The fall in GDP should be a big warning sign for the government

The government’s continuing lack of movement is quite staggering. More tiresome sabre-rattling over the Northern Ireland protocol won’t help people as the bills roll in, argues James Moore

Winter in May? It does rather feel like it, given the way the UK economy is going.

The latest official figures – for March – were Leonard Cohen album-level grim. They showed a 0.1 per cent contraction against the flat zero the City had expected. There is probably worse to come. This economic frost is going to bite hard. The stock market doesn’t always react to this sort of release, partly because the FTSE 100 is a very international market, especially at the top end.

But it did this time, with the figure serving as another pointer to a potential global slowdown – as if there weren’t enough already out there. Investors were already rattled by the worse than expected core inflation numbers in the US, so dealing screens were dominated by red pixels.

These figures are, it is worth pointing out, subject to revision. They are based on incomplete data so could yet be pushed upwards. But they could be revised downwards too.

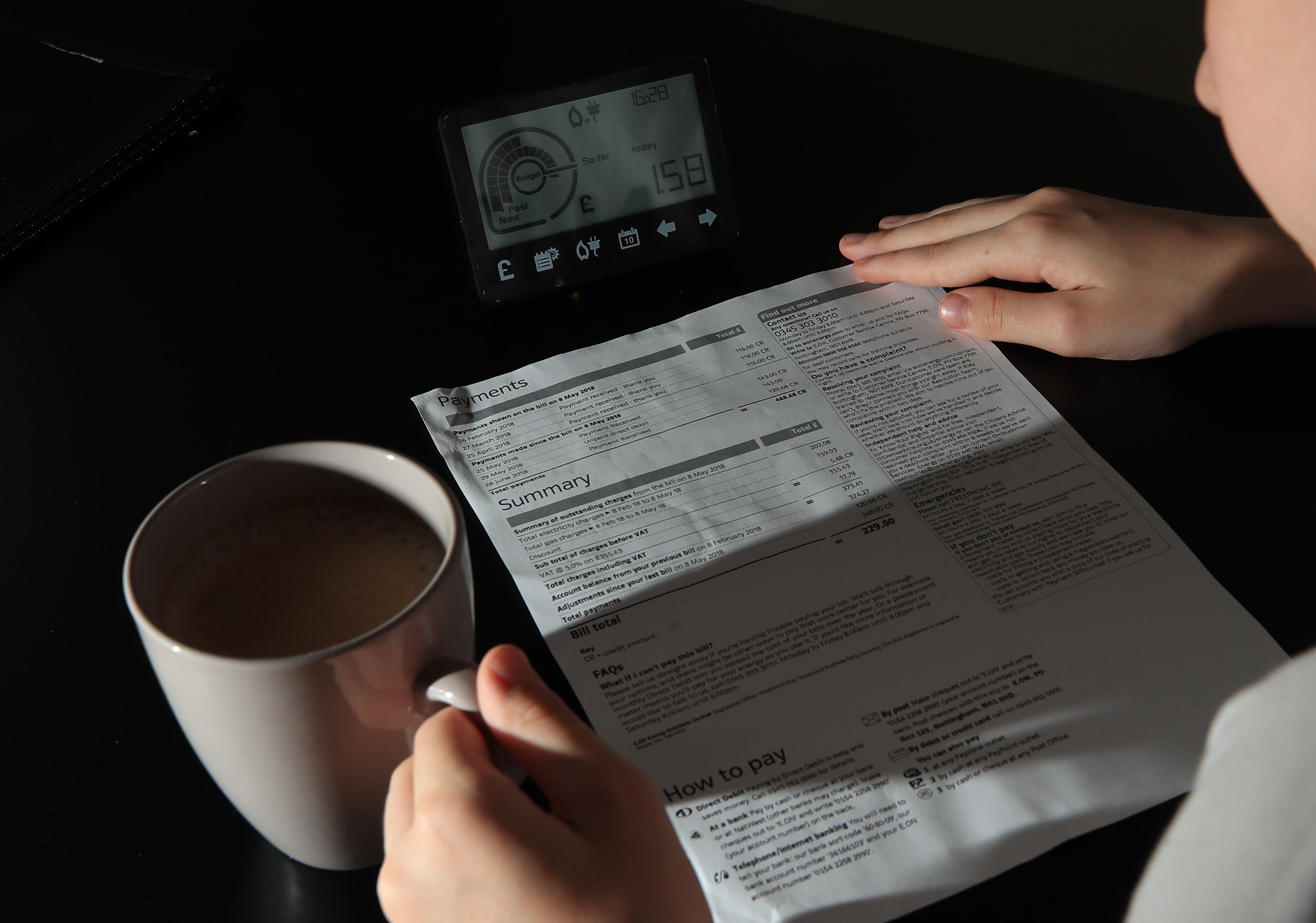

The real stinger: the period they cover is before April’s domestic fuel price spike and the impact of the heavily – and justifiably – criticised decision to increase national insurance for both employers and employees. They have had an immediate, and a sharply negative, impact on household budgets.

The first quarter’s overall 0.8 per cent growth figure is still fine. There are plenty of countries that would be delighted with such a number.

But the UK’s January and February numbers were themselves revised downwards, and the outlook remains unrelentingly grim. Suddenly the “R” word – recession – is making a regular appearance in the notes put out by brokers.

It all serves to underline the staggering irresponsibility of the government’s sabre-rattling over the Northern Ireland protocol that it willingly signed up for as part of its Brexit deal. The last thing UK plc needs right now is a trade war with the EU, its biggest trading partner. Businesses are already struggling with paring back their investment, revisiting their budgets and revising their expectations down.

The protocol is being raised again for purely political purposes, by a prime minister who has just endured a kicking at the hands of the voters. It is yet another mark of Boris Johnson’s unsuitability for the office he holds. But this has been said before, and it will be said again.

A bit of Brexit might gee up the right-wing tabloids but the rest of the country is fed up with it, and focused on weathering a cost of living storm that looks set to develop into a fully fledged hurricane.

Earlier this week – so before this latest batch of numbers came out – the National Institute of Economic and Social Research warned of a contraction in the second part of the year.

In a withering assessment, Britain’s oldest independent economic research institute said that “poor policies” were set “to leave households permanently worse off”.

Even more disturbing was its estimate that 1.5 million of them across the UK will be facing “food and energy bills greater than their disposable income”. This is a truly chilling prospect.

The highest incidences of this will be seen in London – where it is too often forgotten that there are pockets of dire poverty – and Scotland.

The government’s failure to respond to this, beyond its childish posturing at Britain’s neighbours, is stunning. Johnson’s vague talk of “doing what we can” to help struggling households simply won’t cut it.

Some Tory MPs appear to see the danger. Their clamour is likely to grow louder as they start to see the effects of the government’s failure in their constituencies. So it should, because almost all of them will have people left below the economic waterline.

Their plight must be addressed, starting with an emergency universal credit increase. After that, ministers urgently need to get to work on the wider economic crisis the UK faces.

The government has the wherewithal, and the fiscal headroom, to stave off the looming recession. It is just a question of will.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks