Should we trust forecasts of a return to real wage growth? The figures don't support such optimism

Look out for lots of excuses from George Osborne when a large negative number appears next month

In an interview with Sky News, Mark Carney, Governor of the Bank of England, waxed all optimistic about real wage growth. “We would expect to see sustained real wage growth over time. Historically, one expects to see something in the high threes, about four per cent real wage growth. We are just at a point right now where basically earnings growth is matching inflation… We see real wages turning positive soon, that's in our forecast.”

It may well be in the MPC's forecast but, as so often is the case, that doesn't mean it will happen. Just because real wage growth was three or four per cent in the period of the Great Moderation that doesn't mean that those heady days will return. Others have gone even further, declaring that the real wage declines we have seen for months in a row are now a thing of the past, despite the fact that in only one month of the last 47 months of data since the Coalition was formed have wage rises exceeded price rises. The Financial Times claimed “real wages are on the rise for the first time since 2010”. David Smith in The Sunday Times even declared that “we will soon reach the point at which growth in real pay for private sector workers is incontrovertible”. So let's take a look at the data and see if any of that is true.

The monthly Labour Force Survey has the most comprehensive coverage, being a random sample of workers and producing estimates of hourly and weekly earnings for both full-time and part-time workers. There are concerns about the validity of the LFS wage data as some of the responses are made by proxy, usually another family member, although it remains unclear why the ONS doesn't simply exclude such responses from their calculations. Last week we received an update of the LFS estimates, which are produced as three-month averages. To put these results in context, between May 2010 and March 2014 prices were up 11.63 per cent using the Consumer Price Index and 13.95 per cent using the Retail Price Index. In the year to March, the CPI rose 1.6 per cent while the RPI rose 1.8 per cent.

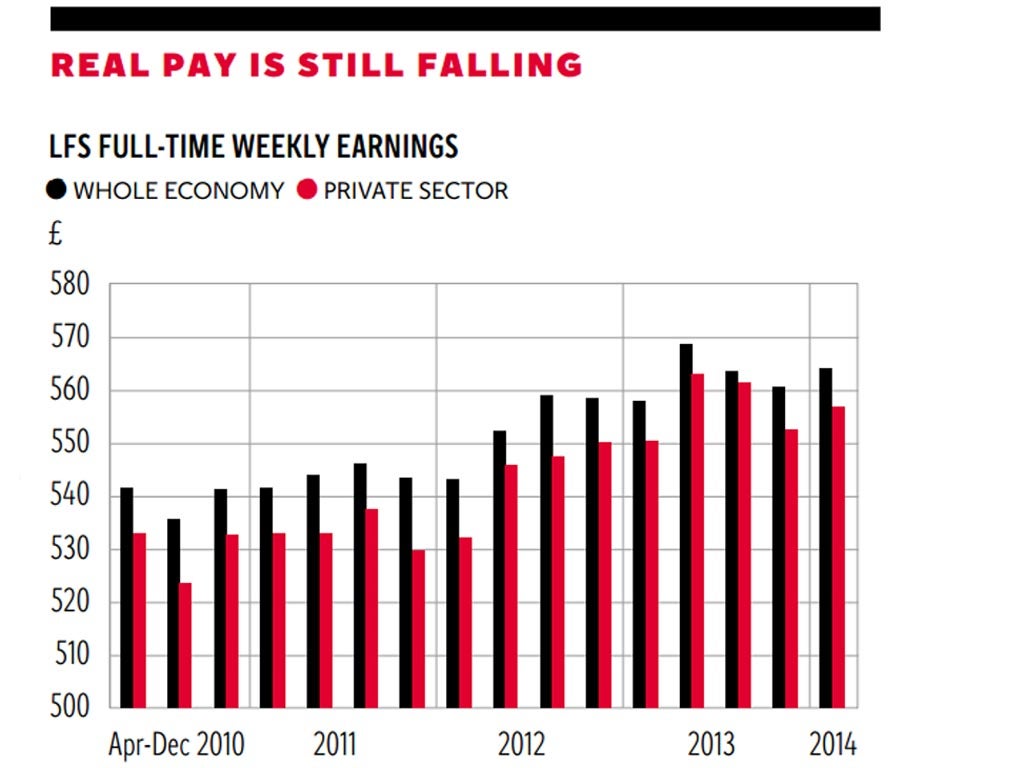

The LFS weekly earnings results are reported in the first chart. For the whole economy weekly earnings of full-time workers in the LFS were up from £561 to £564 compared to the previous quarter, 1.1 per cent on the year and 4.2 per cent since May 2010 (April-June 2010 data). In the private sector they were up from £552 to £557, or 1.2 per cent on the year and 4.4 per cent since May 2010. The results are similar when hourly earnings are examined. It is simple then to calculate changes in the purchasing power of worker's wages by simply deducting wage inflation from price inflation. According to the LFS, real whole economy earnings, whether hourly or weekly, have fallen by between 7 per cent and 10 per cent since the Coalition took office, depending upon which measure is used. Results for the private sector are similar. Real wages have fallen in every quarter since the Coalition took office and they continue to fall.

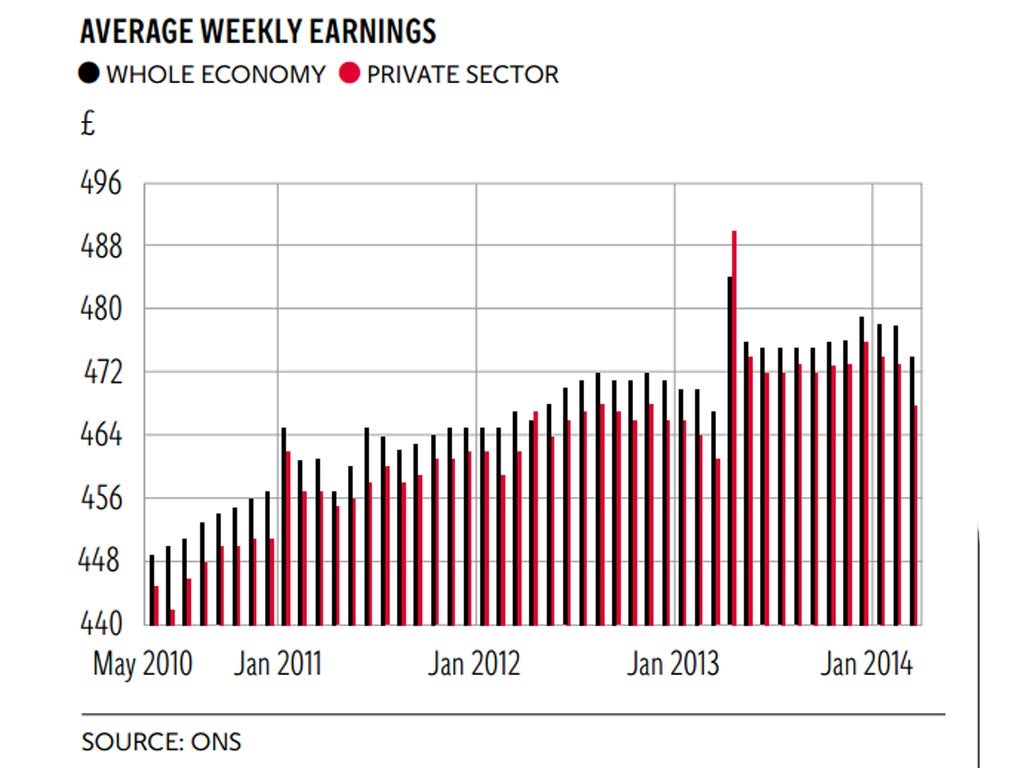

The same message is confirmed by data on average weekly earnings (AWE) illustrated in the second chart. Despite the fact the AWE excludes workers in the smallest firms, results are remarkably similar to those from the LFS. Both surveys exclude the self-employed. Average weekly earnings in March 2014 were £474, down from £478 in February, up 1.5 per cent on the year and 5.6 per cent since May 2010. Private sector earnings were also down from £473 to £468, up 1.6 per cent on the year and down 5.2 per cent since May 2010. So, real weekly earnings are down between 6 per cent and 8 per cent since the Coalition took office, depending whether you deflate by the CPI or the RPI. As with the LFS, real wages continued to fall on the year in the whole economy and the private sector.

In the latest Inflation Report, the Bank of England's Monetary Policy Committee said things are set to get worse, and quickly, because of the unusual spike in earnings in April 2013, because some people took advantage of the prospective reduction in the top rate of UK income tax to defer bonus payments until after the cut. Hence they forecast 3.5 per cent annual pay growth this March, before turning “markedly negative” in April. The spike is apparent in both graphs in April 2013. But we already know that private sector pay didn't jump by 3.5 per cent in March, only 1.6 per cent. The MPC seems to be right that there is a big negative coming next month, especially in the private sector, where pay jumped from £461 to £490, and £467 to £484 overall, in April 2013. April 2013 is the only month of the last 47 we have data for since the Coalition took office when wage growth was positive. So look out for lots of excuses from George Osborne when a large negative number appears next month - if it is £474, which doesn't seem unlikely, then annual nominal private sector wage growth will be around minus 3 per cent, with real wage growth close to minus 5 per cent. But it doesn't look like that's going to be a one-off given the jump in the base over the next 10 months or so to approximately £474. The base effects look likely to dominate for some time, while real wages at best remain flat.

I wish the MPC good luck with their forecast that real wages are set to rise in the second half of 2014. What I can say is that we are an extremely long way away from the point at which growth in real pay for private sector workers is “incontrovertible”. Forget the spin, look at the data. Real wages continue to fall.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks