Yes, the pound plunged after the exit poll – but Corbyn can't harm our economy more than a hard Brexit

Would it be the worst thing in the world if nothing got done for a while, and a shaky coalition said, you know what, we’ll stay in the European Economic Area for a bit and see how it goes? No it most certainly wouldn't

Crash, bang, wallop. Yes, as soon as the first exit poll was in, and pointing to a possible hung Parliament, the markets started having a tizzy. We’re doomed, I tell you, doomed! What’s happened to the “strong and stable government” we were told was a cert?

Theresa May’s hubris, and a desultory campaign, was what happened. Letting a lead of – what was it – 20, 25 points – has quickly evaporated. Quite an achievement.

Barely had the poll surfaced and the panicky predictions were flying in. UBS was first out of the stalls: this does not bode well for the Brexit negotiations, they said. As if they were going to go well with Theresa May getting a comfy majority. Chaps, have you not seen the people around her who would in theory end up running the negotiation?

Time to take a chill pill. For a start, it’s going to be a long night and the poll might be wrong. Someone might have to eat their hat. Perhaps not Paddy Ashdown, and certainly not the boss of YouGov. Its polls might have come closest. Someone, though.

However, here’s the thing. Compared to Brexit, the market reaction to the poll was a barely perceptible wobble rather than anything serious.

The pound fell by 2.5 cents against the dollar on its release, about a cent against the euro, and it then started inching back up (it’s only a poll, after all).

The Brexit vote? That knocked 10 cents from the value of sterling. So, context.

FTSE 100 futures rose a bit, because that’s what happens when the pound falls. Then they started drifting off (Jeremy Corbyn in No 10? Nooooo!)

However, the business community more generally might be less disturbed about this than the initial wobble might suggest. The biggest economic risk facing Britain is, after all, not Jeremy Corbyn but a chaotic, hard Brexit. Most strategists were (until the poll) predicting just that.

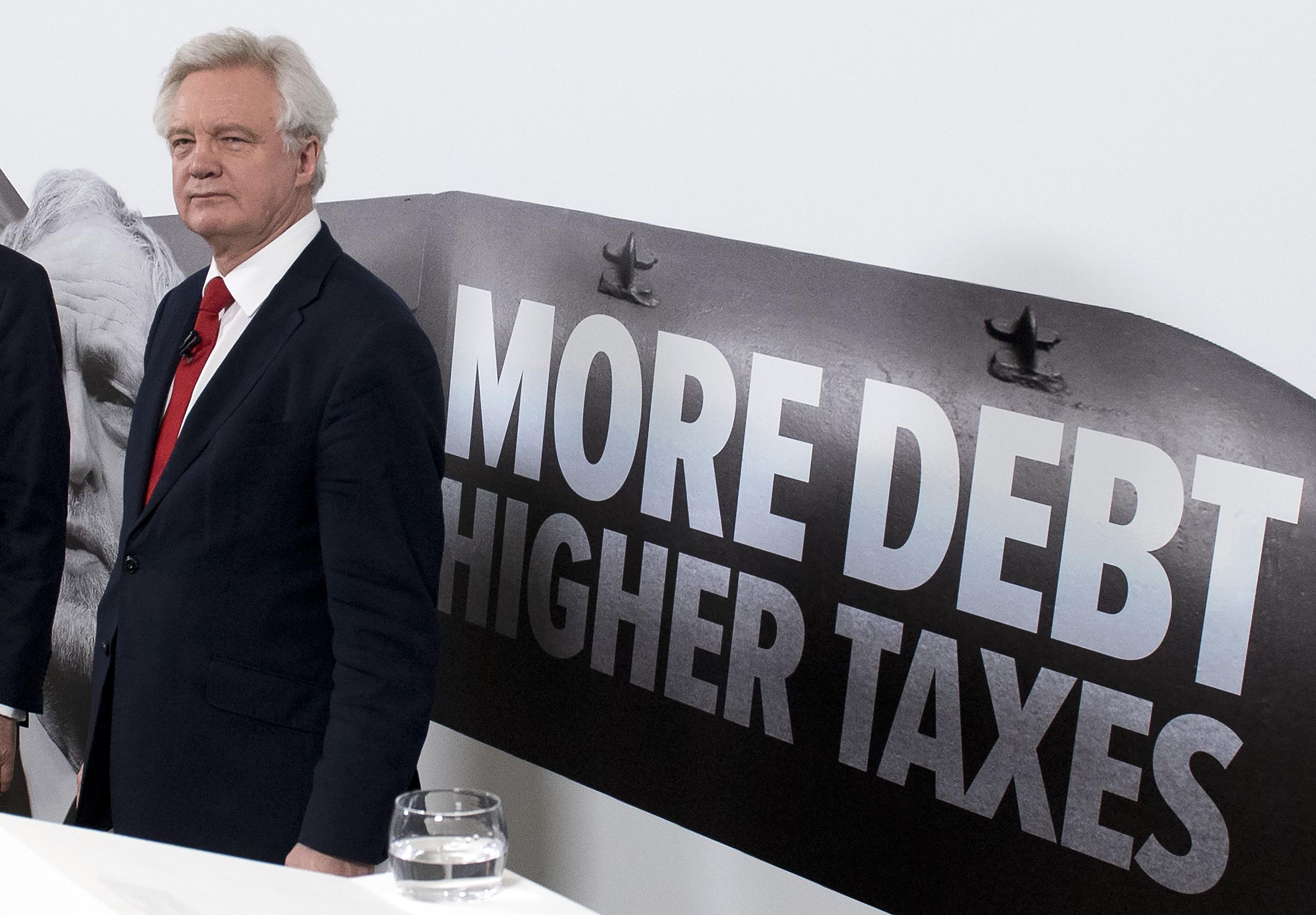

Conservative ministers keep saying no deal is better than a bad deal, when in fact no deal is the worst possible option. Moreover, people are starting to believe that the swivel-eyed EU-haters dominating the party’s thought processes right now mean it about flouncing off into the North Sea.

If that happens, exporters to Britain’s biggest overseas trading partners will overnight start facing WTO tariffs. They could be every bit as damaging and destructive to the UK economy as Labour’s plan to hike corporation tax (which anyway might not happen).

Would it be the worst thing in the world if nothing got done for a while, and a shaky coalition said, you know what, we’ll stay in the European Economic Area for a bit and see how it goes?

A bit more tax, but stable-ish free-ish trade? That might not be such a bad idea.

Business would not love the instability – it never does – but once business leaders start thinking about it, it might be the least worst option.

Which was what the election was all about for a lot of people anyway.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks