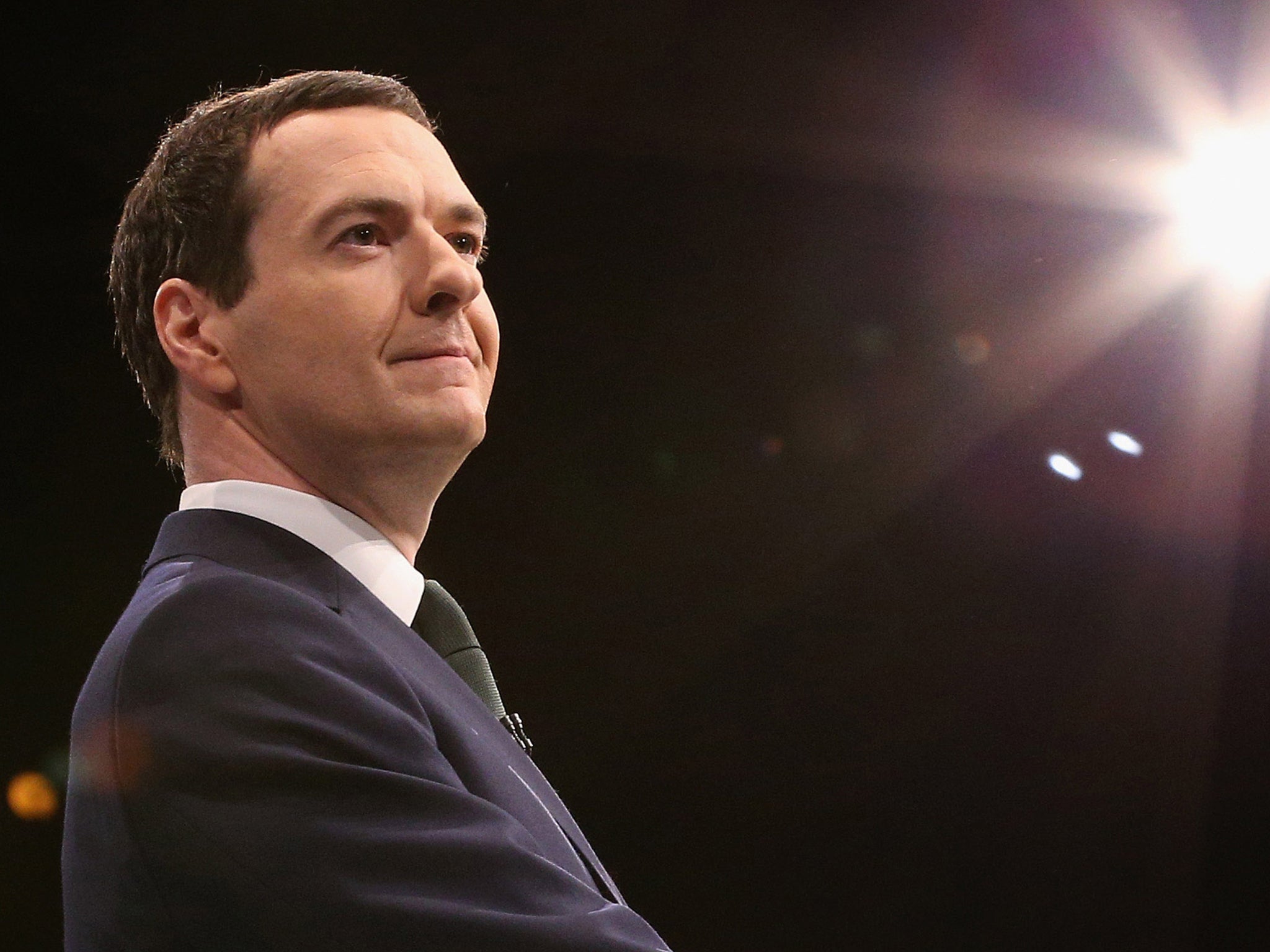

George Osborne knew what would happen if he cut tax credits – and did it anyway

Making a very big reduction in one single leap was not a mistake

The growing furore over cuts to tax credits has many familiar ingredients: an internal revolt, dissent from parts of the normally supportive media, an emotional intervention from a member of the Question Time audience, as well as a Prime Minister and Chancellor standing firm for now – but not for much longer. The policy has been compared in its calamitous electoral implications with Margaret Thatcher’s poll tax, an initiative that played its part in her fall.

The comparison is another familiar ingredient that comes into play at this stage of the sequence: a degree of disproportionate hysteria. In terms of a political calamity, the poll tax is in a league of its own. It hit nearly all voters and not just the low paid. There were riots in Tory Kent and the Conservatives never recovered in Scotland.

The current situation is nowhere near as politically grave, but there are some revealing parallels. For the ideologically committed, there was logic to the poll tax, a measure aimed partly at making councils more efficient and accountable.

Thatcher also made a perfectly rational political calculation. She assumed the poll tax would be less unpopular as a way of paying for local services compared with the alternative – local rates on properties. She had become a star in her party during the October 1974 election when she pledged to abolish the property tax. She never forgot the impact of that pledge and promised again to abolish the tax on properties in the 1987 election that she won by a landslide.

At first Thatcher did not believe the estimated poll tax bills. The then Environment Secretary, Chris Patten, told me at the time that he used to present the mind-boggling and accurate predictions to Thatcher: “Margaret Hilda looked at them for a few seconds and told me they were wrong.”

Fast forward to the current crisis in relation to the cuts in tax credits. Once again there is logic. George Osborne needs big savings to meet his obsession with wiping out the deficit quickly, even if nowhere near as speedily as he originally envisaged. Polls suggest welfare cuts are popular. Osborne seeks to move to a higher-wage economy where workers earn more and are no longer dependent on welfare benefits. This is a good idea. The former Labour leader, Ed Miliband, made a similar case for what he called “pre-distribution”. But the term was incomprehensible and Miliband did not develop the policy partly out of fear of appearing “anti-business” by proposing an immediate compulsory national living wage. Osborne’s announcement of a new living wage, or an increase in the minimum wage, was significant by comparison. Labour would not have risked adding such a burden to employers so quickly.

In some respects Osborne had no choice but to announce a “living wage”. The impact of his welfare cuts would have been even more brutal had he not compelled employers to make up some of the gap. But there is still a big gap for low earners, such is Osborne’s determination to cut spending. How much more sensible it would have been for the Chancellor to announce with a flourish the new living wage or higher minimum wage as a way of maintaining incomes for low earners. He would still have made a substantial saving on paying out tax credits, but obviously not the same very big reduction in one single leap.

The leap is not a “mistake”. He made his move knowing some of the risks. Early in the summer after their unexpected election victory a senior government insider told me that David Cameron and Osborne knew they faced three big challenges with their tiny Commons majority: the decision on airport expansion, Europe and the cuts to tax credits. While Europe and airport expansion hover without obvious resolution, the cuts were announced immediately, a product of ideological logic and electoral calculation.

Yet there is something very troubling about the decision. Cameron and Osborne made a One Nation centrist pitch after their election victory. A severe cut to tax credits is directly at odds with such an approach. When deciding to implement the policy, did the duo discuss the degree to which it would undermine their pitch? Did they anticipate the opposition of The Sun? Did they reflect on the hardship that would arise?

No one would cite the relationship between Tony Blair and Gordon Brown as a working model, but the mutual suspicion did mean their respective proposals were ferociously scrutinised. Osborne ranges at least as widely as Brown across government, but is not subjected to the same critical scrutiny from No 10. The strong support for Osborne in the media is also double edged. The Budget in which the tax credit cuts were announced was widely hailed as an address of such centrist brilliance that the 2020 election was as good as won. Brown despaired of Blair’s interference and vice versa, but sometimes the obstructions stopped one or the other from going too far. Osborne has gone too far.

Last week, the Chancellor interviewed Charles Moore about the latter’s biography of Margaret Thatcher. Osborne displayed genuine curiosity and wit, powerful weapons in politics and indeed media. At one stage Osborne asked Moore what a Chancellor should do when asked to implement a disastrous policy. He was referring to the poll tax and the impotent disapproval of Thatcher’s Chancellor, Nigel Lawson. And yet there he is, going too far with a policy that will hit low earners his Government is meant to admire. Sometimes the attractively curious Osborne is not curious enough about the consequences of his own policies.

No doubt he will ease the pain of cuts to tax credits while insisting there is no change. The revision will be straightforward compared with the abolition of the poll tax. The worry is that the sweeping cuts on the working poor were considered acceptable in the first place.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks