Long or short Covid? The true state of the UK economy

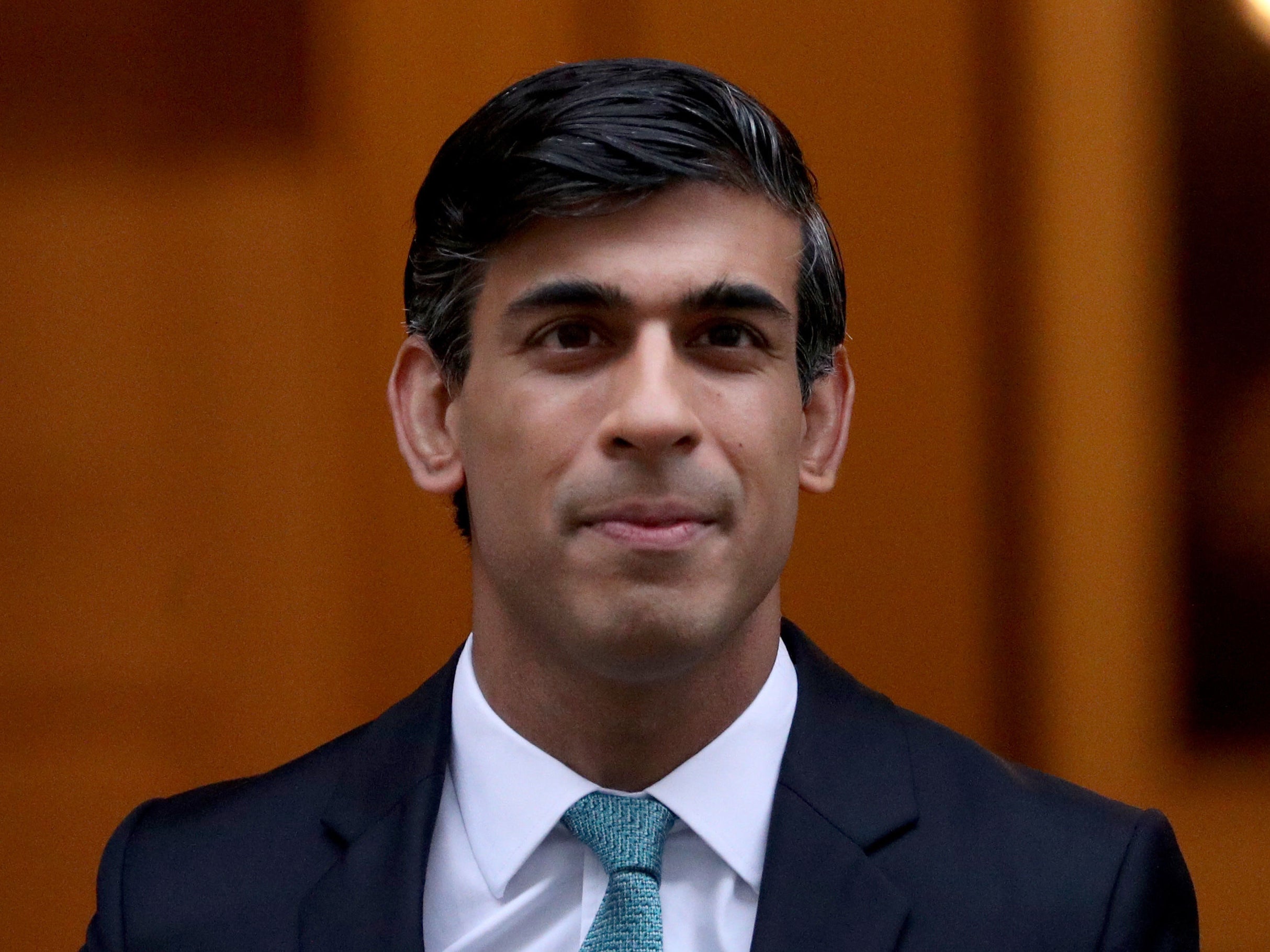

Ahead of Rishi Sunak’s potentially pivotal pandemic Budget, Ben Chu examines how bad things got for the British patient in 2020 – and the prognosis for recovery

Long Covid describes the symptoms of people who have been infected by the coronavirus, survived it, and yet who just can’t seem to return to normal health. There’s fatigue, shortness of breath, depression, anxiety – things aren’t right and it’s not clear why. The great fear is that the UK economy might experience something similarly unwelcome when this pandemic is otherwise over, that the shadow of this crisis will stretch out over the years to come.

With Boris Johnson having unveiled a conditional plan for releasing the UK economy from its latest national lockdown and with the Chancellor, Rishi Sunak, preparing his 3 March Budget, now seems an appropriate time to take stock, not only of how bad things got for the British patient in 2020 but the prognosis for recovery.

Dubious comparisons

It’s become common to hear that the UK is bottom of the table for health and wealth – that Britain has experienced, along with one of the most severe death tolls per head from the pandemic, one of the largest economic shocks.

On the face of it the figures produced by international forecasting bodies such as the International Monetary Fund seem to bear this out, showing UK Gross Domestic Product down by around 10 per cent over the course of 2020, compared with 5.5 per cent in Germany and just 3.5 per cent in the United States.

There’s no question the UK has suffered a hit to activity of historic proportions, the largest slump since modern records began according to the UK’s own statistics agency, the Office for National Statistics (ONS). Yet those international comparisons, most economists now accept, are rather misleading.

The ONS is more assiduous than other national statistics agencies in the developed world in factoring in the reduction in the quality of public services during the pandemic when measuring their output – think of all those untreated non-Covid patients and all those children with interrupted schooling.

While other agencies assume the overall quality of the output of their publicly funded health and education sectors has held up over the past year, the UK’s statisticians, looking at various performance metrics, assume the opposite. This makes a considerable difference to the GDP figures given the size of education and health sectors in modern economies.

Whether this austere statistical approach from the ONS is appropriate can be debated. Is it true, for instance, that the quality-adjusted output of the NHS has declined over the past year when doctors and nurses have run themselves into the ground to save lives? The reality is that the difference in measurement approaches by national statistics agencies means their headline GDP figures are not truly comparable at the moment.

If one uses measures which ignore quality adjustments, the UK’s economic performance looks closer to other G7 countries, although it remains very possible that less hesitation from ministers last year in imposing restrictions would have resulted in a better controlled epidemic and shorter lockdowns.

Dodging the bullet

Any survey of the past year, it should be acknowledged, would have one shaft of light: unemployment. Fears abounded last summer that the UK was facing an explosion of joblessness. The Office for Budget Responsibility (OBR), the Treasury’s official forecaster, projected three to four million unemployed by early 2021 – meaning more working age adults on the dole than even during in the peak of the 1980s recession.

That didn’t happen: unemployment currently stands at around 1.7 million, around 5 per cent of the workforce. But it’s important to recognise why the employment collapse didn’t materialise.

The OBR’s forecast – which was in line with many others’ – was based on the assumption that the chancellor would, as he explicitly planned, wind down the furlough scheme last year, and that millions of the people whose incomes it had supported would be made redundant.

In the end Rishi Sunak – under huge pressure from the opposition, trade unions and even some Conservative MPs – extended the scheme and it remains in place today. In the absence of the extension it’s quite conceivable – perhaps even likely – that unemployment would have shot up spectacularly as it did in America, where a sixth of the workforce was out of work at one point last year.

We dodged a bullet on jobs, though the threat of mass unemployment has not disappeared. There are estimated to be 4.5 million UK workers currently on furlough. It’s far from clear how many of them – particularly those working in hospitality and retail - will have jobs to go back to when the economy starts to re-open in the coming months.

Coiled spring or damp squib?

The central debate among economists and policymakers is the prospect for recovery. The two views can be (very crudely) characterised as the coiled spring and the damp squib.

Those who subscribe to the coiled spring view look at the fact that many UK households have been effectively forced to save extremely large amounts of money during lockdowns because their incomes have largely been protected yet they have been unable to spend at restaurants, visit the theatre, or go on holiday and so on.

The Bank of England estimates that UK households accumulated “excess savings” amounting to £125bn in 2020. And it thinks that it could be above £250bn by the middle of the year.

Some, such as the Bank of England’s chief economist Andy Haldane, see the potential here for a major consumer spending boom when the economy is able to re-open, with people desperate to spend after a year of boredom and now enjoying the financial means to do it. A rush of consumer spending, in this view, will encourage businesses to invest too, which will help push the overall economy into a boom.

“The recovery should be one to remember after a year to forget,” predicts Haldane.

However, some of Haldane’s colleagues at the Bank are considerably more sceptical. They point out that these savings have not been accumulated evenly across households. Many poorer families – and also the young, who have suffered much more in the labour market than their older peers – have been much more negatively affected by the crisis. Far from building up their savings, they have been forced to take on borrowing to ride out the crisis.

Their household balance sheets have deteriorated, rather than improved. It seems unrealistic to imagine that they will be big spenders in the coming months.

Similarly, many businesses have taken on loans to get through the past year. It seems vain to see an investment boom coming from them. Will spending by the savers of the past year compensate for the lack of demand from the losers? It’s possible, but by no means assured. The danger is that the hoped-for spending boom, will fizzle out like a damp squib, especially if the furlough wind down, as expected, is accompanied by a rise in joblessness.

Economics or politics?

The chancellor has spent £285bn through the pandemic, to finance the furlough scheme and to fund the health response to Covid. To support business he has also suspended the collection of business rates and other taxes. As a result, public borrowing this fiscal year is set to be north of £350bn, a peacetime record.

The national debt is already roughly equal to the size of the overall economy, a rate not seen since the 1960s. Yet one thing that economists are not concerned about is the debt accumulated during the crisis, especially with the UK government able to borrow in the markets at close to record lows.

The overwhelming consensus is that this surge of government borrowing, largely spent on worker and business support, has helped the economy remain afloat in this emergency, preventing even worse damage. And no serious analyst talks about the debt needing to be “paid back”.

Nevertheless, the scale of the borrowing seems to have unnerved the chancellor, and he has been dropping hints for many months that taxes will need to rise. A theme he has repeatedly returned to is the idea that the Conservatives must show fiscal restraint or they will be no different from Labour.

For the past few months his team have been floating revenue-raising ideas in the media, ranging from hiking corporation tax, to imposing a new digital sales levy, to mandating new carbon taxes.

In one sense, it’s true that taxes need to rise. Even before the pandemic, a gap had opened up between projected spending and projected tax revenues over the coming decades, mainly due to age-related pressure on health spending.

With few realistic options of reducing public spending after a decade of austerity, that clearly pointed to tax rises to secure long term fiscal sustainability. The Institute for Fiscal Studies (IFS) estimates the fiscal gap might currently be around £60bn, or around three per cent of GDP (although it emphasises the size of the hole will depend on the strength of the recovery). For illustrative purposes, such a sum is equivalent to an extra 11p on the basic rate of income tax.

Yet it’s a question of timing. If the chancellor were to raise taxes now, before the economy has fully recovered, that could undermine growth, damage businesses, erode workers’ skills, and reduce the overall capacity of the economy. That would, in turn, reduce tax revenues. In other words, raising taxes (in net terms at least) at this fragile stage in the economic cycle would be self-defeating as a method for reducing public borrowing.

“Sunak needs to focus on support and recovery,” says Paul Johnson, director of the IFS.

Many say the chancellor should be looking, instead, to increase fiscal support for the economy, particularly through prolonging the furlough scheme well into the year and extending support for businesses which are being forced to shut for months to come.

If the chancellor were to raise taxes now, before the economy has fully recovered, that could undermine growth, damage businesses, erode workers’ skills, and reduce the overall capacity of the economy

The Resolution Foundation think tank is calling for £100bn of fiscal measures from the chancellor – a package worth 5 per cent of UK GDP, including a permanent increase in the generosity of benefits and billions of pounds for retraining.

“That is the scale of ambition needed to increase the chances that Britain sees a strong recovery from its pandemic-induced slump, and to ensure the recovery reaches firms and families across the UK,” says James Smith of Resolution.

There is a debate, however, over whether the time is yet ripe for traditional “stimulus”, in the form of inducements for people to go out and spend. The Eat to Help Out policy that Sunak unveiled last summer is increasingly seen as an own goal because it spread infections and contributed to the need for another lockdown.

But Sunak will also likely be concerned that if he delays raising taxes they could coincide with the next election.

“Big tax rises eventually will have to be announced, with 2022 likely to be the worst year, so that they will be far from voters’ minds by the time of the next general election in May 2024,” predicts Samuel Tombs of the consultancy Pantheron.

But will that be too soon for the economy to bear?

This Budget, then, is a major economic and political test for Sunak. Will he defer to economic advice or political instincts? The balance he strikes could have very profound consequences.

Roaring Twenties?

Yet could things be much better than they seem? Some optimists have suggested we might be set for not just a boom this year, but a decade-long festival of prosperity. They cite the “roaring Twenties” in the US which followed the economic shock and privations of the First World War and also the influenza pandemic of 1918.

While no one doubts the urge for release from lockdown and restrictions, this, alas, seems overoptimistic. Any surge in consumer spending will, in itself, at best recover lost economic ground.

The only thing that can deliver a long-lasting surge of general prosperity will be a pick-up in productivity growth, which has been disturbingly stagnant in the UK since the financial crisis.

And why would the pandemic lead to that? One could point to the fact that many businesses have been forced to sell more online and to figure out new, more efficient, ways of working. Any major crisis does tend to throw up new opportunities.

If there is one lesson he and the government should learn from 2020, it is that he needs to be willing and able to adapt as circumstances change

Yet it’s just as easy – perhaps easier – to point to the lost education resulting from school closures, the wasting of skills of workers on furlough and a surge in the indebtedness of many companies as reasons why our productivity hole may, in fact, have got even deeper over the past year.

And the Budget is an important piece of that jigsaw. If the optimists are right and the economy springs back strongly later this year – and sparks sustained productivity growth – its decisions might prove irrelevant.

But if the pessimists are on the money and the economy falters, a poorly designed fiscal package from Sunak could magnify the pain and lead to unnecessary and permanent damage.

“The chancellor cannot expect to embark on an unwavering journey to economic recovery,” says Gemma Tetlow of the Institute for Government.

“If there is one lesson he, and indeed the whole of the government, should learn from 2020, it is that he needs to be willing and able to adapt as circumstances change.”

No one can know for certain what will happen to the British patient but, given the balance of risks, a wise chancellor would surely hope for the best, while budgeting for the worst.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks