Fears grow over the fallout from a Greek default

Concerns were mounting yesterday about whether the IMF had the resources necessary to tackle any fall-out from a Greek default, should it trigger a wider financial crisis and threaten the solvency of other, bigger governments.

The head of the International Monetary Fund (IMF), Christine Lagarde, said the fund was able to meet its current obligations, but the situation may change if the eurozone crisis worsens. The organisation, which acts as lender of last resort for struggling governments, is reviewing whether to ask for additional contributions from its members, but the review will not conclude until April.

Rumours circulating around the IMF conference in Washington suggested Greece could default on as much as half of its €350bn (£305.65bn) sovereign debt, a larger figure than markets expected. Traders are predicting another volatile week for equity, bond and currency markets amid the uncertainty.

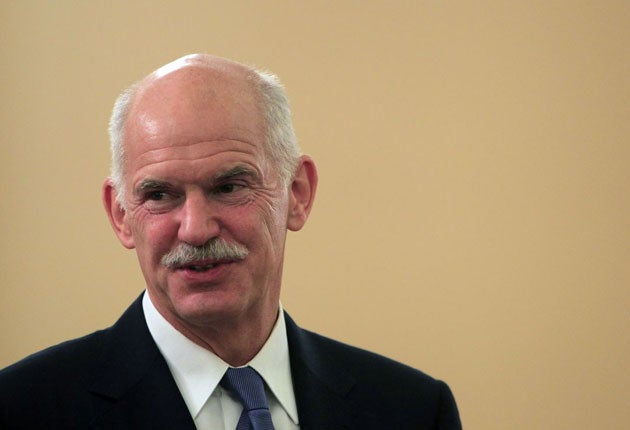

Ms Lagarde was last night due to meet the Greek finance minister, Evangelos Venizelos, to press for further austerity measures aimed at reducing the country's debts. Mr Venizelos publicly declared that "no Greek paper will ever go uncovered", but behind the scenes, talks about a possible government default were also being stepped up.

IMF member countries said at the weekend that they would act collectively and decisively to get through a "dangerous phase", but the communiqué contained no new measures and acknowledged the "different national circumstances" of its members.

At the IMF conference, there were sharp differences and sometimes stinging words between the players. The Swedish Finance Minister, Anders Borg, told reporters "there is some risk of market disappointment due to the fact there were no further, more specific pledges from the euro countries at this time".

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies