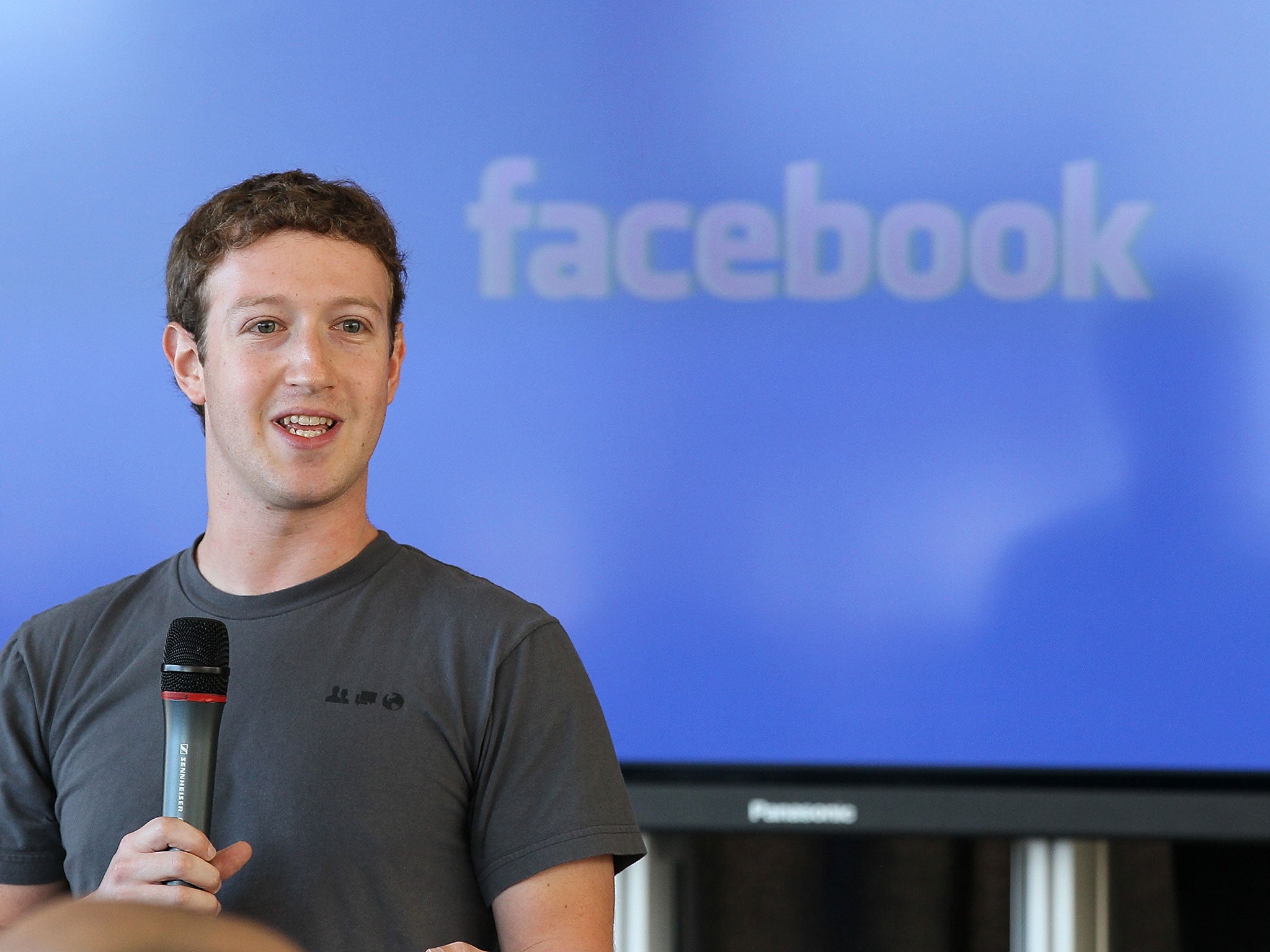

Facebook paid more by HMRC for adverts than social network pays in tax

HMRC paid Facebook £27,000 last year for adverts advising people how and when to pay their taxes

HMRC pays Facebook six times the amount the company pays in tax to buy adverts telling people to pay their taxes, it has been reported.

While Facebook paid £4,327 in tax in 2014, a Freedom of Information request by Channel 4 News revealed the company was paid £27,000 by HMRC the following year.

The money paid for adverts advising people how and when to pay their taxes.

Facebook's tax bill is actually lower than that of the average worker.

In 2014, the company paid its UK-based employees an average of £210,000 in pay and bonuses. It gave its London staff Facebook shares worth £35.4 million, pushing its losses to £28.5 million - hugely reducing its tax bill.

Many of its other profits from the UK are sent to its international headquarters in Ireland, which then puts them in the low-tax Cayman Islands.

In 2013, Facebook paid no corporation tax at all.

A spokesperson for HMRC told Channel 4 News: "Like all large organisations we find that an increasing number of those we serve communicate through and get their information from social media

"Our investment in social media is carefully evaluated to ensure we are getting maximum value for the taxpayer."

Facebook said: "We are compliant with UK tax law and in fact all countries where we have employees and offices."

The social media giant has been accused of paying corporation tax rate of 3.6 per cent around the world in 2014, much lower than the 21 per cent corporation tax rate large companies have to pay in the UK.

A number of huge Silicon Valley firms, such as Facebook, Google and Amazon, have been accused of using complex arrangements to legally pay low rates of tax on profits generated in the UK.

Google was forced to pay £130 million in back taxes dating back to 2005, which Shadow Chancellor John McDonnell said meant the company had an effective tax rate of three per cent.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks