Black gold rush: boom and bust and boom again in Pennsylvania

In the oilfields where John D Rockefeller drilled his way to a fortune, business is booming once more. Rupert Cornwell reports

"I feel like I'm taking care of a herd of cows," says Bill Huber as he gently nudges his pick-up truck along muddy, gouged-out tracks to check on his precious charges, scattered through the woods. "Every day there's something to be done. A problem with a drill pipe, a bearing to replace, or something wrong with a pumping jack."

Which is not surprising, given that some of the venerable contraptions in question first started to extract oil a century or more ago, and have now been pressed back into service, even though they yield just a few gallons a day. "You get one well going again, it may give you 10 to 15 barrels a day straight off. Then it tapers off. But even if it keeps going at just a third of a barrel a day, it's still pretty good."

Americans may wince at the ever-rising cost of petrol, a daily reminder of the grinding economic crisis that grips the country. But Bill Huber and the other "mom-and pop" producers in this part of the world aren't complaining, not when a 42-gallon barrel now sells for $135 (£68) or so, double what it fetched only a year ago, when every day seems to bring a new record price – and when the first commercially exploited oil field on the planet is enjoying a late-life renaissance.

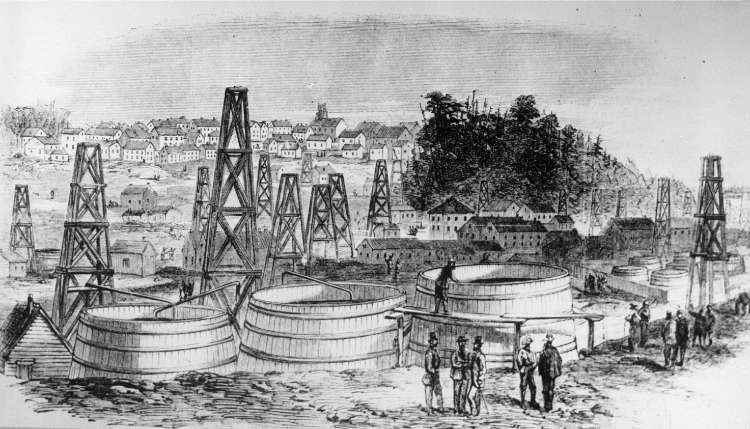

These steep, wooded hills of north-western Pennsylvania are the cradle of the modern, trillion-dollar, global oil industry. Here, on the edge of the stream called Oil Creek, a well drilled by Edwin Drake first coughed up the black stuff on 27 August 1859. A couple of years later, the world's oldest continuously producing well – the McClintock No 1, housed a couple of miles north of Oil City in what looks like an ancient garden shed – went on stream, and a few years after that, the world's first commercial oil pipeline was laid. Here too the first oil boom-and-bust cycle happened. From the fledgling industry, fragmented and unorganised, John D Rockefeller ruthlessly forged the monopoly of Standard Oil and became the richest man of his era.

Then came a long, genteel decline of an ancient family fallen on hard times, long surpassed by brash upstarts in Texas, the Middle East and beyond. The last refinery in the area was pulled down a few years ago. But the past lives on, not only in the rickety wells hooked up by rusty brown pipes, snaking through the mud and dead leaves to storage tanks from which trucks pick up the crude for refining. There are the town names like Oil City and Oleopolis, thoroughfares called Petroleum Street, opulent late 19th century houses built by the world's first oil moguls, even in the title of Oil City's daily paper – you've guessed – The Derrick.

With his slow way of talking, and oil-splatched overalls – not to mention the kennels behind his modest house – Mr Huber, 67, is no Rockefeller. But he has his own small place in the venerable history of Pennsylvania's oil patch.

His great-great grandfather, a cooper by trade, came to the area in the mid-19th century and made some of the barrels used by the early local oil industry. Mr Huber's grandfather got into the production business proper at the start of the 20th century, drilling more than 50 wells. Now the third generation oilman has inherited the business, and even expanded it. Over the years he has bought up scores of other wells, mostly during the barren years when Pennsylvania's oil industry seemed doomed. In the late 1980s, the oil price sank to $10 a barrel, before recovering, only to plummet again amid the financial crises in Asia and Russia a decade later. "Many people round here said, 'we're done and that's it'. But me and three others stayed and bought up some of the wells, dirt cheap."

Even so, Mr Huber often needed the income from his kennels to balance his books. But now he has his petroleum herd, 230 low-volume "stripper" wells of which some 45 are in production, yielding "70 or 80 barrels a month, maybe 100 in a good one". Northwest Pennsylvania isn't Kuwait. But 100 barrels a month provides a decent income. Not that Mr Huber is living it up. He's put a new roof on his house in the woods, a few miles north-east of Oil City, and bought a new (or rather new-er) pick-up truck. Soon he may get round to doing up the kitchen. But that's it.

Elsewhere, however, the boom is unmistakeable. The big energy companies are back in Pennsylvania, seeking oil and, more importantly, gas. Already Pennsylvania has more stripper natural gas wells than any other state, and its proven gas reserves are half the US total. In the woods new wells are being drilled. Farmers who own the "OMG" (oil, mineral and gas) rights are leasing land to the companies for $2,500 an acre a year, compared with $25 a decade ago, and get production royalties on top of that.

In five years, production of the waxy, paraffin-rich crude from Pennsylvania's Appalachian basin field has shot up 50 per cent to 3.8 million barrels. But experts reckon that two-thirds of the oil that was there when Drake drilled his way into history is still in the ground. Once it wasn't worth bothering with, but no longer. Rock Well Petroleum, a Canadian company, has plans not only to drill scores of new wells, but to dig huge underground caverns to collect the oil and pump it to the surface.

There's just one problem, however: what to do with the brine that comes with the oil, especially from older wells. McClintock No 1, for instance, now delivers 300 barrels of brine for every barrel of oil, says Barbara Zolli, the director of the state oil museum in nearby Titusville, at the site of Drake's first well.

The museum is about to be given a massive facelift, to mark next year's 150th anniversary of Drake's find. A replica has been built at that spot, but the hole in the ground is the original. "This place has relevance for everyone's life. People come here from all over the world to see it, they want to know where the oil industry started," Ms Zolli says. "Even now, you look at that hole and you feel goose-bumps."

And now this Indian summer for the industry. "It's never been as good as this," says Mr Huber, who remembers the bad times when he had to call the buying companies to collect oil even when the tanks weren't full, to get money to pay his bills. "Maybe the present sky-high prices won't last, but from what I can see, what with the Middle East troubles and China's huge demand for oil, they'll never go back down too far. And they keep telling us there's only so much oil left." He has had some offers, but isn't selling. One reason is history, a sense of obligation to his forebears. A fourth generation Huber, Bill Jr, is set to take over the family business, and such father-to-son traditions are hard to break. And then, of course, there's the money. "You may have just 20 wells and get a third of a barrel a day from each of them," Mr Huber notes. "But as my dad used to say, 'It all mounts up.'"

But you can't miss the caution in his voice. Good times are not eternal. Drake might have launched a giant industry, but spent his later years in ill-health and poverty. And as this tiny corner of the petroleum universe proves, booms are invariably followed by busts. The day the Drake well came in, world production doubled. By 1861, oil had hit $20 ($600 in today's dollars) a barrel, before crashing to 10 cents, equivalent to $3 now.

And then there was the story of Pithole, an incredible tale even by the wild standards of the American frontier. Oil first gushed along Pithole Creek in January 1865. By October the settlement was producing a then gigantic 6,000 barrels a day, delivered to barges by a new-fangled, five-mile-long pipeline. From nothing grew a town of 15,000 people, with 54 hotels, oyster houses, and a theatre that put on Shakespeare, most notably a louche version of Macbeth.

But in three years Pithole was gone. The forest of wells were pumping oil from the same deposit, which ran dry just as other fields in Pennsylvania came on stream. In 1866, the town's land was valued at $2m. A dozen years later, the local authority bought the lot for $4.37 – a real estate collapse beside which today's sub-prime mortgage crisis pales. The biggest hotel in town, costing $40,000 ($1.2m today) to build, was sold for firewood for $16. Today, not a stone, not a shard, remains; only a grid of mown strips between the trees, denoting where Pithole's streets had briefly stood.

In the modern history of big oil, Pennsylvania merits little more than a similar footnote. But in its day it taught the world. In the 1880s, engineers from Oil City went to Baku in the southern Russian empire to develop the industry there, in the process undercutting their own business.

And a Russian connection persists. Out inspecting Mr Huber's wells one recent morning, we ran into John Cubbon. An oil engineer and scion of an established Pennsylvania oil and lumber company, he has crude (or "maybe kerosene") in his blood. He worked with Shell in Russia, married a Russian woman, and was now with BP on another Russian project. Waiting for the Russian government to give him a visa, he had come home to take a look at the mini-boom. Pitholes come and go. But, Cubbon noted, "there's never been an oil field that's been totally abandoned".

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks