Dozens of Barclays Bank branches superglued shut by climate activists

Nearly 50 branches have had their doors glued shut

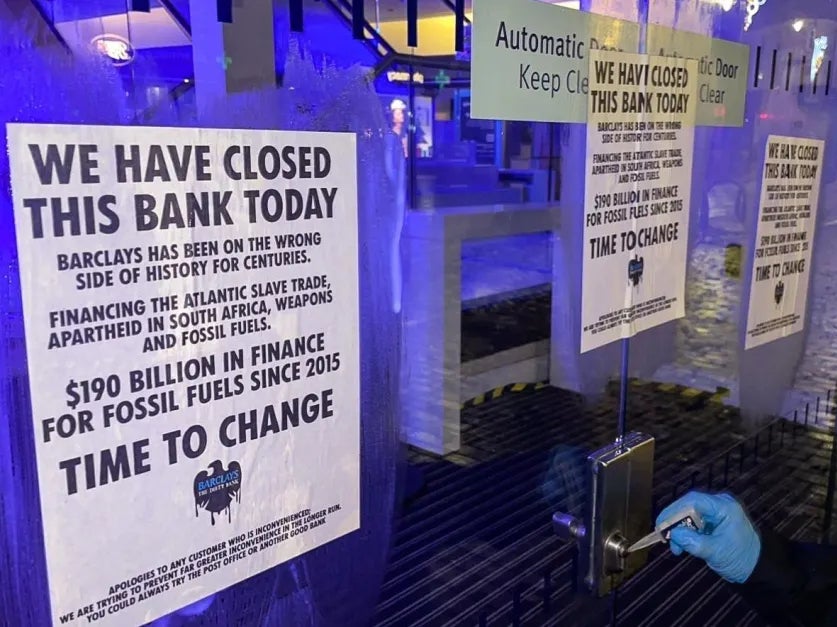

A protest group linked to Extinction Rebellion has superglued the doors shut of nearly 50 Barclays Bank branches across the UK.

XR’s sister organisation Money Rebellion targeted dozens of branches on Monday, including London’s Tottenham Court Road and Kilmarnock Road in Glasgow.

Money Rebellion is demanding the bank stop its investment in fossil fuel projects and is calling on customers to boycott Barclays in favour of “ethical banks”.

Pictures from a Barclays branch in Albion Street, in Leeds, showed “fossil fools” graffitied across the front doors.

The disruption follows a similar move by Greenpeace in 2020, when the group disabled the doors of 97 Barclays branches across the country.

Earlier this month, nine XR activists were cleared by a jury of causing £500,000 worth of criminal damage for shattering windows at HSBC bank's headquarters in London.

The group is known for its disruptive action which includes blocking roads and covering artwork and buildings in orange paint.

A spokesperson for the group said this disruption is “part of a significant new wave of property-focused climate action”.

It added: “Superglued locks shutting down a branch may impact its business in the short term, but the longer term damage is to Barclays’ reputation as customers discover how its outdated business model destroys the environment, and take their money elsewhere.

“Climate change is real and happening now. We urge Barclays customers to use their power by moving their account to a bank more aligned with a liveable future for the planet.”

The 2023 Banking on Climate Chaos report said Barclays invested more than $190.58 billion in fossil fuels between 2016 and 2022. The report was authored by seven different charities and activist organisations, including Rainforest Action Network and BankTrack.

According to Bank.Green, which campaigns for banks to fund green projects, Barclays Bank is Europe’s largest funder of fossil fuel projects.

Barclays Bank said it has reduced its investment in five high emitting sectors by 32 per cent since 2020.

A Money Rebellion activist who took part in the action, who did not wish to be identified, said: “Barclays are pumping billions into the fossil fuel industry, completely at odds with advice from the International Energy Agency, United Nations and IPCC.

“Barclays are choosing short term profits over a liveable future and a lot of us are sick of the measly progress they’re making, as they hide behind their lies and greenwash.”

An XR activist added: “We’re responding to public attitudes and targeting the perpetrators of climate breakdown, not ordinary people and we apologise for any inconvenience caused to staff and customers.

“The inconvenience we’ve caused this morning is small in comparison to the catastrophic events already happening due to Barclays’ financing of fossil fuels.”

A Barclays spokesperson said: “Aligned to our ambition to be a net zero bank by 2050, we believe we can make the greatest difference by working with our clients as they transition to a low-carbon business model, reducing their carbon-intensive activity whilst scaling low-carbon technologies, infrastructure and capacity.

“We have set 2030 targets to reduce the emissions we finance in five high emitting sectors, including the Energy sector, where we have achieved a 32% reduction since 2020. In addition, to scale the needed technologies and infrastructure, we have provided £99bn of green finance since 2018, and have a target to facilitate $1trn in Sustainable and Transition financing between 2023 and 2030.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks