The economy is turning a corner? No, Osborne is just taking us all for a ride

In the labour market evidence suggests many, or even most, are being left behind

Last week George “Slasher” Osborne gave a carefully orchestrated speech from a not-so-carefully chosen building site at One Commercial Street, London, in the centre of the City, where he claimed that Britain “is turning a corner”. Turning a corner on many roads, including mine, just takes you back to where you started from. Sometimes turning a corner takes you to a dead-end. It isn’t necessarily progress.

In the speech, Mr Osborne claimed that “just like this building, with office space, private flats and affordable housing, the job is not finished, but everyone will benefit. This is how we will build an economy that works for everyone”. But of course, starting at the very top and working down but very slowly.

If you go to the website www.onecommercialstreet.com you see adverts for four penthouse apartments with no prices; two from the City Collection for £1.4m and a further 18 Tower Apartments on the 12th to 19th floors with prices varying from £720,000 to £975,000.

The cheapest of these apartments costs 29 times average earnings so it’s hard to see how anyone but his rich pals benefit.

Just the place for the bankers to spend their bonuses and their high-end tax cut so they can have a weekday apartment, away from their weekend country pile. George said it best: “This building is a physical reminder of what our economy has been through.” It sure is.

Mr Osborne probably wasn’t well pleased to hear Mark Carney say at the Treasury Select Committee hearings that cutting public spending and raising taxes had been a “drag on growth”.

In contrast, the Chancellor claimed in his speech that the decline in growth was better explained by external inflation shocks, the eurozone crisis and the ongoing impact of the financial crisis. In other words, nothing to do with me mate.

He may have been equally unchuffed at Lord Wolfson of Next who commented that “we believe that talk of a full-blown recovery is premature... how can you have a recovery when people are getting poorer. Then there was Dalton Phillips of Morrisons, who noted that “for most people, at the end of the month there is no money left in their pocket”. Vince Cable wasn’t impressed either.

Mr Osborne also argued that “the evidence suggests tentative signs of a balanced, broad-based and sustainable recovery”, but the evidence does seem to the contrary especially in the labour market where many, or even most, are being left behind.

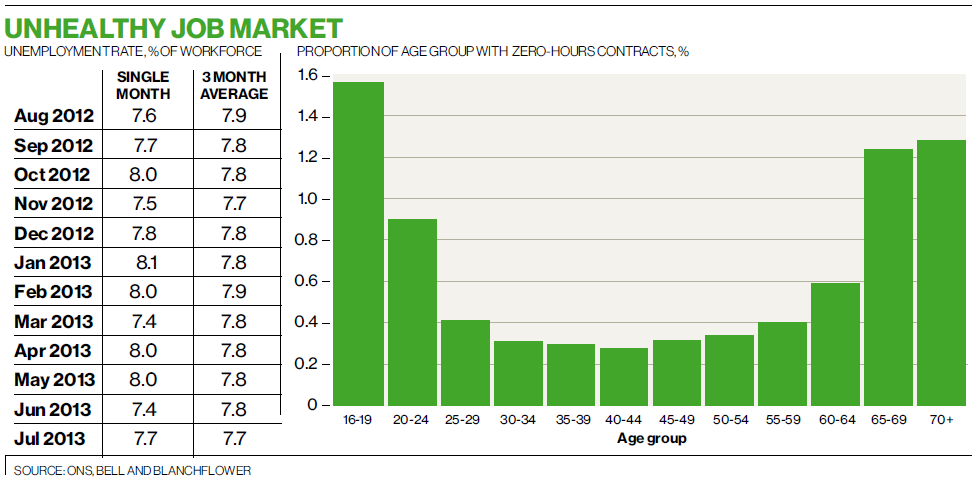

According to the KPMG/REC Report on Jobs, temporary hirings showed their fastest rise since July 1998. Permanent hirings remained strong, but the rate of growth slowed. The Office for National Statistics labour market release had a much more nuanced picture. The unemployment rate fell to 7.7 per cent but as the table above shows, there is little sign that it is trended downwards.

I report the single monthly estimates which jumped this month from 7.4 per cent to 7.7 per cent and the three-month, rolling average which suggests over the last 12 months the unemployment rate has been broadly flat at 7.8 per cent. The 7.4 per cents in June and March 2013 look like outliers; the big question over the next few months is whether they are duplicated.

Unemployment went up in six regions; the North-east, North-west, Yorkshire and Humberside, West Midlands, the East of England and Scotland. More than one in 10 of the workforce is unemployed in the North-east. Youth unemployment rose (+10,000) as did the numbers continuously unemployed for at least two years (+11,000). So we are not all in this together.

Of concern also is that average weekly earnings actually fell on the month, implying annual growth of only 0.6 per cent and, given CPI inflation of 2.8 per cent, suggests that real wages are falling even more sharply than in most of our lifetimes. In addition the number of part-timers who couldn’t find full-time work jumped again (+25,000).

Plus there are growing numbers on zero hours contracts. David Bell and I, in new work have found some new facts. There has been a trend increase in the number of workers who believe they are on zero-hours contracts. Our estimate is that 26.5 per cent of those on zero hours wish to have more hours compared with 0.9 per cent of those on other contracts.

The average extra hours wished for by those on zero-hours contracts was 21.7, compared with 16.6 hours for those on other contracts.

The other chart above shows our estimate of the share of zero-hours contracts by age group which implies zero-hours are U-shaped in age. This is consistent with our earlier work on underemployment showing that the young want more hours.

So the young are hit by a triple whammy – they can’t get jobs but when they do get them they have fewer hours than they would like and disproportionately they are on zero-hour contracts.

The Labour Party is on to something given its latest moves to emphasise unfairness. But the zero-hours contracts do present it with an obvious dilemma. It’s better to have a job than no job. If you abolish zero-hours contracts employers will give people two-minute contracts, or fire them and use temps or hire self-employed folks. The big question for Ed Balls and Ed Miliband is how to get real wages up.

Hard. Taxes are likely to be important to ensure that there is an incentive to work and the poor aren’t being left behind.

So the recovery is ploughing ahead, except for those who live outside the South-east, wage earners, the unemployed and the young. Maybe I missed a few? But the rest are doing great.

David Blanchflower is a professor of economics at Dartmouth College and a former member of the Bank of England’s Monetary Policy Committee

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks