.

The price falls appear even more dramatic given the remarkable period of stability that preceded them, which had prompted some analysts to warn that the lack of any major market movement since early September would likely be the "calm before the storm."

Speculation around why the cryptocurrency collapse has happened focusses not on bitcoin but its spin-off, bitcoin cash.

On 15 November, the rival cryptocurrency experienced something called a hard fork, whereby a brand new cryptocurrency was created. This led to uncertainty in the market and a major sell-off of bitcoin cash.

With a market cap of around $4 billion, bitcoin cash is the world's fourth most valuable cryptocurrency, however more than half of its value has been wiped off since last week's split.

It is not clear if or when the crypto market will level out, with many of the price predictions from earlier this year now looking improbably optimistic.

In April, Rodrigo Marques, CEO of investment platform Atlas Quantum, told The Independent that similar gains could be expected that saw the price of bitcoin rise close to $20,000 at the end of 2017.

Several renowned figures in the space also gave extremely hopeful price predictions for bitcoin and other cryptocurrencies over the coming months and years.

Investor and self-described “bitcoin evangelist” Alistair Milne, said bitcoin would reach between $35,000 and $60,000 by 2020, while celebrated investor Tim Draper said bitcoin would soar to $250,000 by 2022.

Some analysts were able to put a positive spin on the downturn in the market, suggesting that the low prices mean it is now a buyers' market.

"Just a few weeks ago crypto traders were airing concerns about the lack of volatility in the crypto market. Now volatility is back and many savvy investors will be using this as a major buying opportunity, perhaps the last one of 2018," said Nigel Green, founder and chief executive of deVere Group financial consultancy firm.

"Digital currencies are the future of money and, as such, they will be capitalising on the lower prices in order to build their portfolios and shore-up their positions.

"Financial traditionalists view cryptocurrencies the way traditional stores used to view online retailers. But with their hands in the sand they are failing to see that cryptocurrencies have already changed forever the way the world handles money, makes transactions, does business, and manages assets."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks