The US sneezes and the UK still gets a cold

So let's hope the debt ceiling and spending cut negotiations are resolved swiftly and without mishap

So the art of cliff diving is not going to be practised by the US – for now, anyway. Fights over the debt ceiling and an expiring government spending Bill involving cuts in both defence and other spending have been delayed but will follow in a couple of months.

At the final hour the House of Representatives passed the American Taxpayer Relief Act on a vote of 257 to 167. The vast majority of Democrats voted for it –172 to 16 – compared with only one third of Republicans (85 to 151), including the vice-presidential candidate Paul Ryan.

The Republican Majority Leader, Eric Cantor, voted against, and the ideological divide within the Republican Party was complete. From a British perspective it is difficult to understand why he doesn’t have to quit, given his failure to back the party line: it looks like a resigning matter to me. The infighting in the Grand Old Party has really started.

The Bill had been passed the night before by the Senate by a bipartisan majority of 89-8. Predictions by the Congressional Budget Office suggested that without a deal US GDP in 2013 would have fallen by 4.5 per cent, pushing the US economy back into recession, and the unemployment rate would have gone back to double figures from the current 7.7 per cent.

The right wing of the Tea Party, who voted against the deal, seems more interested in playing ideological games than governing the country. The polls show that President Barack Obama’s ratings have risen since the election, while those of the GOP have fallen.

Partisanship

The next day Chris Christie, Republican governor of New Jersey, whom many Republicans blame for contributing to Mitt Romney losing the election because of his willingness to put aside politics to work with Mr Obama during Hurricane Sandy, lambasted his fellow Republicans in Congress for delaying a vote on a bipartisan compensation package for victims in New York and New Jersey. He said: “Americans are tired of the palace intrigue and political partisanship of this Congress, which places one-upmanship ahead of the lives of the citizens who sent these people to Washington DC in the first place. America deserves better than yet another example of a government that has forgotten who they are there to serve and why. Shame on you. Shame on Congress.” This looks like old-time pay back.

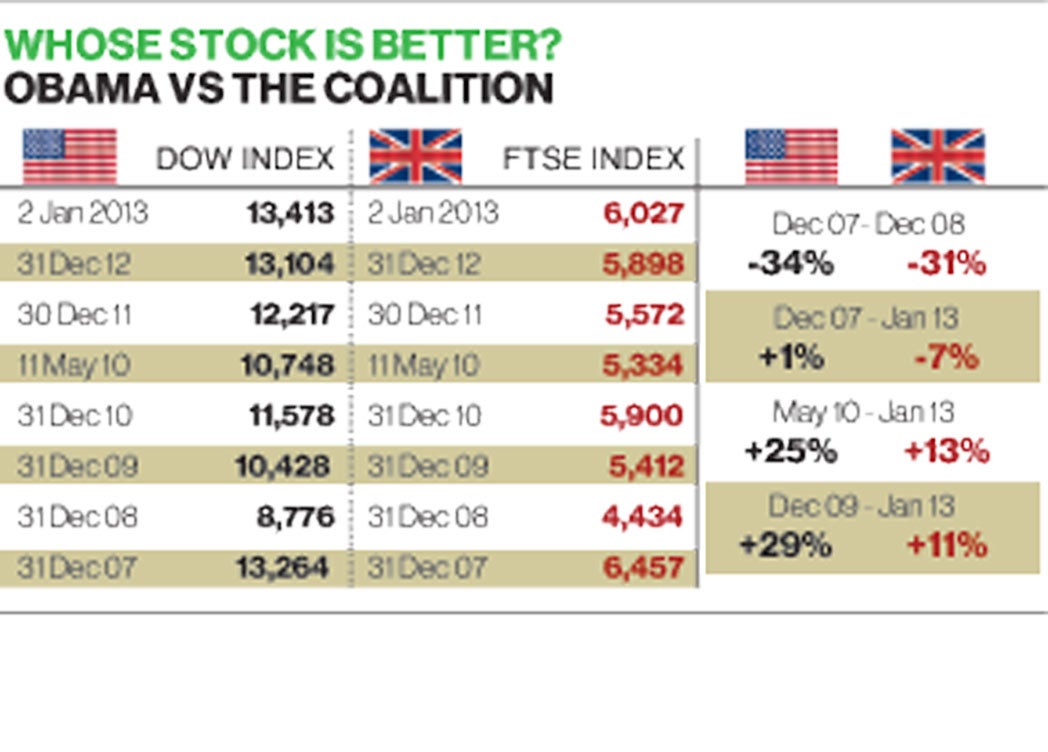

The markets had essentially priced in that the deal would be done, but even then there was a nice relief rally in most equity markets around the world, including the FTSE, which was up 2.2 per cent, and the Dow, which rose to 13,413, up over 308 points, or 2.4 per cent. As the table above shows, that rise in the Dow took it above the level it was at the end of 2007, whereas the FTSE is still 7 per cent below that level. Since Mr Obama came into office at the beginning of January 2009 the Dow is up 29 per cent, compared with a rise of 11 per cent for the FTSE. The FTSE has risen 13 per cent since the Coalition took office in the UK in May 2010; over the same period the Dow is up 29 per cent.

Compared with continuing 2012 policies, the agreement will raise tax revenues by $620bn (£380bn) over the next decade, according to the White House. The Bush tax cuts are being made permanent for American households earning less than $450,000 for married couples, well above Mr Obama’s election promise of a cap of $250,000. The rich are the big losers as they will pay more with a jump in the top tax rate from 3 per cent to 39.6 per cent: the first jump in their tax rates for two decades.

Unemployment benefits for 2 million unemployed were extended for a year, but social security payroll tax cuts of 2 per cent expired, so they will rise from 4.2 per cent to 6.2 per cent. This move alone, according to the non-partisan Tax Policy Center, will increase taxes on around three-quarters of households, and will pull as much as $125bn out of the economy in 2013.

According to economists at JPMorgan Chase the elimination of the payroll tax cut will reduce growth in the first quarter of 2012 to 0.25 per cent from 0.75 per cent in 2012Q3. So job creation will inevitably slow.

Debt Ceiling

The debt ceiling is the next thing on the political agenda; failure to sort the problem out in August 2011 caused the US to lose its AAA credit rating. This arises because of the need to raise the $16.4 trillion debt ceiling. Republicans want debt limit increases to be matched dollar-for-dollar with spending cuts, while Mr Obama wants future deficit-reduction deals to feature a “balanced” approach that includes spending cuts and further tax increases.

At a press conference late on New Year’s Day, after the House vote, Mr Obama declared: “While I will negotiate over many things, I will not have another debate with this Congress over whether or not they should pay the bills that they’ve already racked up through the laws that they passed. Let me repeat: we can’t not pay bills that we’ve already incurred. If Congress refuses to give the United States government the ability to pay these bills on time, the consequences for the entire global economy would be catastrophic, far worse than the impact of a fiscal cliff.

“People will remember, back in 2011, the last time this course of action was threatened, our entire recovery was put at risk. Consumer confidence plunged. Business investment plunged. Growth dropped. We can’t go down that path again.”

The battle lines are being drawn. Thankfully some of the downside risks to UK economic growth have been reduced, although many remain. The fact is that, for now, the US has avoided going over the fiscal cliff is good news for the UK.

I recall travelling back and forth from the US to the UK for Monetary Policy Committee meetings in 2007 and 2008 and watching the Great Recession spreading from the US to the UK as night followed day. Nobody much seemed to notice for many months, including all the other eight members of the MPC, who apparently were asleep at the wheel. All of the talk that the two countries had decoupled was abject nonsense then, as it is now.

When the US catches a cold, the UK gets pneumonia. Let’s hope that the debt ceiling and spending cut negotiations are resolved quickly and without mishap. Slasher Osborne is a very interested observer.

David Blanchflower is a former member of the Bank of England’s Monetary Policy Committee

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks