Gen Z is getting serious about their financial independence. Here’s how they’re doing it

Two Gen Z personal finance experts explain how their generation is prioritizing financial well-being and independence

When Taylor Price was 17 years old, she dreamt of becoming a neurosurgeon.

Price enrolled at a New York community college as a pre-med student, but after facing a series of health challenges, she left the field behind to study finance instead. However, Price quickly realized that she didn’t have a grasp on her own finances, she told The Independent.

“I'm a corporate finance major, and yet I know nothing about personal finances. I'm expected to make multi-millions to billions and manage that money for someone else, and yet, I don't know how to manage my own or make my own,” Price recalled thinking.

That experience inspired Price, who is now 25, to launch the online platform Priceless Tay, where she creates personal finance education content for Generation Z (those born between the late 1990s and early 2010s).

Price is one of many young adults prioritizing their financial health. About 72 percent of Gen Z took steps to improve their financial health in the last year, according to Bank of America’s 2025 Better Money Habits financial education study. Meanwhile, just 39 percent of Gen Z reported receiving financial support from their family, which is down from 46 percent in 2024, the survey revealed.

Holly O’Neill, president of consumer, retail and preferred banking at Bank of America, said in a statement that Gen Z is “challenging the stereotype when it comes to young people and their finances”.

“Even though they’re facing economic barriers and high everyday costs, they are working hard to become financially independent and take control of their money,” O’Neill said.

Here’s how Gen Z is prioritizing financial health and independence as they enter adulthood:

Online resources empower Gen Z

The advent of social media has made personal finance education more accessible than ever, which has, in turn, empowered Gen Z to take control of their money, Price explained.

“I don't have to go to a financial advisor or have a wealthy next-door neighbor to go and ask. I can just go online, on YouTube University, and learn, ‘what is a Roth IRA?’” she said.

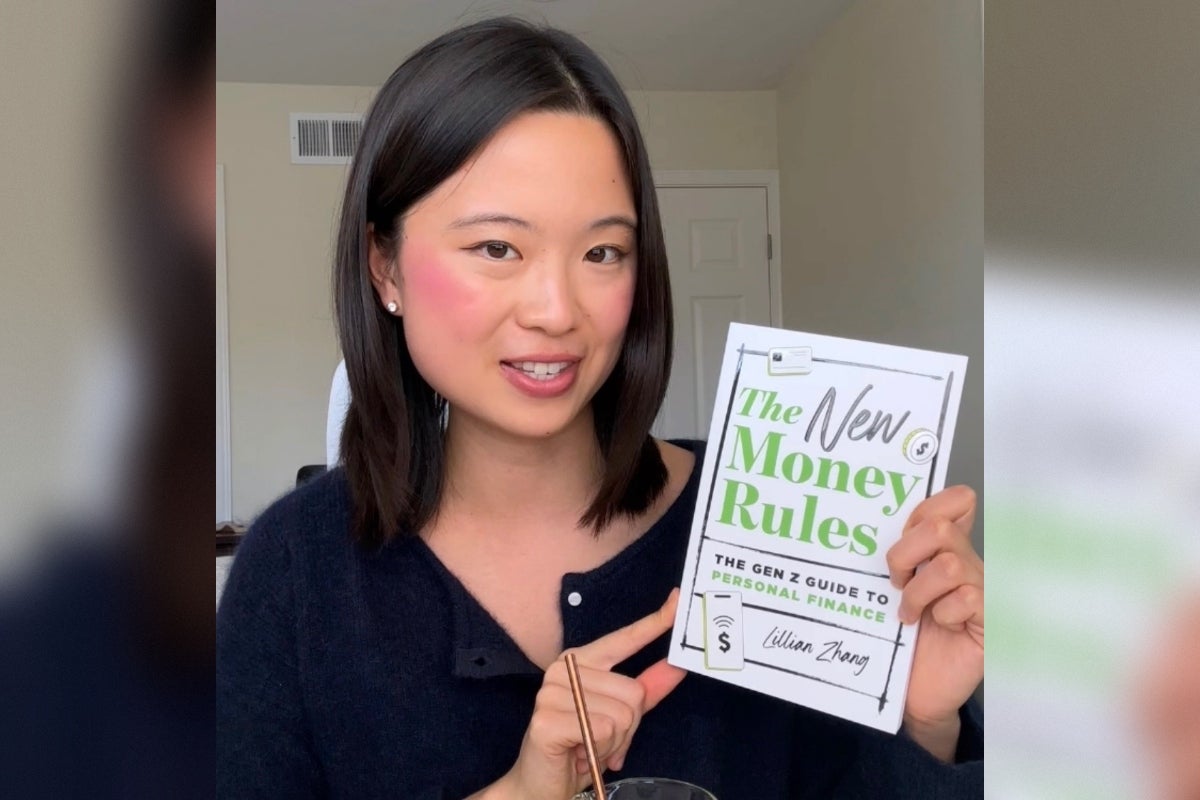

Lillian Zhang, a 25-year-old finance educator and author of The New Money Rules: The Gen Z Guide to Personal Finance, told The Independent that she has also used internet resources to learn more about the topic.

“I became really interested in personal finance, especially during COVID. I was diving really deep into personal finance YouTube videos. I was reading those classic books that get you started on learning personal finance. I was very into that world,” Zhang said.

Zhang said her interest in finance began at a young age, when she made and sold stuffed animals to her classmates. “That was the first moment in my childhood when I started making my own allowance or money, and it was one of the first times I understood the value of the dollar and how savings work,” she said.

Gen Z is rethinking what financial independence means

For Gen Z, financial independence “isn’t about appearing wealthy…it’s really more about having options,” Price said. This could mean having the financial flexibility to take a sabbatical or quit a soul-crushing job, for example.

Gen Z is also thinking about retirement differently from older generations. “I don't think their idea of retirement is complete work exile, stop working, I really think it's more about having work optionality,” Price said.

Zhang made a similar point: “In my opinion, based on what I've surveyed and seen, I feel like for Gen Z a lot about financial independence is about optionality and not about retiring early.”

“It's not just about the number, it's about the peace of mind and the options that it gives you,” she added.

Building healthy financial habits

Gen Z doesn’t “rely on just discipline alone” to meet their financial goals, Price said. They also take actionable steps to improve their financial health.

For example, Price suggests setting up automatic bill payments and savings account transfers, which helps consumers avoid “making 100 micro decisions every month” about where their money will go.

Zhang said awareness is also important for financial health, even if it’s a stressful topic for some.

“One concept explained in my book is something called the ostrich effect. Ostriches, when they're stressed about something, they bury their head in the sand. That’s the same concept in your finances,” Zhang explained.

“For a lot of people, including myself sometimes, if you know finance is a stressful topic, you tend to avoid it or not look at your situation or accounts. I think once you push yourself to become more aware and to face your situation head-on, then a lot of clarity comes into that,” she added.

This article is sponsored by Credit Karma. We may earn a commission if you engage with their services using links in this article.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks