Does Big Short investor Michael Burry know something we don’t about AI?

Nvidia, the $5-trillion chipmaker, is suddenly worth billions more than was forecast – at a moment that the entire AI bubble was predicted to burst. So why is the man who correctly predicted the 2008 global crash shorting stocks, asks James Moore

Hollywood loves a sequel – and, thanks to the AI bubble, I think I have the perfect idea for one.

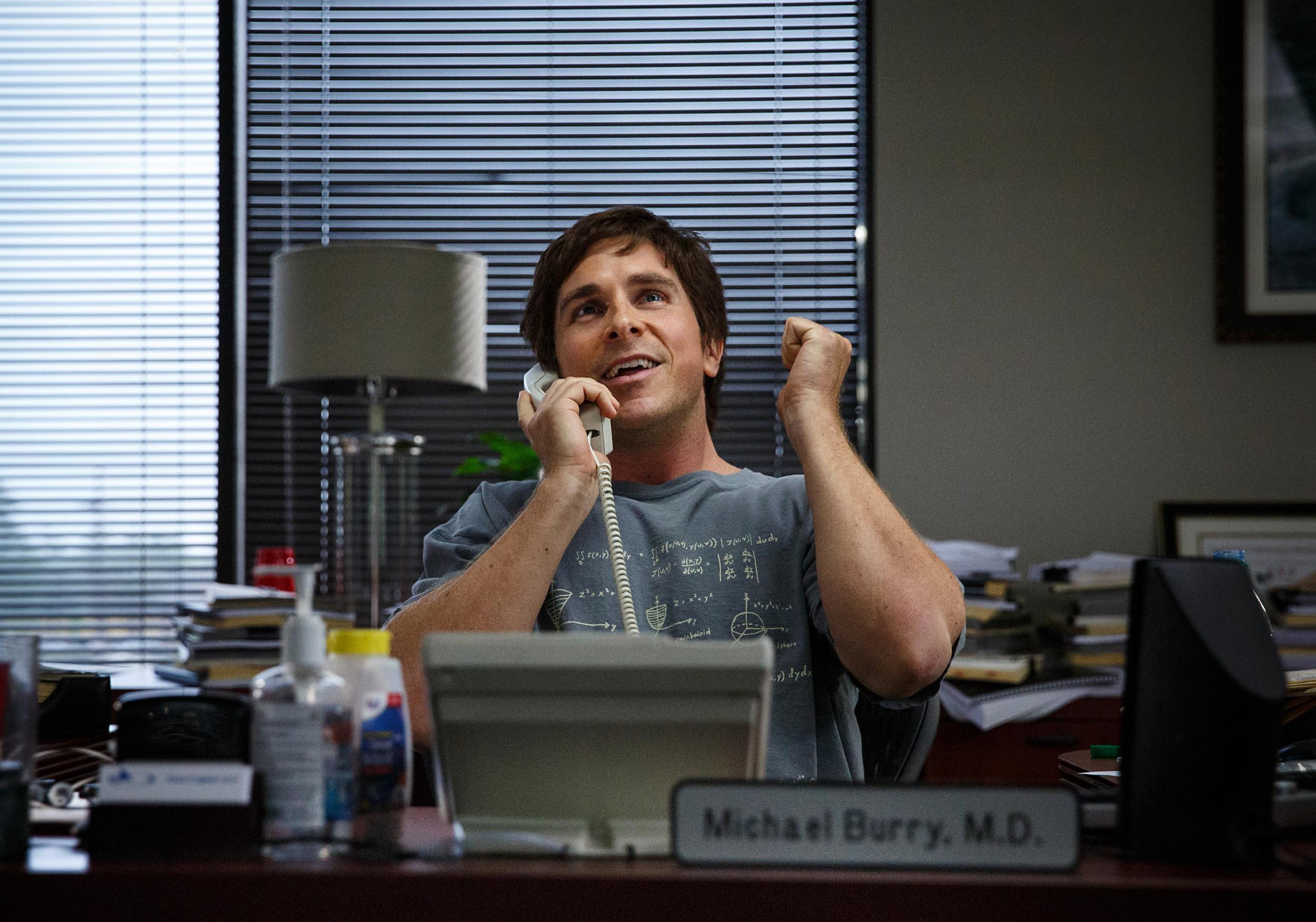

Released in 2015, The Big Short was an Oscar-winning adaption of Michael Lewis’s non-fiction book about America’s sub-prime mortgage meltdown that caused the 2008 global financial crisis. Christian Bale starred in the film as Michael Burry, the Californian hedge-fund investor who was among the few who noticed that a vast number of home loans had been advanced to those with poor credit histories and less well-off, and were dangerously close to defaulting – and bet against it all.

Burry’s “big short” of the US housing market was phenomenally successful, reportedly making him an $800 million profit as financial institutions from Bear Stearns to Lehman Brothers collapsed, and banks – including Bank of America – required government bailouts to survive.

Earlier this month, amid concerns that the AI tech bubble was about to pop, Burry bet against Nvidia, the juggernaut AI chipmaker that was briefly the world's most valuable company and which was the first to reach a market capitalisation of $5 trillion; and Palantir, the data analytics giant that uses AI-powered super-databases, and which was the top-performing stock in the S&P 500 last year.

By taking a large short position against the superstar stocks of artificial intelligence, Burry has again set himself apart from the markets. Which is why I believe it’s time for a follow-up to Christian Bale’s film – The Big Short 2: The Wrong Shorts.

Or maybe not quite yet. Burry’s high-profile shorting of Nvidia and Palantir has so far come to nothing. Fears that the AI bubble was popping evaporated this week when the chipmaker unveiled its forecast-beating third-quarter results. When it posted another set of record-breaking quarterly figures – which, at $65bn, were larger than even the wildest estimates – shares rose by 4 per cent.

I suspect that the figures will prompt no small amount of schadenfreude at Burry’s expense. Suffice it to say, I’m not among those laughing, shamefully or otherwise. He might look like he’s got this one badly wrong. Indeed, he has already deregistered Scion Asset Management, his hedge fund, with America’s Securities & Exchange Commission, effectively closing it.

In a letter to his investors, who’ll get their capital back by the end of the year, Burry explained his valuation views have been out of sync with those of the markets for some time. So he’s no longer going to manage their money.

However, this is not Burry waving the white flag. He’ll still be looking after his own considerable pot of capital, and he’ll still be making bets with it. What he won’t have to do is put up with his investors squawking each time a company he’s down on beats expectations with a quarterly results statement and the herd rushes in while he’s on the outside. You can hardly blame him for asking why he needs the grief.

Burry has long taken a decidedly contrarian stance against artificial intelligence, flagging “suspicious revenue recognition” across the AI sector. At a time when most people are falling over themselves to follow the latest investment fashion, contrarians are very welcome.

Remember the last tech boom? It emerged during the birth of the internet in the late 1990s, when the early dot.coms used to put out statements gushing about the number of page impressions they’d achieved while pooh-poohing concepts such as revenues, and especially profits, as outdated and old hat.

None other than billionaire investor Warren Buffett, the legendary ‘Sage of Omaha’ missed out. He once confided that he did not understand tech valuations. Rightly, as it turned out. Too many of the first generation of dot.coms had built castles of sand, which got blown away.

Yes, the 95-year-old CEO of Berkshire Hathaway, who plans to step down in the new year, missed out on some handsome returns from riding the tech tiger up and quitting before the royal hunting party shot it. However, Buffett’s reputation has remained stellar.

Side note: Buffett recently jumped into Google’s holding company, Alphabet. Does this mean he’s ditched his antipathy towards frothy tech stocks and forgotten all his arguments about their fancy-pants valuations? Not if you consider his “castle and moat” investment philosophy, which means protecting long-term profits and market share from rivals.

Google’s search business gives it that. It enjoys a dominant position, which won’t be challenged anytime soon. It will still be printing money if/when the AI bubble pops. It can survive such an extinction-level event – and potentially emerge as one of the victors, should this technology prove that it is all it is cracked up to be. But also if it doesn’t.

I’m on the same page as Burry and Buffet and think the AI bubble will pop sooner or later. Even Sunder Pichai, Alphabet’s CEO, has warned that the AI investment boom has “elements of irrationality”.

Burry’s timing might have been out with AI stocks, but he may yet have the last laugh. Perhaps the screenplay for The Big Short 2 should be a comedy?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks