Treasury to consult Singapore on new financial services regulation

A new deal will boost trade with the city state, Chancellor Rishi Sunak said

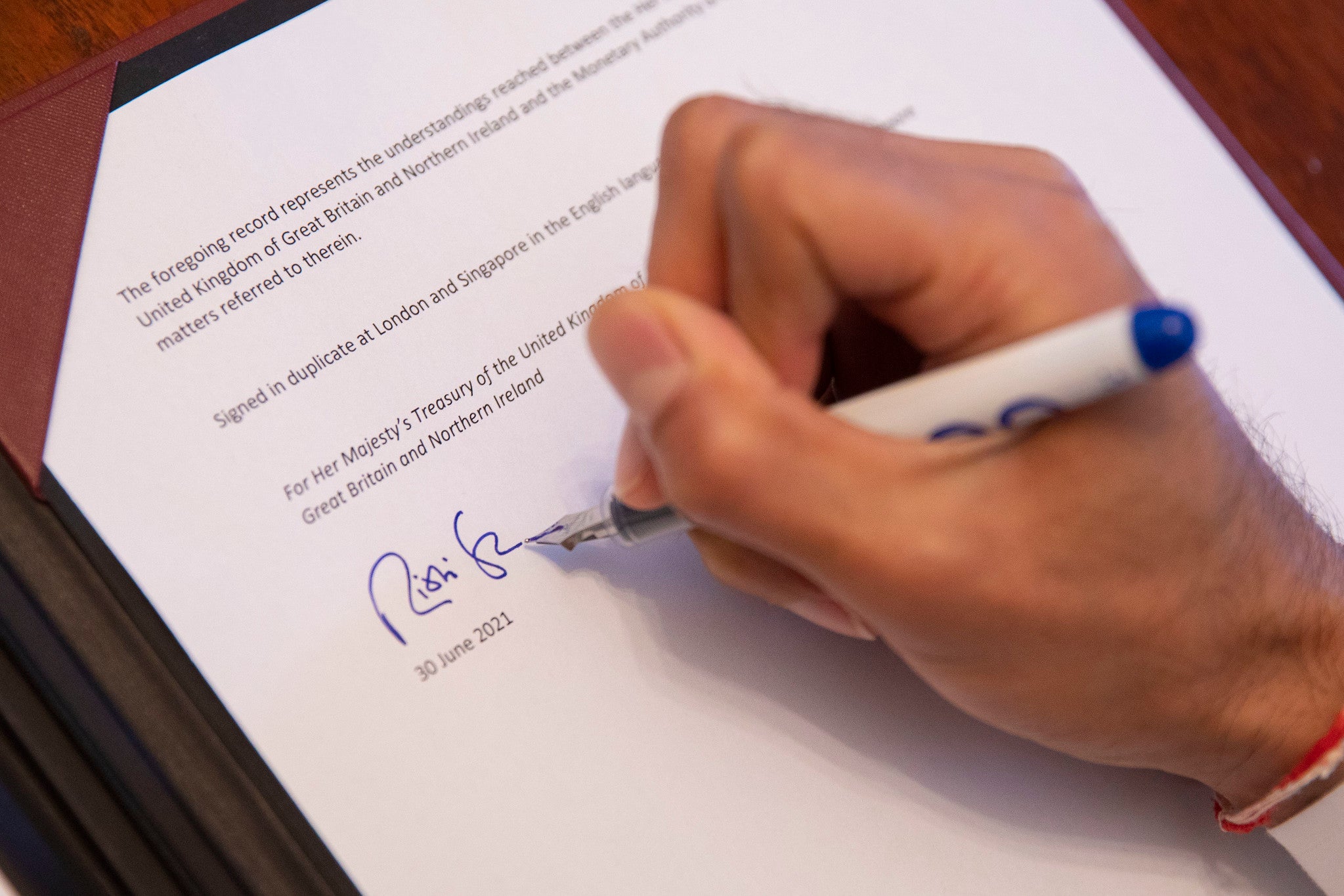

The Treasury will consult with Singapore’s authorities when planning to introduce new financial services regulation under a deal signed by the Chancellor on Wednesday.

Rishi Sunak said the agreement would help increase trade with Singapore and other countries in the region, and spark new collaboration on financial technology and green finance.

The memorandum of understanding between the Treasury and Singapore’s central bank will allow both to comment when their counterparts plan to make new rules for financial services that affect the two countries.

It will also see them working towards ensuring that regulatory and supervisory frameworks for the sector are compatible in both countries and commits them to lobby international bodies together.

“Our financial services industry helps to grow the economy and create jobs, and today’s agreement is a landmark step in showing the UK – as one of the world’s pre-eminent financial centres – is both open to the world and committed to maintaining the highest standards of regulation,” Mr Sunak said on Wednesday after signing the deal.

“Our financial partnership will help increase investment and trade with Singapore and the Asia-Pacific region and boost collaboration on important areas such as fintech and green finance.”

The deal will reduce frictions for firms serving the UK and Singapore markets and recognises that both systems are trying to achieve similar outcomes.

Since the 2016 referendum, some politicians and businesspeople have advocated for the UK to set up a system termed “Singapore-on-Thames” after Brexit.

The idea would see the country become a low-tax and light regulation economy, setting it apart from the more heavily regulated European model.

However, the concept has also attracted criticism, not least from those who say that too much divergence from the EU rules could make it more difficult for UK firms to operate in the bloc.

During discussions on Wednesday, Mr Sunak and Monetary Authority of Singapore chairman Tharman Shanmugaratnam reiterated the importance of green finance and developing markets for carbon.

They also had a “productive conversation” about new payment methods like e-wallets and digital financial services.