The Independent's journalism is supported by our readers. When you purchase through links on our site, we may earn commission.

This is the policy which would guarantee Biden left-wing support — if he's brave enough to bring it in

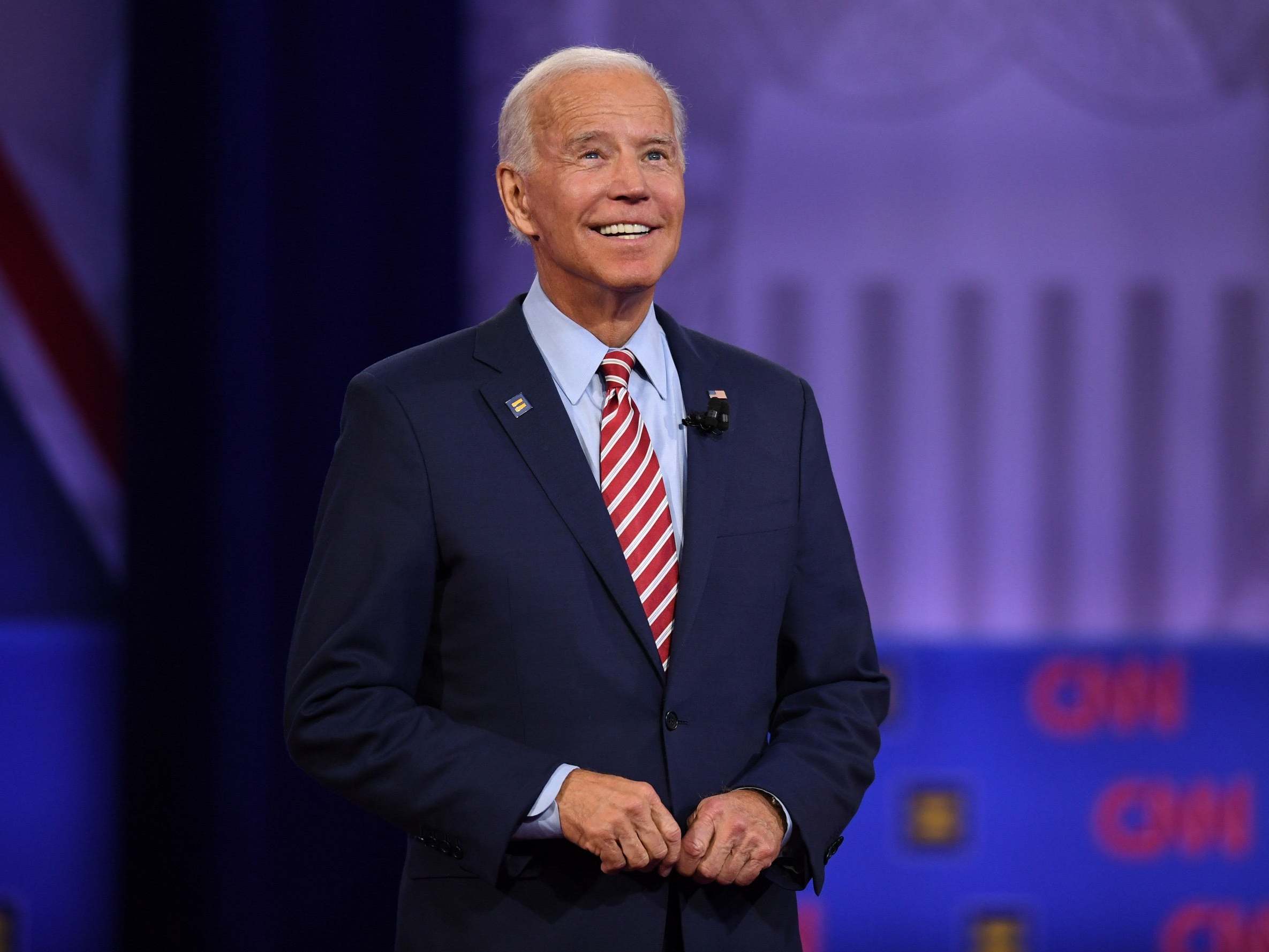

The former VP has been reaching out to progressives with some Bernie and Warren-inspired policies since becoming presumptive nominee. But this is the one that could really change everything

As the presumptive Democratic nominee for president, former vice president Joe Biden has been trying to reach out to the left wing of the party. He has adopted a number of progressive policies, including Massachusetts Senator Elizabeth Warren's bankruptcy reform bill that would allow student loans to be eliminated in bankruptcy. He's also promised to lower the Medicare cut-off age from 65 to 60. That's an effort to compromise with Vermont Senator Bernie Sanders, who has pushed a plan of Medicare for All.

These are positive steps, and I hope Biden continues to embrace proposals from Biden and Warren's excellent policy platforms. One obvious proposal to bring in is Warren's wealth tax. It's a simple, popular policy that could help define Biden's campaign against wealthy plutocrat Donald Trump.

Warren's tax proposal is straightforward: She calls for a tax of 2 per cent on every dollar of net worth above $50 million, and a 6 per cent tax on every dollar of net worth above $1 billion.

This is not an income tax on money earned per year. The very wealthy don't have to work, and so often don't have much in the way of taxable income. Donald Trump, for example, who claims to be a billionaire, has refused to take a presidential salary in office, instead donating the money. That may allow him to take a tax write-off.

Instead of focusing on income, Warren's tax targets total wealth. That means it would force Jeff Bezos to pay around $6.5 billion per year. That's a lot more than Bezos' company Amazon currently pays in federal taxes: $0.

In the United States, wealth is extremely concentrated among the wealthy. The highest 20 per cent of US households earn more income than the lower 80 per cent combined — and the 400 richest Americans have more money than all black households in the United States combined. As a result, taxing the extremely wealthy can raise a lot of money; Warren expects her plan to generate $3.75 trillion over 10 years. (Sanders proposed a similar, slightly more complicated wealth tax which could raise even more.)

That $3.75 trillion was enough to fund most of Warren's agenda when she was still running for president, including canceling student loan debt and quadrupling public education funding. It could certainly pay for Biden's less ambitious student debt cancellation plan. It could also help Biden pay for a public healthcare option, which he currently plans to fund through capital gains taxes.

Warren's wealth tax is important because it can fund much-needed programs, and because it establishes a precedent for holding the rich accountable and forcing them to contribute to the common good. But the tax is also valuable because it's a clear, easily explained policy which is very popular. Overall, 61 per cent of voters approve of the proposal, while only 20 per cent oppose it. That includes a striking 50 per cent Republican support.

It's not surprising that a tax on the ultra-wealthy gets bipartisan public approval. Higher taxes on the rich are generally popular (as this 2015 poll shows.) Inequality in the US has been rising for decades, while billionaires are able to game the tax system to pay a lower tax rate than working people. Jeff Bezos has a fortune of $124.7 billion but warehouse workers can't get the company to pay them sick leave during a pandemic. Most people want to rectify our current situation by taxing the wealthy and using the funds to create a safety net for the people whose labor generates the wealth in the first place.

The tax would also draw a stark contrast with the Trump administration. Trump is himself an ultra-millionaire, who would be subject to Warren's tax. (As aforementioned, the president likes to claim he's a billionaire, though he probably isn't, but even skeptics agree his fortune is more than $50 million.) His signature legislative accomplishment, and a chief priority of his first term, was a massive tax cut for the wealthy. It cut federal revenue by around $450 billion. That's an especially egregious giveaway, considering Republicans’ reluctance to fund essential services in crisis such as the post office during the coronavirus pandemic.

Trump is the candidate of oligarchs, plutocrats, and the mega-rich. There's no better way for Democrats to underline that than by running on a tax on oligarchs, plutocrats, and the mega-rich. As the pandemic grinds on, and people watch their savings and their jobs evaporate, Democrats need to reject a system that has shoveled billions to the powerful, and left the rest of us vulnerable. They need to show working people that they're on their side.

A wealth tax isn't the only policy Biden should adopt to do that. But it's a good start.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks