The Independent's journalism is supported by our readers. When you purchase through links on our site, we may earn commission.

Inside Tesla’s terrible year, and what comes next for the electric car giant

Elon Musk made Tesla what it was, but he could also be its undoing, Richard Hall reports

Even in a turbulent economic climate, in a nascent industry that is prone to volatility, and in the middle of a geopolitical balancing act that impacts all of the above, the fall in the value of Tesla over the last year has been dramatic.

From a valuation of $1 trillion near the end of 2021, the American electric car company began 2023 with a market cap of $383.76bn. In the last 12 months, the share price has fallen by 69 per cent.

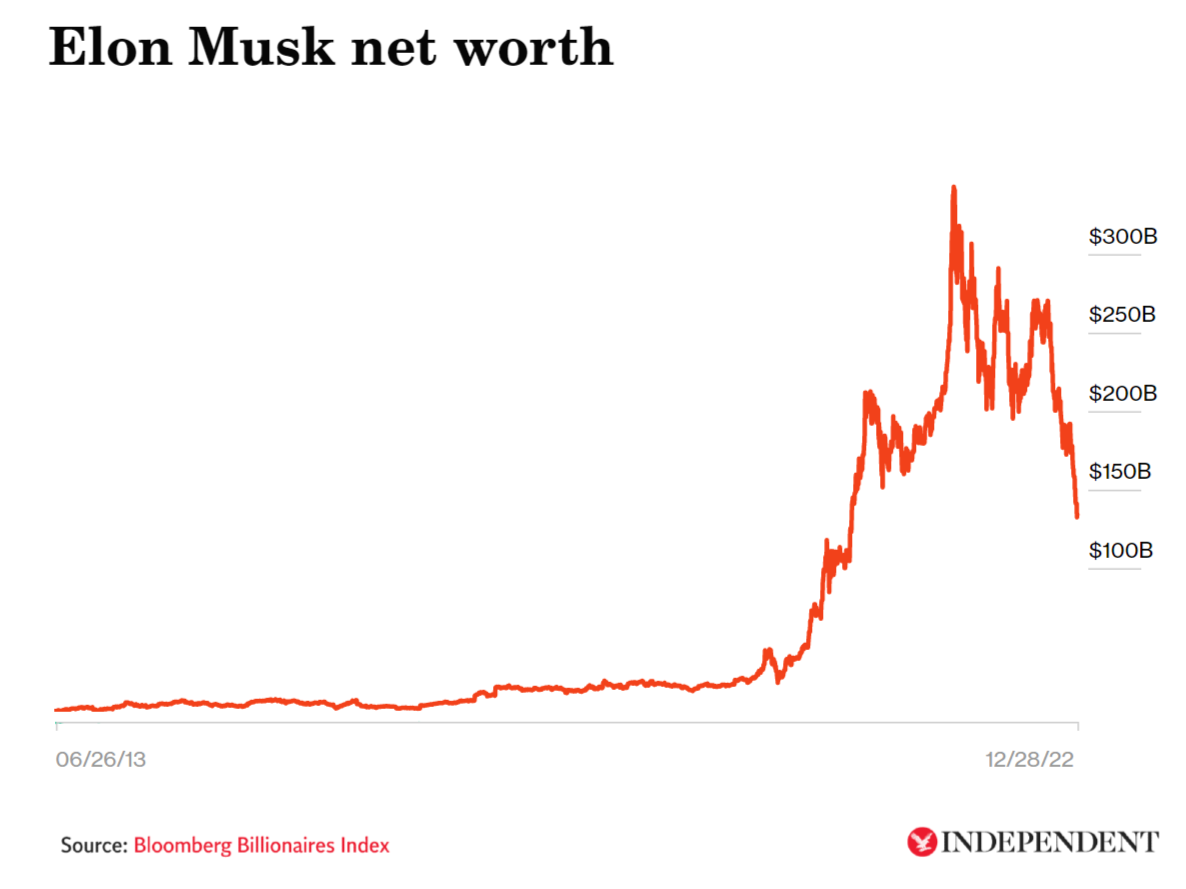

That drop made Tesla CEO Elon Musk the first person ever to lose $200bn (£165bn), the largest wealth decrease in history. It also threatens the supremacy of the first car company to bring electric vehicles into the mainstream.

So, why has Tesla stock fallen so dramatically? And can the former darling of Wall Street reclaim his crown?

A social media obsession

The story of Tesla’s decline begins with an obsession. Long before Musk sought to buy Twitter, he was a prolific user of the social media site. Musk has tweeted more than 22,000 times since joining in 2009, sharing personal musings, news about his various businesses, alt-right memes and about Twitter itself.

But Musk was not content to be just a user of Twitter, he wanted to control and shape it. At the beginning of April, a filing with the Securities and Exchange Commission revealed that Musk was Twitter’s biggest shareholder, with a stake of 9 per cent. Soon after, he announced his intention to buy the company.

From the day his stake in Twitter became public, Tesla stock began to steadily decline. At the time, Tesla’s shares were trading at around $360. When he finally purchased the company in October the price had dropped to $219. By December of 2022, Tesla’s price had dropped to $150, and longtime investors in the company were beginning to sound the alarm.

It was not just that taking on Twitter was a distraction for Musk – although that was a significant factor – but a series of seemingly bad business decisions he made in his first months at the social network that caused alarm.

In his first month, Musk oversaw massive layoffs of staff responsible for content moderation, the reinstatement of accounts that were previously banned for posting extremist content and conspiracy theories, including former president Donald Trump, promoted and engaged with far-right content himself and launched an ill-fated premium service that led to mass impersonations of public figures and companies.

Those abrupt changes led half of Twitter’s top advertisers to stop spending on the website. They didn’t just harm Twitter, but also Tesla, a company that owes much of its success to a belief in Musk’s business acumen. Tesla’s brand image took a major hit, according to successive surveys.

Tesla investors started to speak out publicly.

“There is no TSLA CEO today,” tweeted Gary Black, managing partner of the Future Fund LLC, which owns Tesla stock worth some $50m at the time of writing in December.

“The market voted today that the $TSLA brand has been negatively impacted by the Twitter drama. Where before EV buyers were proud to drive their Teslas to their friends or show off Teslas in their driveways, now the Twitter controversy is hurting Tesla’s brand equity,” he added.

Distraction is a word that comes up a lot when analysts discuss Tesla’s downfall. Len Sherman, an adjunct professor at Columbia Business School who used to own Tesla stock and worked as a consultant to the auto industry, believes Tesla’s “completely ineffectual” board holds much of the blame for allowing Musk to run wild.

“The fact that they didn’t really read the riot act when he started getting involved with Twitter is just not responsible board governance,” he told The Independent in a phone call from his Tesla. “From the standpoint of Tesla, what he’s been doing has been very harmful to shareholder value of Tesla, and that should be the board’s concern. his isn’t a normal board. This is a board that serves Elon Musk, not vice versa.”

Though, Sherman also believes Musk was overextended before Twitter came along.

“The bigger concern is just the lack of focus and attention. Even before Musk began his dalliance with Twitter, he was overextended. He was running Tesla, he was running SpaceX, he was running Neuralink, he was running the Boring Company. The Twitter thing just might be system overload,” he said.

While Sherman credited Musk for his “astonishing” management of Tesla to make it the biggest car company in the world today, he also questioned his strategy going forward. The two new Tesla vehicles commanding Musk’s attention at present are the Cybertruck – a futuristic-looking vehicle with “more performance than a sports car” and a second-generation Roadster which promises to be one of the fastest and most expensive cars on the market.

Sherman pointed to Tesla’s original mission, which is explained on its website, was to “accelerate the advent of sustainable transport by bringing compelling mass-market electric cars to market as soon as possible.”

Both of the current projects, Sherman said, “are the antithesis of a mass market vehicle”, which is what Musk originally promised. Instead, Musk is driving Tesla to produce vehicles that are “interesting from an engineering standpoint,” but do little to benefit Tesla’s long-term outlook or meet its founding mission.

“This is the kind of thing that is always captured Musk’s fancy, he wants to prove to the world that he could do things that no one else thought was possible,” he said. “A Tesla electric vehicle that could reach everyone’s budget, that’s gone. He’s not talking about doing an affordable mass-market car anymore… Tesla’s product roadmap seems more aligned with stroking Elon’s ego and engineer-lust than serving shareholders and the planet.”

Tesla did not respond to The Independent’s request for comment for this story.

Big trouble in China

Twitter, and Musk’s obsession with Twitter, isn’t the only thing dragging down Tesla’s stock price. The electric vehicle market as a whole, and particularly Tesla, faces industry headwinds.

Tesla has dominated the electric vehicle market in the US, but also in China, for years. Its presence in China accounts for some 40 per cent of Tesla’s sales and is seen as crucial to the company’s future ambitions. Notably, competition has increased in both markets.

In the US, Tesla’s share of new electric light-vehicle registrations dropped from 79 per cent in 2020 to 65 per cent in the first nine months of 2022, according to S&P Global. Last week, the company saw its worst week on the stock market in two years, falling 12 per cent, when it posed lower-than-expected sales figures.

In China, Tesla sold some 56,000 cars in December, a decline of 21 per cent from the year before and 44 per cent from November, The New York Times reported, citing data from the China Passenger Car Association.

Tesla responded by cutting the price of two of its vehicles in China for the second time in three months, after doing the same in the US.

Responding to the drop in demand, Dan Ives, tech analyst for Wedbush Securities, told CNN: “The Cinderella ride is over for Tesla.”

Musk’s problems in China go far beyond demand. He faces a complicated political environment that bleeds into every other area of his business, and which was made more complicated by his purchase of a social media giant.

Isaac Stone Fish, the founder and CEO of research firm Strategy Risks, which quantifies corporate exposure to China, told The Independent that there is a significant contradiction at the heart of Tesla’s global business model that may attract the attention of regulators.

“Both for Musk in the United States, and Musk in China, the issue is his relationship with the Chinese Communist Party ~ and the two things move in opposite directions. The closer Musk is to the Chinese Communist Party in China, the more likely Tesla is to succeed in China, and the less likely Musk is to succeed in the United States,” he said. “I think when you make enemies in Congress, like Musk has, and you are so exposed to the Chinese Communist Party, as Musk is, you are opening up vulnerability for someone on Congress or a committee to take advantage of that.”

Stone Fish added that the Chinese government may be looking to reduce some of the perks it has given to Tesla to boost its own electric vehicle industry.

“The classic China story is Beijing allows a foreign brand to flourish in China while it allows domestic competitors to borrow, steal, copy its technology. And then once they feel like they no longer need the foreign brand and they begin to ice it out. This may be the beginning of that process for Tesla,” he said of Tesla’s recent troubles in China.

For Sherman, the auto industry analyst, there may be another answer to why Tesla’s stock has fallen much more sharply than other carmakers. It is a development that has impacted much of the technology sector, of which Tesla was seen as being part of by investors.

“My first reaction is not why is it fallen so far, but why did it ever get so high?” he said, noting an “irrational exuberance” that drove the stock price to $400 in previous years, in part driven by confidence in Musk’s abilities.

Sherman further added that there is a “reckoning” taking place in the entire tech sector, fuelled by rising interest rates, which has “forced companies to justify the valuations they’ve been given.”

Sherman said he believes Tesla still has an opportunity to retain its crown. For that to happen, Musk must be reined in from pursuing his various curiosities in engineering marvels and social media wars. That, he added, may be a problem.

“I would challenge you to find someone who thinks that anyone could persuade Elon Musk to do anything,” he said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks