Look out for financial crisis part II: Donald Trump has just appointed a key architect of the 2008 global meltdown

The man who had to say 'sorry' to Congress in 2010 for multi-billion dollar losses is the same man being appointed to oversee economic policy in Trump's cabinet

Boom and bust economic theory suggests that, however we regulate banks, we should expect another financial crisis in the near future. With Goldman Sachs president and COO as the new national economic council director under Donald Trump, that theory might materialise a lot quicker.

Besides the anti-gay, anti-women, anti-Jewish, anti-Muslim men and women that are already in the cabinet of hell, Mr Trump has just appointed one of the most powerful men on Wall Street and a key architect of the 2008 financial crisis.

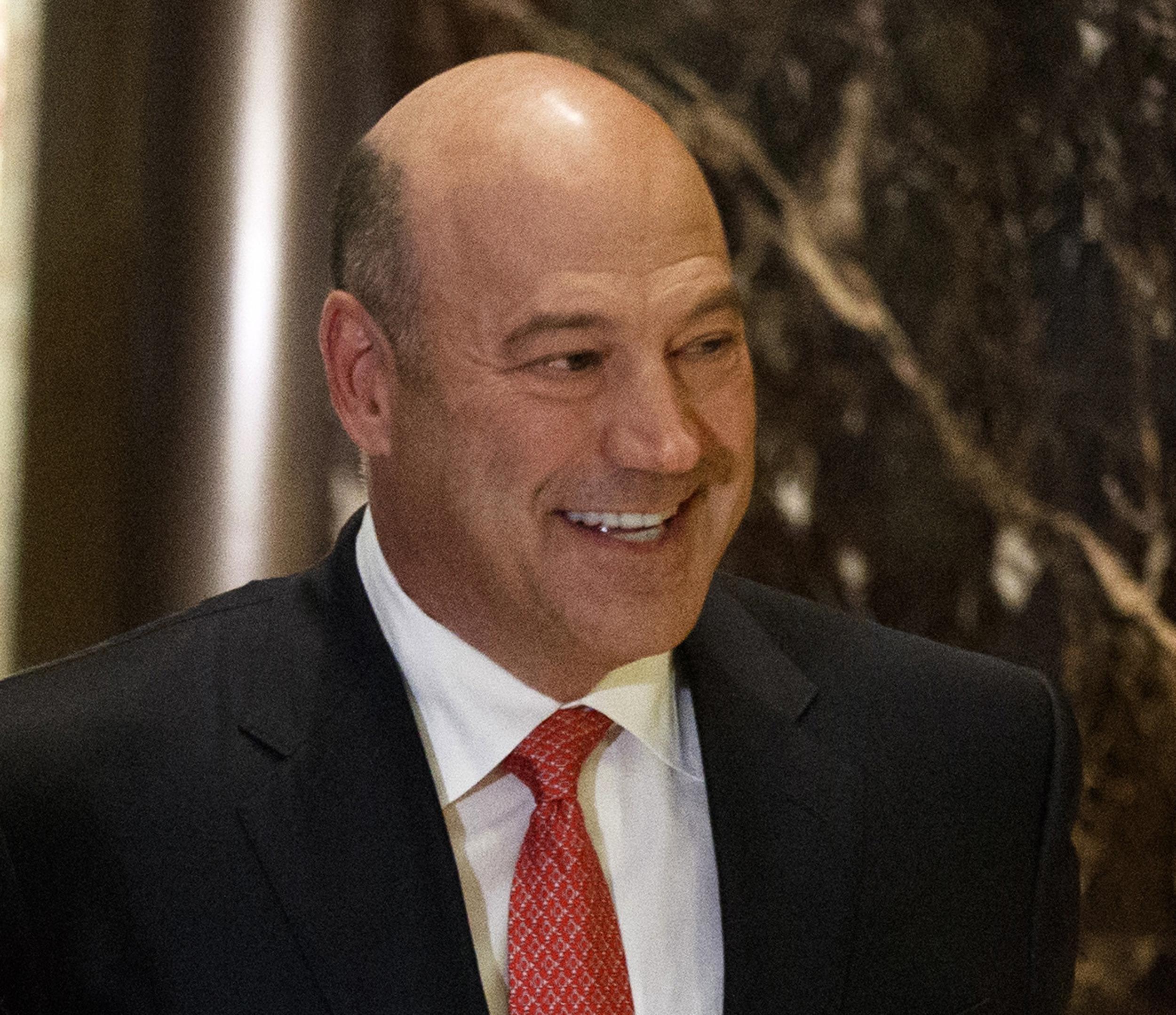

Pinning blame for the world’s financial crisis of 2008 on one man or one bank would not be fair, but Gary Cohn and his entourage at Goldman Sachs is a good place to start.

What is indisputable is the root of the crash: the systemic mis-selling of risky assets from banks to consumers. Sub-prime mortgages were handed out like free candy on Halloween. And when consumers started defaulting like a pack of lemmings throwing themselves off a cliff, banks were swirling overhead like vultures. But before long, banks crashed too, ultimately leading to global instability and the destruction of people's livelihoods.

Mr Trump said he wanted to "drain the swamp" of Washington DC.

So why did he hire someone who is second in command at one of the biggest Wall Street banks and who is known for his "abrasive" management style and his appetite for taking financial risks?

The bank that he built up lost billions of dollars during the crisis, and $1.2 billion of that was lost from the residential mortgage business alone - a section of the business he had pushed to expand before 2008.

"Of course, we regret that we did not do many things better: like having less exposure to leveraged loans, which caused us approximately $5 billion in losses, having less exposure to mortgages, and, it should go without saying, we wish we had seen more proactively the effects of the housing bubble," he told Congress in 2010.

The losses were, he said, proof that the bank and consumers all went down together. Yet somehow, Cohn stayed dry on board that massive, sinking ship.

The champion of trickle-down economics earned more than $60 million between 2012 and 2015 alone - not including shares and stock options etc - and he, along with every other white, middle-aged man with a Rolex, escaped imprisonment for the US government’s largest bailout in history. In goverment, he can liquidate all his shares in the bank, worth $212 million, tax free.

Mr Trump also admitted that he had been rooting for the housing crisis. As a real estate developer in the wreckage of the crisis, he made a fortune from picking up bargains. Oh well, that's capitalism right?

Now just a few years after the crash, perhaps the memory of people’s suffering has dimmed in Cohn's brain, or the hunger for risk-taking is back.

Cohn has given numerous speeches to universities and has consistently lobbied Congress, arguing that although banks are safer now than pre-2008, they are not better. His logic is that banks being hampered by regulations means that consumers suffer. Has he conveniently forgotten how much we suffered without regulations less than a decade ago?

Forget the Dodd-Frank Act and large capital buffers for banks. The era of less regulation, no ring-fencing and big risk-taking will be back within a few months.

The barefaced hypocrisy of Trump’s cabinet seemingly has no limits. Thanks to an ignorant, narcissistic, self-entitled president-elect, people all over the world will face the consequences of a cabinet of yet more white, self-entitled, self-serving hypocrites who will rub their hands with glee every time they see a buying opportunity.

The golden rule in capital markets is that for every seller, there is a buyer on the other end of that trade, ready to take advantage. But Cohn and his generation forget that when he takes a risk, the world takes a risk with him.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks