Daily catch-up: David Cameron, inertia-selling the European Union

Plus more about income and wealth inequality in Britain

David Aaronovitch in The Times (pay wall) has a good column about the Prime Minister and his speech about Europe on Tuesday:

Uncertainty about Mr Cameron is the most consistent thing about him. If you read any of the biographies of him, or compilations of his speeches and writings, what strikes you is the steady lack of conviction. Almost every position he holds he holds faute de mieux. Had he inherited a more pro-European party he would have been a more pro-European leader. If folks had been kinder about wind farms, there’d still be a big subsidy. His settled view is that he is the prime minister and that’s a lot better than most other people being prime minister.

He marvels at the skill with which David Cameron is making the "Safety First" case for staying in the European Union:

What Cameron has realised is that most people essentially just want an excuse for voting for the status quo. They know it’s dull and that the antis have more rhetorical force, but in the absence of a clear, convincing and positive picture of what the Out future would look like, they will be inclined – as the Scots were last September – to stay in. Just give them a reason.

My own pale imitation effort is in The Independent today. I focus on the Prime Minister's skill in handling his party, which, contrariwise, just wants an excuse for voting to leave the EU, and he's not giving it to them.

• As a footnote to my article about inequality in Politico, which I mentioned yesterday, I should note two things that appear to contradict my assertion that inequality in Britain has not increased since 1997.

One is a Social Market Foundation study published in March this year called "Wealth in the Downturn", which was reported by The Independent under the dramatic headline, "the rich are 64% richer than before the recession, while the poor are 57% poorer". The words are accurate, but they do not reflect quite what might be expected. The study looked at the financial wealth – cash savings or debts – of different groups ranked by income (the headline compares the top fifth by income with the bottom fifth). It therefore suggests that income and wealth became more closely correlated between 2005 and 2012-13, which means that inequality might have increased if it were possible to devise a measure like net present value that combines income and wealth. But the effect may have been a short-term response to the 2008 financial crash, and the study excludes wealth in the form of housing and pensions. As I say in my article, it is possible that wealth inequality has risen since the Office for National Statistics Wealth and Assets survey 2010-12, but we need more evidence.

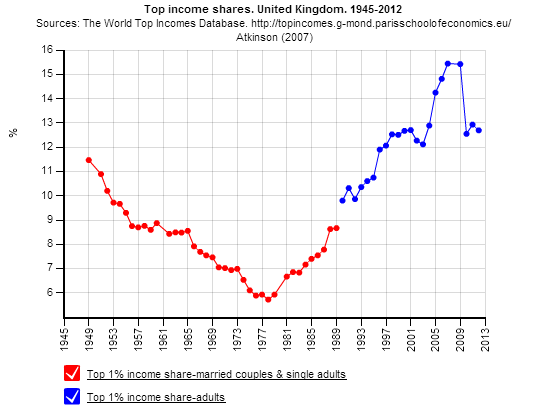

The other is that the share of income going to the top 1 per cent did rise after 1997, going from 12 per cent to 15 per cent in 2008, but then falling back to 13 per cent in 2012 (chart taken from the The World Top Incomes Database).* The top 1 per cent is different from the rest (not just because it has more money), and its share may be responsible for some of the resentment at inequality, which is why it was the target of the Occupy protests. Statistically, its gains since about 1990 have been offset by (slightly) more equality among 99 per cent of the income distribution, but that doesn't affect how people feel about the 1 per cent.

* The post-tax income figures are in The World Top Incomes Database, but are not easy (for me) to turn into a chart: the share of post-tax income going to the top 1 per cent rose from 10 per cent in 1997 to 12.5 per cent in 2007 before falling to 9.5 per cent in 2012.

• And finally, thanks to Moose Allain for this:

"One day I hope to be ubiquitous. That's me all over."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks