Finally, we have a turkey in banking who will vote for his own roasting

We do not know how much the 54-year-old Cryan, a lifelong investment banker, takes home himself, but we can assume it will be a fairly hefty chunk of cash. Does this make him more or less qualified to stand in judgement on others in his industry?

“Many people in the [banking] sector still believe they should be paid entrepreneurial wages for turning up to work with a regular salary, a pension scheme and playing with other people’s money. There doesn’t seem to be anything entrepreneurial about that.”

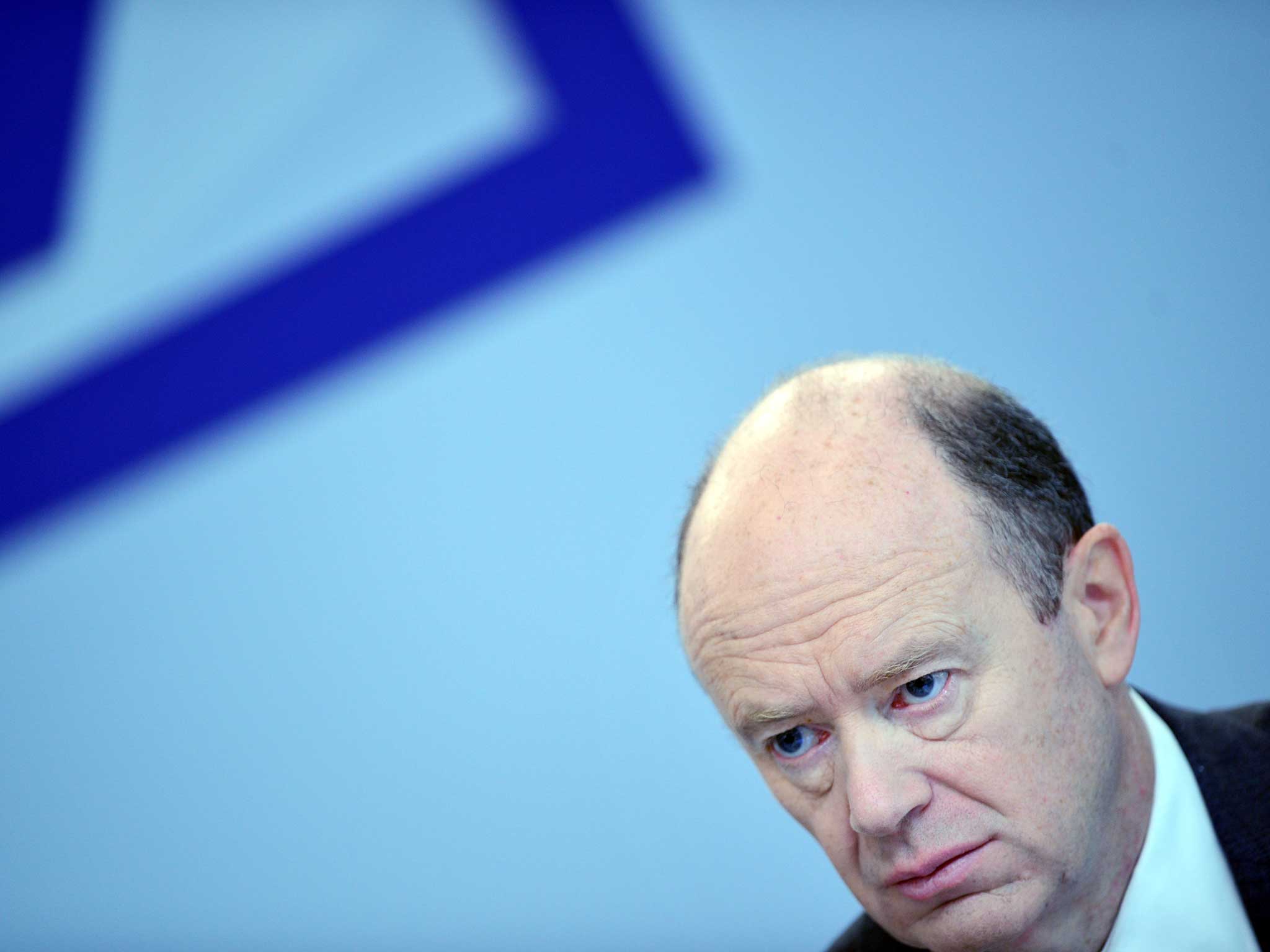

These words, which no one in the real world would be inclined to disagree with, come not from Jeremy Corbyn or Owen Jones, but from the most unlikely of sources. John Cryan took over as joint chief executive of Deutsche Bank earlier this year, and his comments, made at a conference in Frankfurt this week, remind us that, while the banking industry has been forced to reform, and is now regulated within an inch of its life, the trough is still full of fleshy snouts.

As we approach the season of bonuses, Cryan’s intervention is particularly timely, and powerful. He was critical of the rewards for short-term success. “We should reflect on people’s contribution over a much longer period than one year,” he said – and felt that the bonus culture didn’t necessarily make people work harder, but changed the way they acted. “I’ve never been able to understand the way additional excess riches drive people to behave differently,” he added.

Note the precision in the use of language here. Additional and excess riches. Most of us would be happy with either additional or excess riches, but this being the banking sector, it’s a double bubble. And Cryan may be alone in not understanding how the prospect of a top-of-the-range Lamborghini or a watch costing the same as a house will motivate people on the trading floor to take more chances or push at the edges of legality.

Cryan, a Briton at the top of Germany’s biggest bank, has problems of his own. Deutsche Bank has, in recent times, been ravaged by scandal and poor performance. It was fined £1.7bn for rigging Libor rates earlier this year, and last month the bank warned that it would lose £4.4bn in the third quarter. Cryan is reportedly planning to cut 8,000 jobs in the coming years, so it’s clear that his speech was designed for an internal audience, as much as the outside world. He has already warned Deutsche Bank employees that their bonuses will reflect the cost of past misdemeanours.

We do not know how much the 54-year-old Cryan, a lifelong investment banker, takes home himself, but we can assume it will be a fairly hefty chunk of cash: his co-chief exec received pay and perks worth £4.7m last year. Does this make him more or less qualified to stand in judgement on others in his industry?

Some have already pulled up the drawbridge, but Cryan should be applauded – no matter how rich he is, or becomes. The culture of excess in banking has survived all manner of public and regulatory reproof, and even if Cryan’s is a lone voice echoing in a black hole, it’s about time someone from within spoke up. There is nothing more commendable than a turkey who votes for Christmas because he believes in it.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks